Bitcoin (BTC) begins the weakest month of the 12 months with new native lows and predictions of extra BTC value draw back.

-

Bitcoin drops to $107,270 after the weekly open earlier than rebounding as volatility ramps up.

-

The US Labor Day vacation retains merchants guessing over how markets will react to recent US tariff chaos.

-

Gold is again in breakout mode, however the outlook for crypto is something however bullish, says gold bug Peter Schiff.

-

Bitcoin institutional curiosity is beginning to mirror value weak point as August caps $750 million of ETF outflows.

-

September is historically dangerous information for Bitcoin bulls — will this 12 months be completely different?

Merchants retain sub-$100,000 BTC value targets

Bitcoin started the week by setting new native lows at $107,270, knowledge from Cointelegraph Markets Professional and TradingView confirms.

A subsequent bounce took the pair towards $110,000, a volatility attribute of low-volume weekend and public vacation buying and selling.

Amongst merchants, the temper is tense: some are ready for a extra convincing ground, and even see $100,000 help coming in for a retest.

Others are concentrating on upside liquidity on alternate order books. With the market overwhelmingly quick, a “squeeze” to focus on these positions is more and more of curiosity.

$BTC helps

Above the 92k excessive goal, these are the helps I´m seeing for Bitty.

I doubt it is going to slice via all of those, that may be completely shocking for me and what I´m anticipating.

