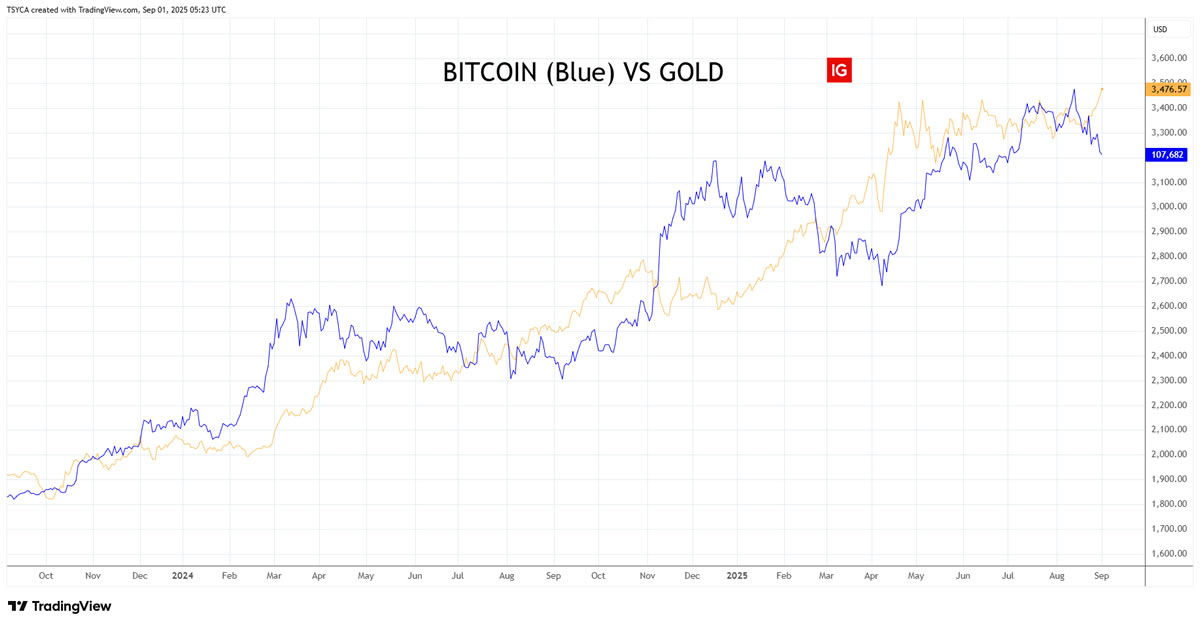

The value of gold hit an all-time excessive after US President Donald Trump commented on inflation on his social media platform, however Bitcoin was transferring in the wrong way on Monday, in what could possibly be seen for instance of Bitcoin’s “cut up character.”

Over the previous two and a half years, there was a robust correlation between gold, Bitcoin, and the Nasdaq, with all of them ripping increased, IG market analyst Tony Sycamore informed Cointelegraph.

“Nevertheless, there was a breakdown within the correlation between gold and Bitcoin in current weeks, which isn’t unusual for temporary durations and comes on account of Bitcoin’s cut up character.”

“At instances, Bitcoin is considered as a retailer of worth or a secure haven, and at different instances it’s considered as a danger asset,” he added.

The value of gold climbed to its highest ever stage on Monday, reaching $3,485 per ounce after a 1% spike, in keeping with GoldPrice. It got here after Trump posted to his social media platform Reality Social on Sunday, stating “costs are ‘WAY DOWN’ within the USA, with nearly no inflation.”

In the meantime, Bitcoin (BTC) has fallen to its lowest stage since early July in a divergent transfer.

It fell to a two-month low of $107,290 on Coinbase on Monday morning, in keeping with TradingView. This has resulted in its deepest correction from the mid-August all-time excessive, because the pullback exceeded 13%.

Bitcoin-gold correlation questioned

“As of late, Bitcoin and gold aren’t actually transferring collectively,” Vince Yang, co-founder of Ethereum layer-2 platform zkLink, informed Cointelegraph.

“The correlation’s been fairly low, even damaging at instances this yr. Gold’s nonetheless the basic ‘safe-haven’ play, whereas Bitcoin is extra tied to liquidity and market danger,” he stated. “Mainly, they steadiness one another out somewhat than run aspect by aspect.”

Nevertheless, Sycamore believes the correlation between Bitcoin and gold might ultimately realign, because it has performed earlier than.

Associated: Bitcoin dangers new 2025 correction as BTC worth uptrend begins seventh week

“Zooming out, I believe if Trump goes to run the economic system crimson scorching and the Fed cuts charges into persistent inflation, Bitcoin’s correlation with gold will reassert itself and each will go increased,” he stated.

“It’s only a query from what stage Bitcoin finds its toehold,” he added.

It might simply be lag

In the meantime, historic knowledge reveals Bitcoin worth rallies inside 150 days of gold hitting new all-time highs.

Gold costs reached a brand new peak above $2,000 in 2020 throughout the pandemic, which preceded Bitcoin’s surge to an all-time excessive the next yr.

Joe Consorti, head of progress at Theya, stated earlier this yr that Bitcoin follows gold’s directional bias with a lag of 100-150 days at a time.

Journal: XRP ‘cycle goal’ is $20, Technique Bitcoin lawsuit dismissed: Hodler’s Digest, Aug. 24 – 30