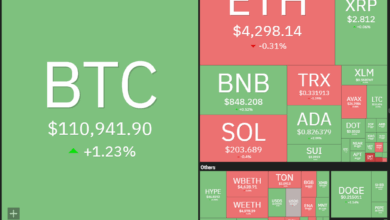

Bitcoin enters September buying and selling close to $107,000, however historical past isn’t on its aspect.

The month has been the weakest for BTC on common, with a median decline of roughly 5% and a mean lack of round 6% over the previous 12 years of market knowledge.

Some level out MicroStrategy’s premium over Bitcoin is slipping on the similar time September’s seasonal weak point looms. Nick Ruck of LVRG Analysis warns this displays deeper doubts concerning the firm’s treasury-heavy technique.

“MicroStrategy’s current wrestle to take care of its Bitcoin premium displays a broader market shift the place traders are questioning the sustainability of company treasury fashions targeted solely on crypto accumulation, a dynamic that might be exacerbated by September’s traditionally bearish development for crypto property,” Nick Ruck, director at LVRG Analysis.

“This cooling urge for food underscores a maturation in crypto markets, the place structural vulnerabilities and competitors are forcing a reevaluation of what really drives long-term worth past mere Bitcoin proxies,” Ruck added.

With Fed rate-cut bets constructing into September, a dovish flip might soften the seasonal drag. Conversely, recent ETF outflows or one other fairness selloff might reinforce the historic sample and push BTC towards $100,000 assist.

In the meantime, ether (ETH) fell 1.7% to $4,390, whereas Solana’s SOL (SOL) dropped 3.4% to $197.6. XRP slid 4.3% to $2.72 and dogecoin retreated 4.2% to 21 cents, extending final week’s positive aspects into reversals.

Since 2013, bitcoin has closed pink in September eight out of twelve occasions, with brutal drawdowns like 2019’s 13% slide and 2014’s 19% hunch. Even throughout bull cycles, rallies have tended to stall. The lone brilliant spots had been 2015, 2016, and 2023, with positive aspects starting from 2% to 7%.

That consistency has led merchants to deal with September virtually as a seasonality commerce. Seasonality refers back to the tendency of property to exhibit common and predictable fluctuations that recur all through the calendar 12 months.

Whereas it might seem random, attainable causes vary from profit-taking round tax season in April and Might, which might trigger drawdowns, to the commonly bullish “Santa Claus” rally in December, an indication of elevated demand.

The sample isn’t distinctive to crypto, as equities additionally present weak point round this time of 12 months; nevertheless, BTC’s sharper volatility makes it stand out.

Learn extra: Gold’s Rally Has a Massive Catalyst, and It May Assist Bitcoin Too