Hope the bulls step as much as the plate quickly. pic.twitter.com/4oxtd95EJr

— Lourenço VS (@lourenco_vs) September 1, 2025

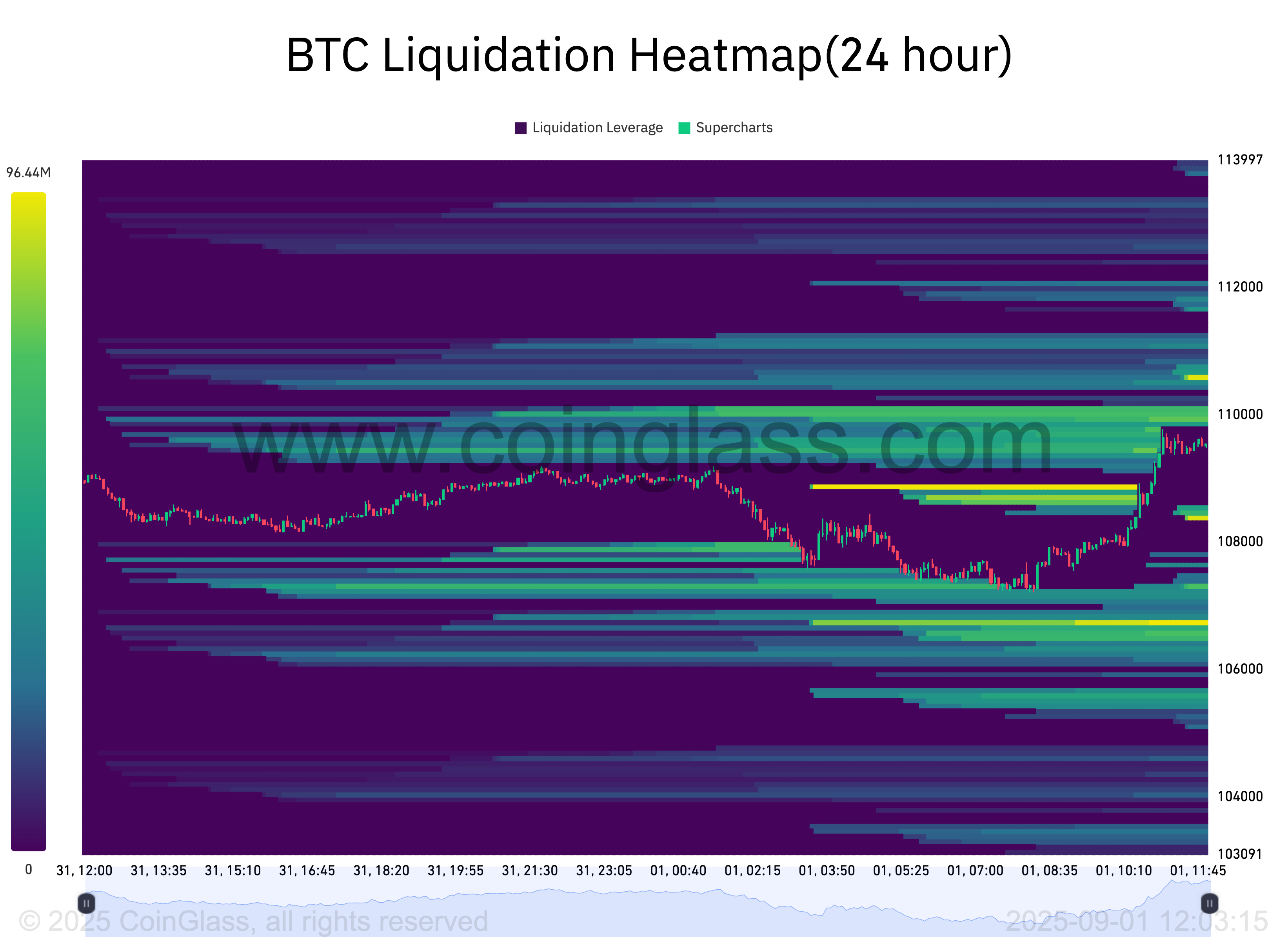

“Brief liquidations are stacking between $112k – $115k,” widespread dealer CrypNuevo confirmed in a thread on X Sunday.

CrypNuevo appropriately anticipated a drop to the $107,200 zone primarily based on bid liquidity sitting there.

“If this turns right into a deeper pullback, I would count on $100k to get hit since it is a psychological degree,” he continued.

“As value dropped, a number of lengthy orders would stack at $100k and a wick decrease to $94k would make sense to hit their SL & liquidations and to fill the draw back small CME hole there.”

CrypNuevo nonetheless described present lows as a “deviation,” eyeing one other CME hole at $117,000.

Knowledge from CoinGlass reveals the $110,000 zone as a preferred one, with value consuming into a piece of overhead liquidity with its Monday reversal.

Tariff woes preclude key US jobs numbers

US markets are closed on Monday for the Labor Day vacation, leaving merchants to attend till Tuesday to evaluate the impression of current confusion over the federal government’s worldwide commerce tariffs.

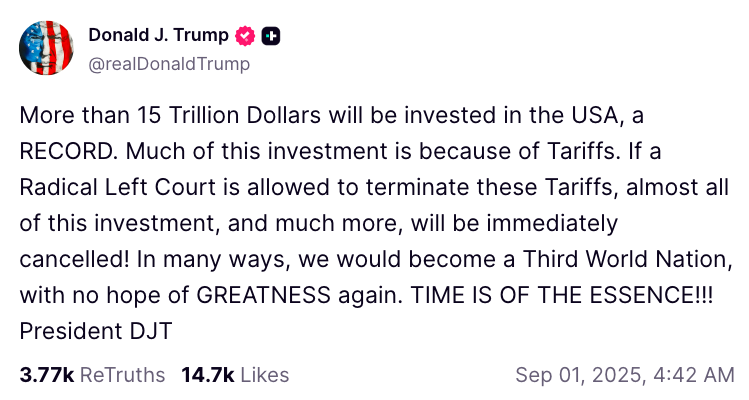

Late final week, a federal appeals courtroom declared President Donald Trump had overstepped his authority in the course of the tariffs’ implementation, leaving preparations in limbo.

The occasion sparked a swift response in crypto, however was introduced after futures markets have been already closed.

Trump subsequently signalled that he would combat to maintain the tariffs in place, warning the US would in any other case develop into a “third world nation.”

With volatility already overdue, risk-asset merchants may even monitor the week’s macroeconomic knowledge within the run-up to the Federal Reserve’s resolution on rates of interest.

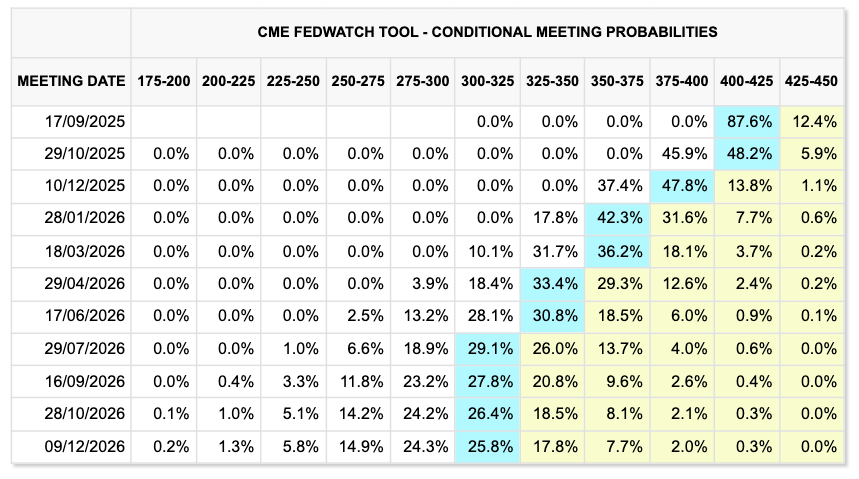

Unemployment claims are of key curiosity this week, because the Fed juggles a mixture of resurgent inflation markers and weakening labor-market cues.

