Gold (XAU) has surged to its highest stage since April, with prospects for additional good points because the often-overlooked issue of Treasury yield curve steepening good points momentum. This shift within the bond market may additionally present a lift to bitcoin .

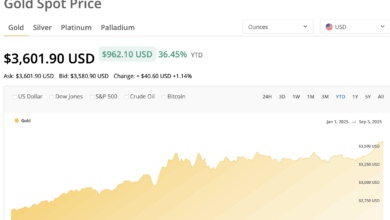

Over the previous ten days, the worth of gold has elevated by greater than 5% to $3,480 per ounce, inching nearer to the report excessive of $3,499 set on April 22, in line with TradingView knowledge.

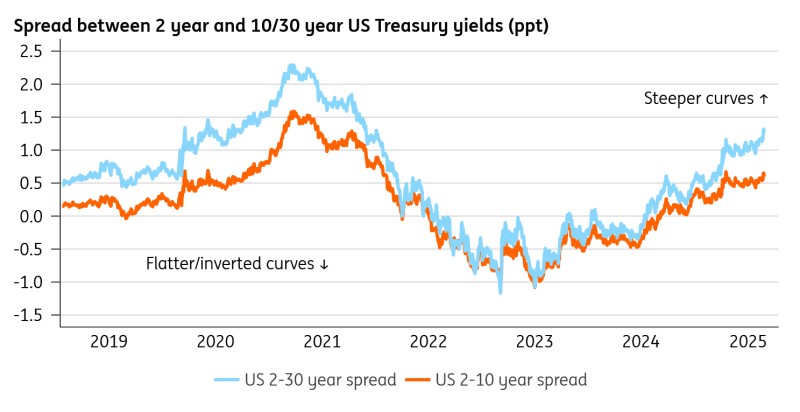

The rally coincides with a steepening U.S. Treasury yield curve, because the unfold between 10-year and 2-year yields (10y2y) widened to 61 foundation factors – the very best since January 2022. In the meantime, the hole between 30-year and 2-year yields reached 1.30%, the widest since November 2021.

This steepening has been pushed largely by a quicker decline within the 2-year yield, which fell 33 foundation factors to three.62% in August, in comparison with a smaller 14-basis-point decline within the 10-year yield, now at 4.23%. In bond market phrases, this is named a “bull steepening,” the place shorter-term bond costs rise extra sharply (yields fall) than longer-term ones. ((Bond costs transfer in the wrong way of yields.)

Ole Hansen, Head of Commodity Technique at Saxo Financial institution, defined that this dynamic is optimistic for gold.

“For gold, decrease front-end yields ease the chance price of holding non-yielding property. This shift is especially related for actual asset managers, lots of whom have struggled—or in some instances been restricted—from allocating to gold, whereas U.S. funding prices have been elevated,” Hansen mentioned in an evaluation be aware Thursday.

Hansen defined that the overall holdings in bullion-backed ETFs declined by 800 tons between 2022 and 2024, because the Fed raised charges to fight inflation, which despatched short-duration yields larger.

Bitcoin is commonly in comparison with gold as a retailer of worth, and like gold, it’s thought of a non-yielding asset. Neither Bitcoin nor gold generates curiosity or dividends; their worth is primarily pushed by shortage, demand, and market notion. So, the decline within the two-year yield might be thought of a bullish growth for BTC.

In the meantime, the relative resilience of longer-duration yields is attributed to expectations of sticky inflation and different elements, which additionally help the bullish case in gold and BTC.

“The U.S. Treasury curve has unsurprisingly steepened: decrease charges as we speak threat inflaming inflation additional forward, which is dangerous information for bonds,” analysts at ING mentioned in a be aware to shoppers Friday.

Hansen defined that a lot of the relative resilience within the 10-year yield stems from inflation breakevens, at present at round 2.45%, and the remainder represents the actual yield.

“[It] alerts that buyers are demanding larger compensation for fiscal dangers and potential political interference with financial coverage. This atmosphere sometimes helps gold as each an inflation hedge and a safeguard in opposition to coverage credibility issues,” Hansen famous.

The nominal yield is made up of two parts: Firstly, the inflation breakeven, which displays the market’s expectation for common inflation over the bond’s maturity. This portion of the yield compensates for the lack of buying energy as a consequence of inflation. The second part is the actual yield, which represents the extra compensation that purchasers demand above and past inflation.

Bull steepening is bearish for shares

Traditionally, gold and gold miners have been among the many finest performers throughout extended durations of bull steepening within the yield curve, in line with evaluation by Advisor Views. Conversely, shares are likely to underperform in these environments.

General, bitcoin finds itself in an intriguing place, given its twin nature as an rising expertise that always strikes with the Nasdaq, whereas additionally sharing gold-like qualities as a retailer of worth.

Learn extra: Purple September? Bitcoin Dangers Sliding to $100K After 6% Month-to-month Drop