Key takeaways:

-

Bitcoin’s MVRV dying cross indicators bearish momentum, traditionally previous large value corrections.

-

Nevertheless, the MVRV Z-Rating stays effectively beneath historic peak ranges.

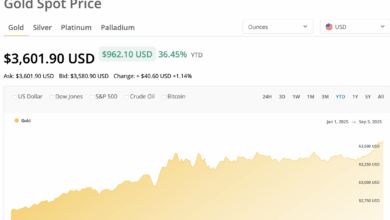

Bitcoin (BTC) could possibly be set for an prolonged correction within the coming weeks as an overvaluation metric sends a bearish sign. The cryptocurrency market may be experiencing a “macro reversal,” in accordance with crypto analysts.

Bitcoin’s MVRV metric exhibits “indicators of exhaustion”

Bitcoin’s Market Worth to Realized Worth (MVRV) ratio, an indicator that measures whether or not the asset is overvalued, just lately printed a “dying cross,” indicating waning momentum, in accordance with CryptoQuant analyst Yonsei_dent.

The “MVRV momentum is displaying indicators of exhaustion with a transparent lifeless cross between the 30DMA and the 365DMA,” the analyst stated in a QuickTake evaluation on Sunday.

The final time the indicator produced this bearish crossover was on the 2021 cycle high, previous a 77% drop to $15,500 from $69,000 in the course of the 2022 bear market.

Associated: Bitcoin liable to Labor Day crash to $105K as sellers capitalize on OG BTC whale risk

Regardless of a 13% BTC value rise to $124,500 all-time highs from $109,000 between January and August, the MVRV declined, “indicating weakening capital influx,” Yonsei_dent stated, including:

“Historical past doesn’t repeat, it rhymes — and the indicators from MVRV deserve consideration.”

The MVRV dying cross “indicators a macro momentum reversal from optimistic to unfavourable, analyst Ali Martinez stated in a Friday publish on X.

If historical past repeats itself, Bitcoin value may embark on a protracted downtrend, with analysts projecting short-term targets round $105,000 and even as little as $60,000 if the bear market takes maintain.

Bitcoin rally not overheated, MVRV Z-score exhibits

Regardless of this potential bearish state of affairs, a number of different onchain indicators counsel that Bitcoin’s $124,500 all-time excessive is unlikely to be the highest. For instance, all 30 CoinGlass’ bull market peak indicators nonetheless present no indicators of overheating.

Equally, Bitcoin’s MVRV Z-Rating stays far beneath ranges traditionally related to market tops. That divergence suggests the present rally should still recuperate from present ranges to new all-time highs.

Traditionally, when market worth vastly exceeds realized worth, the rating enters the crimson zone (see chart beneath), signaling overvaluation and infrequently previous main tops.

“When it is excessive (crimson zone), individuals are sitting on huge income and normally promote. When it is low (inexperienced zone), individuals are underwater and sensible cash buys,” stated widespread analyst Stockmoney Lizards in an Aug. 26 publish on X.

Historic patterns counsel that each macro high coincided with an MVRV Z-score between 7 and 9. In 2017, it surged above 9 earlier than the crash and in 2021, it rose above 7 earlier than reversing.

In 2025, the metric is “sitting at round 2,” the analyst stated, including:

“We’re not even near the hazard zone but. Individuals aren’t massively overextended on income like they have been at earlier tops. This tells me we’ve acquired room to run.”

This means that, from an onchain perspective, Bitcoin will not be but overheated and will proceed climbing earlier than topping, doubtlessly across the bullish megaphone’s $260,000 value goal.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.