“It is all concerning the labor market this week,” buying and selling useful resource The Kobeissi Letter summarized in an X thread.

“It will mark the final week of labor market knowledge earlier than the large September Fed assembly.”

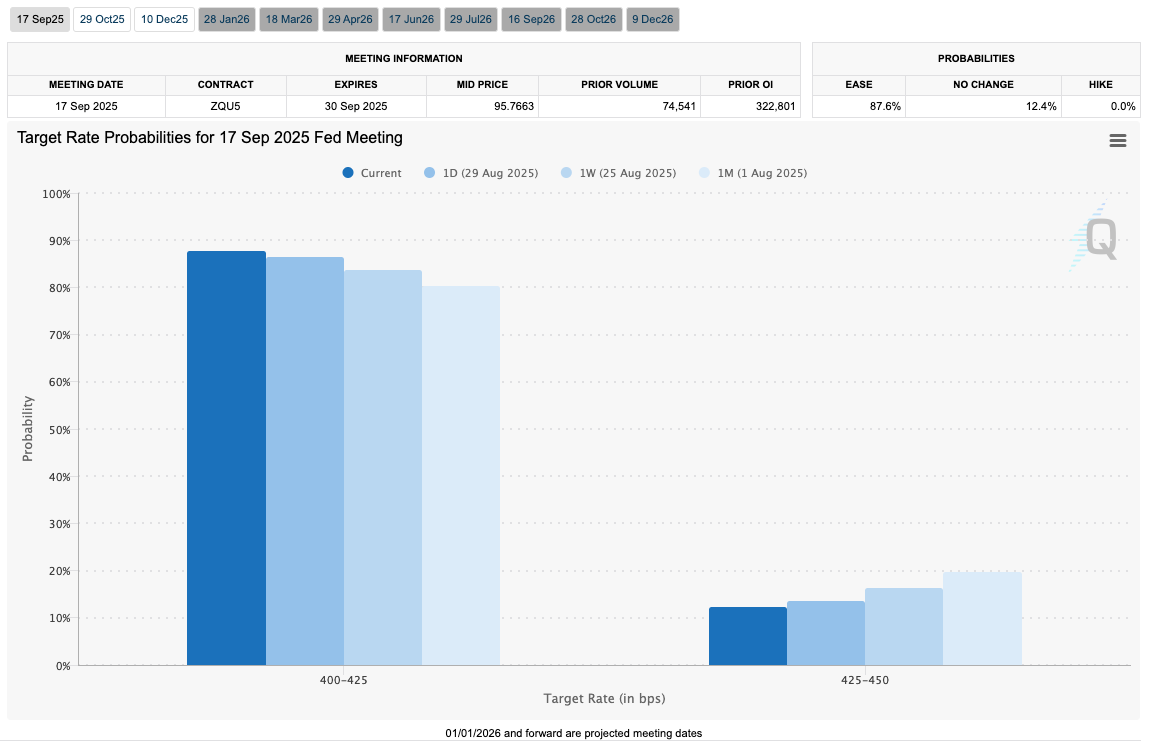

Markets stay assured that the Sept. 17 assembly will ship the primary of a much-anticipated run of fee cuts, permitting liquidity to circulation into threat belongings.

Knowledge from CME Group’s FedWatch Instrument reveals the percentages of a 0.25% minimize at over 90% Monday.

“After reducing charges by 1.0% in late 2024, the Fed has been on maintain for the previous eight months, buying and selling agency Mosaic Asset summarized within the newest version of its common publication, “The Market Mosaic.”

“Issues over the labor market is the first catalyst for reducing charges, however the Fed won’t get too far if inflation holds up.”

Gold challenges all-time highs whereas Bitcoin sags

Whereas Bitcoin and altcoins stall, one safe-haven is outperforming in a fashion harking back to earlier in 2025.

Gold value reached $3,489 per ounce Monday, now simply inches from all-time highs seen on April 22.

