Consensys founder Joseph Lubin says huge Wall Road adoption of Ethereum will ultimately see Ether surge by 100 instances and flip Bitcoin as a “financial base.”

In an X publish on Saturday, the Ethereum co-founder mentioned that Wall Road will stake Ether as a result of they at the moment pay for his or her infrastructure and Ethereum will “substitute a lot of the numerous siloed stacks they function.”

This may result in huge demand for the asset, and big will increase from present ranges, he predicted.

“ETH will possible 100x from right here. In all probability way more.”

He added that monetary establishments might want to change into TradFi corporations that function on decentralized rails, and which means staking, working validators, working layer-2 networks, taking part in DeFi, and writing good contract software program for agreements, processes and monetary devices.

Final week, VanEck CEO Jan van Eck referred to as Ether (ETH) “the Wall Road token,” stating banks should undertake the community to facilitate stablecoin transfers or threat falling behind.

Ether has an extended highway to flip Bitcoin

Lubin mentioned he was additionally “100% aligned” with Fundstrat World Advisors managing associate Tom Lee, who mentioned in August that Wall Road will stake and use Ethereum, and that ETH might flip Bitcoin when it comes to community worth.

“Sure, Ethereum/ETH will flippen the Bitcoin/BTC financial base,” he mentioned.

Associated: Ether breaks under ‘Tom Lee’ trendline: Is a ten% incoming?

Nonetheless, Ether continues to be round 1 / 4 of the scale of Bitcoin in present market capitalization, that means it nonetheless has an extended strategy to go. Its crypto market dominance has doubled since April although, and is at the moment 14.3%, in keeping with TradingView.

Ether is the “highest octane” decentralized belief commodity

Lubin, who additionally chairs the world’s second-largest Ethereum treasury firm, Sharplink Gaming, added that Lee “shouldn’t be almost bullish sufficient.”

“No one on the planet can at the moment fathom how giant and quick a rigorously decentralized economic system, saturated with hybrid human-machine intelligence, working on decentralized Ethereum Trustware, can develop,” he mentioned, including:

“Belief is a brand new type of digital commodity. And ETH, the best octane decentralized belief commodity, will ultimately flippen all the opposite commodities on the planet.”

“Joseph Lubin’s prediction of Ethereum flipping Bitcoin’s financial base is resonating with institutional purchasers, who’re more and more allocating treasury property to ETH on account of its staking yield potential and position in tokenization ecosystems,” Nassar Achkar, chief technique officer on the CoinW crypto trade, mentioned.

Whereas Bitcoin stays the dominant retailer of worth, “Ethereum’s programmability and Wall Road’s adoption of its staking and DeFi rails might speed up the ‘flippening’ by remodeling ETH into each a productive asset and the foundational layer for world monetary infrastructure,” he added.

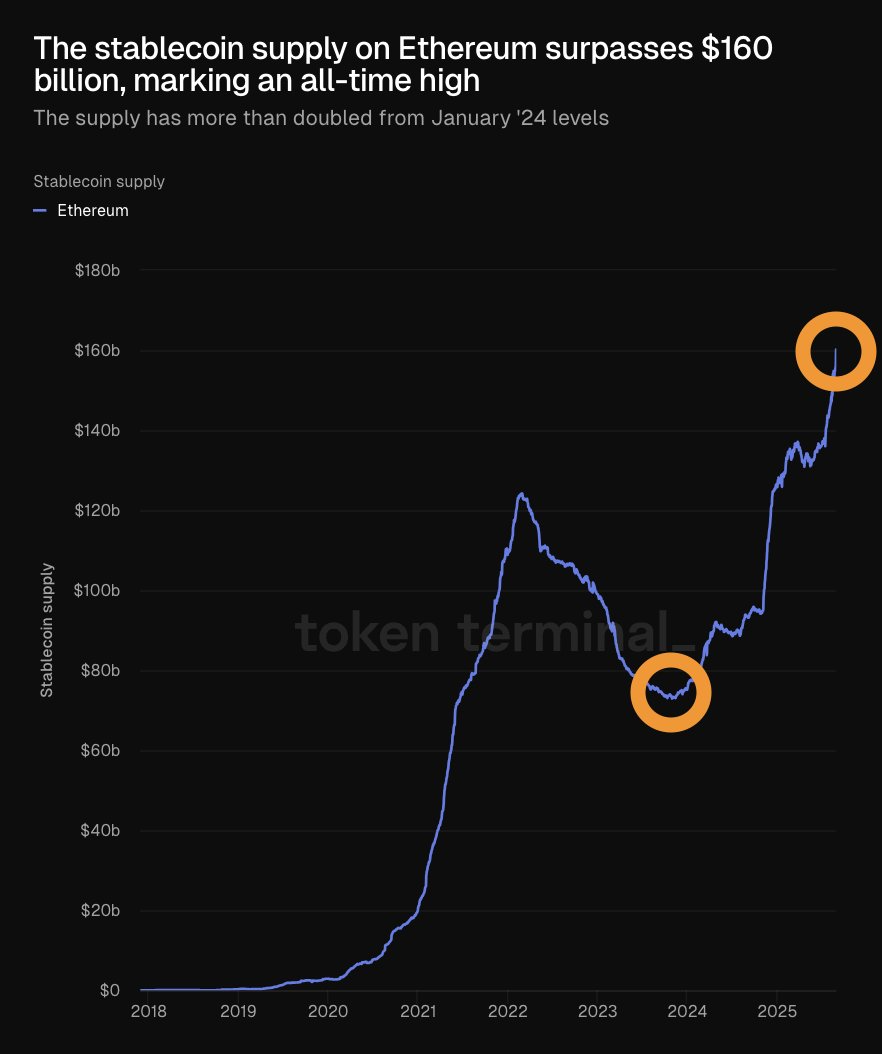

Stablecoins on Ethereum see exponential progress

In the meantime, the stablecoin provide on Ethereum has surpassed $160 billion, marking an all-time excessive and greater than doubling since January 2024, reported Token Terminal on Saturday.

“Stablecoin demand appears exponential on Ethereum,” commented Tom Lee the next day.

Ether gained over the weekend, approaching the $4,500 stage however failed to interrupt resistance there, returning under $4,400 throughout early buying and selling on Monday morning.

Journal: XRP ‘cycle goal’ is $20, Technique Bitcoin lawsuit dismissed: Hodler’s Digest, Aug. 24 – 30