The “Bitcoin OG,” which started rotating its $11.4 billion fortune to Ether in August, has continued shopping for ETH over the weekend and now holds $3.8 billion of it, onchain knowledge reveals.

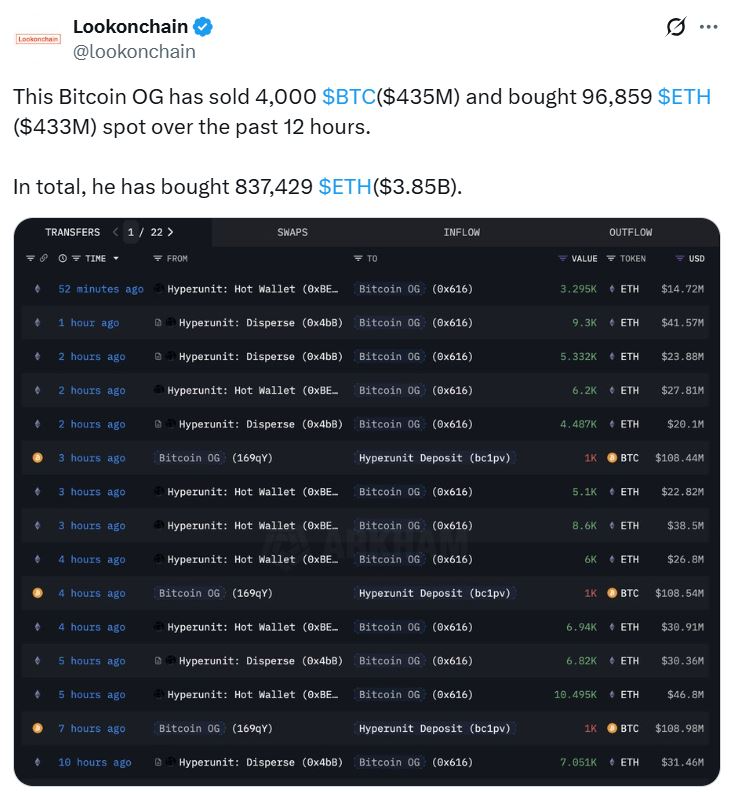

In its newest transfer, the Bitcoin whale offered 4,000 Bitcoin (BTC) value $435 million, exchanging it for 96,859 spot Ether over a 12-hour splurge, Lookonchain mentioned in a publish on Sunday.

The whale then deposited one other 1,000 Bitcoin into decentralized trade Hyperliquid on Monday, doubtlessly for extra ETH shopping for.

The blockchain analytics service first seen the whale on Aug. 25, and calculated its complete holdings at 100,784 Bitcoin, value over $11.4 billion at present costs.

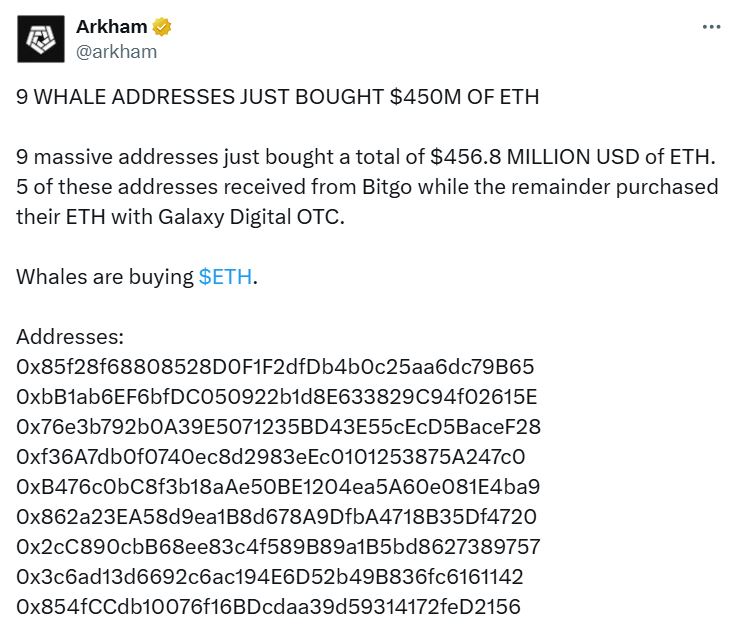

The “Bitcoin OG” joins a string of different whales who’ve been buying and selling out Bitcoin and shopping for Ether for the primary time. Analysts instructed Cointelegraph that it’s a signal that the market is maturing and that whales are diversifying in mild of constructive regulatory strikes within the US.

Whales diversifying as ETH momentum builds

Chatting with Cointelegraph, Henrik Andersson, chief funding officer of funding agency Apollo Crypto, mentioned that it’s arduous to know what particular person whales are considering, however traditionally, there was a market rotation from Bitcoin to Ether, then to altcoins.

“After the GENIUS invoice and pro-US rules, there may be extra gravity behind some altcoins, particularly Ethereum, and it could possibly be some whales selecting to diversify in mild of the constructive backdrop,” he mentioned.

In July, President Donald Trump then signed the GENIUS Act into regulation. The laws focuses on stablecoins and is the nation’s first federal regulation targeted solely on fee stablecoins.

Andersson mentioned Ether has been gaining momentum since. It reached a brand new all-time excessive on Aug. 24, crossing above $4,946, based on CoinGecko. The token is now buying and selling at $4,389, down 1.2% within the final 24 hours.

“Bitcoin has been going sideways for months whereas there may be actual momentum for Ethereum. We’ve seen the ETF flows in August closely favouring Ethereum. In our view, that is prone to proceed within the medium time period.”

Crypto now not a one-horse Bitcoin race

Ryan McMillin, chief funding officer of Australian crypto funding supervisor Merkle Tree Capital, instructed Cointelegraph that though long-standing Bitcoin holders are diversifying into Ether, it’s not an abandonment of the token; as a substitute, it’s recognition that the crypto panorama has matured.

“After years of holding, many OG whales view Bitcoin as digital gold whereas Ether gives yield by way of staking, and publicity to the broader sensible contract financial system,” he mentioned.

“For Bitcoin veterans, allocating into Ether is much less about chasing hype and extra about acknowledging that digital belongings are now not nearly storing worth, however a multi-protocol ecosystem with a various and rising use case set.”

Nevertheless, McMillin mentioned not each OG whale is rotating out; most are protecting their Bitcoin publicity intact. It’s simply this subset that’s signaling that Ether has develop into a core holding fairly than a speculative facet wager.

Associated: OG Bitcoiners are rotating out, but it surely’s a wholesome dynamic: Analysts

On the similar time, he speculates different altcoins might see some inflows from Bitcoin whales as effectively, with the timing hinting at a “basic altseason rotation,” when Bitcoin is robust and a few capital “naturally flows into ETH as traders search for relative worth.”

“If the ETH rotation gathers momentum, it wouldn’t be stunning to see flows lengthen into Solana (SOL) subsequent, given its traction in shopper apps and DeFi.”

Journal: Bitcoin OG Willy Woo has offered most of his Bitcoin: Right here’s why