On the time, Bitcoin was recovering from a visit to sub-$75,000 lows, and on the day of gold’s new file itself jumped 6.7% to shut close to $93,500.

Kobeissi famous uncommon weekend buying and selling exercise on XAU/USD, which surged into the weekly shut and continued into Labor Day.

Gold on an off-the-cuff Sunday night time on a 3-day weekend:

Charge cuts are coming into 3%+ inflation. pic.twitter.com/ZTOopKVte2

— The Kobeissi Letter (@KobeissiLetter) September 1, 2025

“Upside inflation surprises could frustrate the Fed, nevertheless it could possibly be an enormous catalyst for the following uptrend part in gold costs,” Mosaic Asset continued.

Mosaic famous that final week’s Private Consumption Expenditures (PCE) index print had cemented gold’s newest rebound.

“That’s occurring as gold’s historic seasonality is turning into extra of a bullish tailwind as nicely,” it added, flagging September as gold’s second-strongest month of the 12 months over the previous half century.

Amongst gold bugs, a well-known tone has emerged. Peter Schiff, the well-known Bitcoin skeptic who’s chairman and chief economist at funding advisory agency Europac, underscored the divergence between conventional and “digital” gold over the weekend.

“Gold and silver breaking out may be very bearish for Bitcoin,” he instructed X followers, warning that BTC was “poised to go a lot decrease.”

Institutional patrons are stepping again

Bitcoin heading beneath its outdated all-time highs is beginning to take its toll on funding habits.

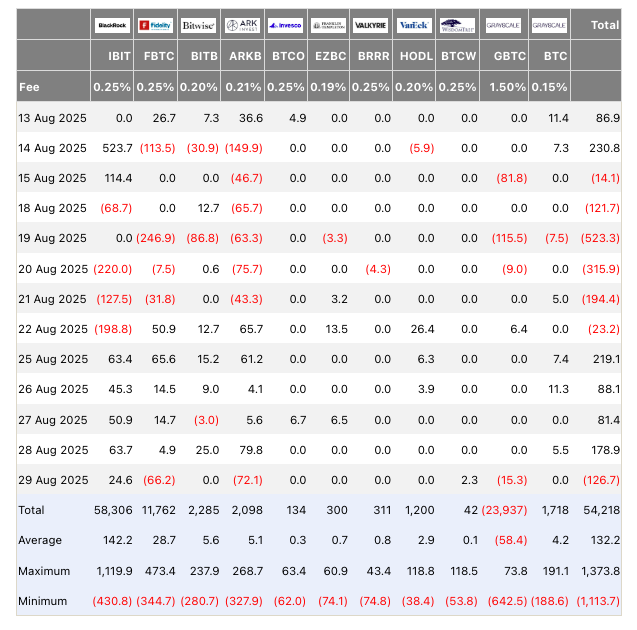

Knowledge from UK-based funding agency Farside Traders confirmed that on Friday, the US spot Bitcoin exchange-traded funds (ETFs) noticed internet outflows of $126.7 million.

This marked a late turnaround for what had in any other case been a promising week, with institutional patrons including BTC publicity regardless of BTC value making new decrease lows.

Zooming out, nevertheless, the image appears extra precarious.

Charles Edwards, founding father of quantitative digital asset fund Capriole Investments, reported multimonth lows in institutional acquisition.

“Institutional shopping for of Bitcoin has plunged to its lowest degree since early April,” he commented alongside Capriole’s personal knowledge.

The numbers nonetheless present that mixed institutional demand nonetheless equals round 200% of the brand new BTC provide added by miners every day.

In August, in the meantime, the ETFs noticed their second-worst month on file when it comes to outflows, community economist Timothy Peterson notes. These totaled $750 million.

Bitcoin ETFs endured $750 million in withdrawals in August, the second worst month on file. pic.twitter.com/uTOU4wHhTr

— Timothy Peterson (@nsquaredvalue) August 30, 2025

Bitcoin sees first post-halving “crimson” August

Bitcoin now stands in the beginning of what’s historically its worst-performing month.

Associated: Bitcoin vulnerable to Labor Day crash to $105K as sellers capitalize on OG BTC whale risk

As Cointelegraph continues to report, September has seen common returns of -3.5% for BTC/USD, with the “greatest” of the previous twelve years solely reaching 7.3% positive factors.

Bitcoin sealed its fourth consecutive “crimson” August with the month-to-month candle shut, capping 6.5% losses.

