It is a each day evaluation by CoinDesk analyst and Chartered Market Technician Omkar Godbole.

Bitcoin has breached key assist ranges in an indication of accelerating bearish momentum that means a threat of a slide to $100,000.

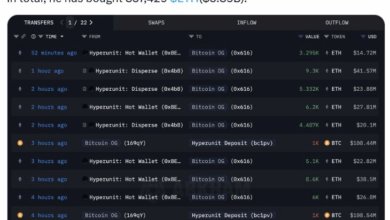

The main cryptocurrency by market worth fell 6.5% in August, ending the four-month successful streak because the U.S.-listed spot exchange-traded funds (ETFs) bled $751 million, in response to knowledge supply SoSoValue.

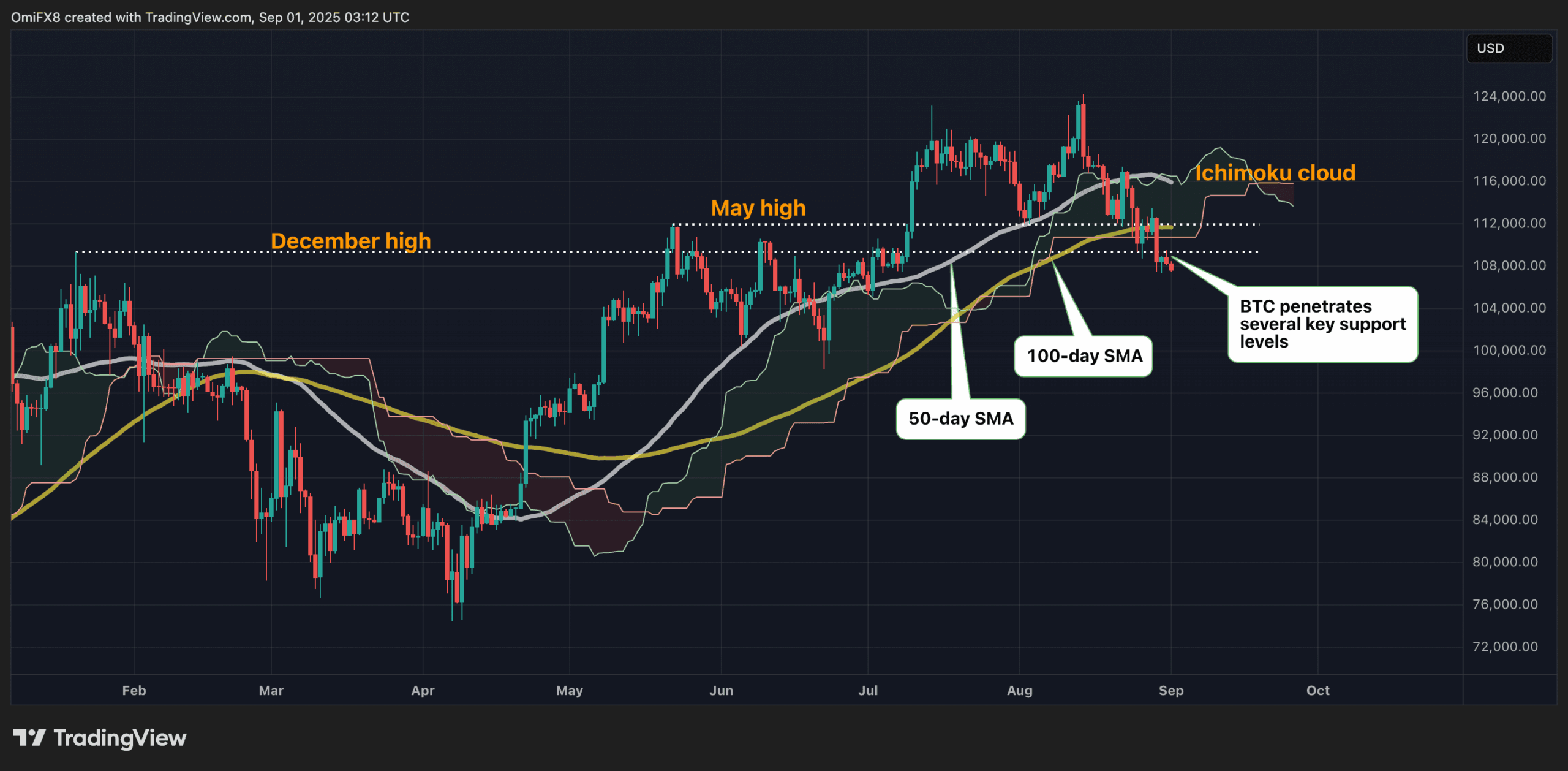

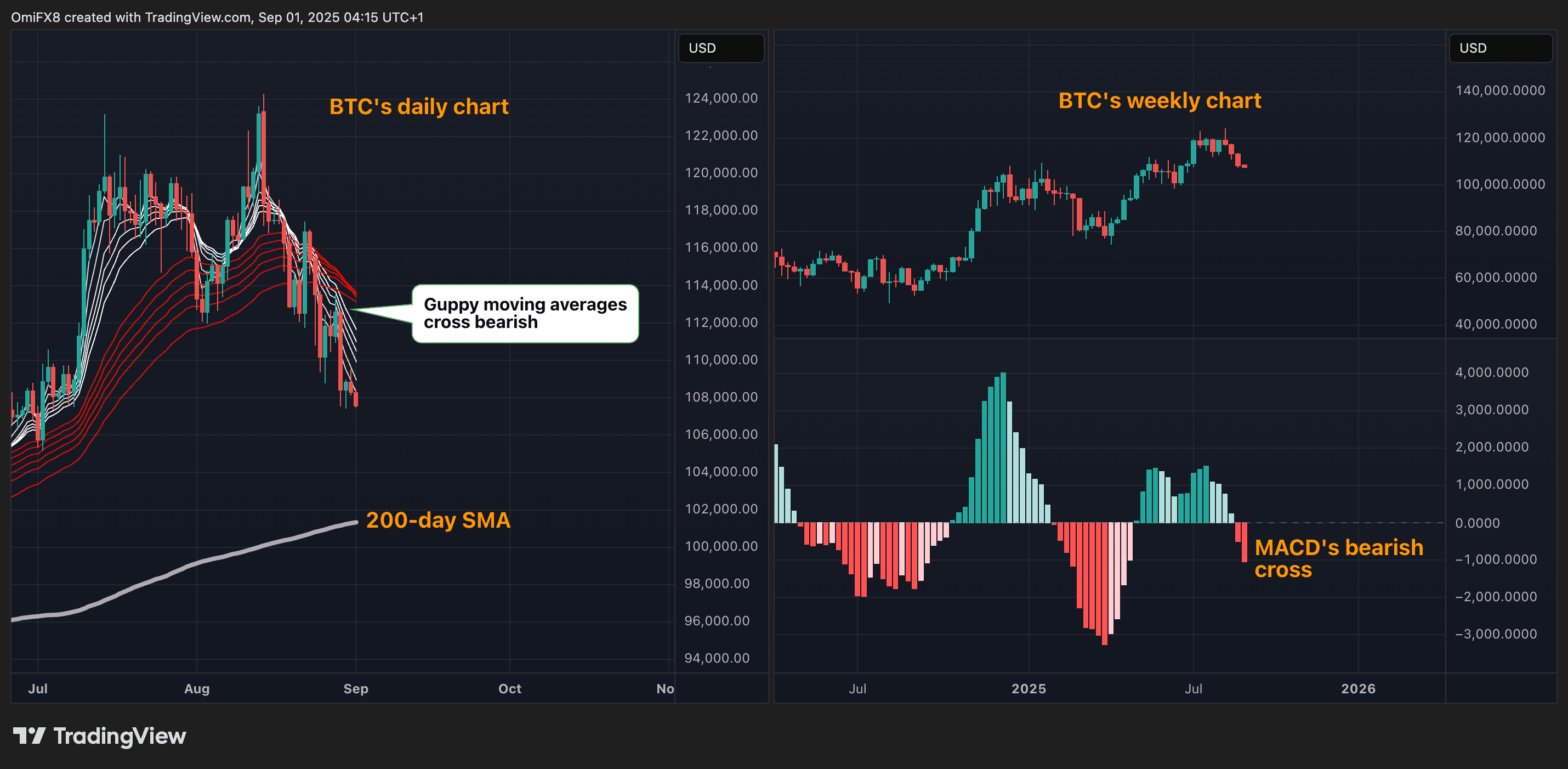

The current value drop noticed bitcoin break under a number of key assist ranges, together with the Ichimoku cloud, and the 50-day and 100-day easy shifting averages (SMAs). It additionally pierced essential horizontal assist zones fashioned by the Might excessive of $111,965 and the December excessive of $109,364, in response to the each day chart sourced from TradingView.

These breakdowns underscore rising market weak point, confirming a bearish shift in key momentum indicators such because the Guppy A number of Transferring Common (GMMA) and the MACD histogram.

The short-term exponential shifting common (EMA) band of the GMMA (inexperienced) has crossed under the longer-term band (purple), signaling a transparent bearish momentum shift. In the meantime, the weekly MACD histogram has dropped under zero, indicating a transition from a bullish to a bearish development.

Collectively, these indicators point out a probability of a sustained sell-off, probably driving the worth right down to the 200-day easy shifting common (SMA) at $101,366, and probably to the $100,000 mark.

The unfavorable technical outlook aligns with seasonal tendencies, which present September traditionally as a bearish month for bitcoin. Since 2013, BTC has delivered a mean return of -3.49%, closing decrease in eight of the previous 12 September months, in response to knowledge from Coinglass.

As for bulls, overcoming the decrease excessive of $113,510 set on Aug. 28 is essential to negating the bearish outlook.

- Help: $105,240 (the 38.2% Fib retracement of the April-August rally), $101,366 (the 200-day SMA), $100,000.

- Resistance: $110,756 (the decrease finish of the Ichimoku cloud), $113,510 (the decrease excessive), $115,938 (the 50-day SMA).