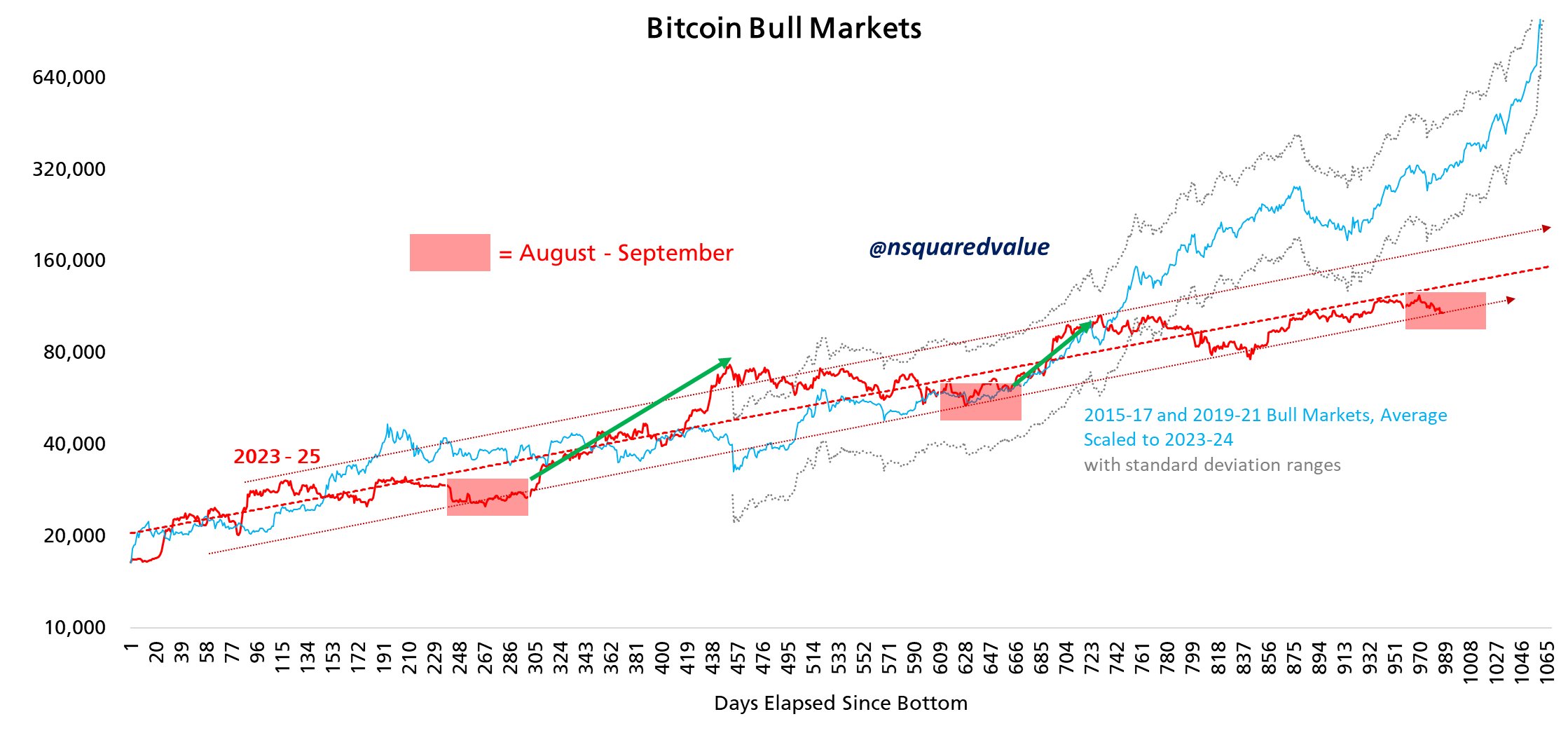

“Seasonality is an actual factor,” Peterson commented alongside a chart evaluating Bitcoin bull markets.

“Bitcoin has adopted seasonality for 15 years; the fairness markets, over 100 years. It repeats and cannot be arbitraged away as a result of issues just like the tax 12 months, college calendar, and climate/agricultural cycles are mounted.”

An accompanying chart underscored the lackluster strikes seen in September, even throughout Bitcoin’s most bullish years.

Investor Mark Harvey famous {that a} crimson August marks a brand new first for Bitcoin in a post-halving 12 months.

Harvey instructed that this was “proof that $BTC is now not following the 4-year halving cycle given current institutional adoption,” suggesting that it was not a bearish sign.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.