Key takeaways:

-

Bitcoin dip patrons are again, however nonetheless being overpowered by sellers within the futures and spot markets.

-

Closed markets on the Labor Day vacation and the specter of promoting by OG Bitcoin whales may ship BTC value to $105,000 and under.

Bitcoin (BTC) trades amid rocky waters as the worth struggles to carry above $108,000, and in the intervening time, there are not any indicators of a restoration in sight. Merchants are exercising warning resulting from Wall Avenue being closed Monday for the Labor Day vacation and the overhang of a Bitcoin whale doubtlessly unloading one other billion-dollar tranche of BTC on the open market.

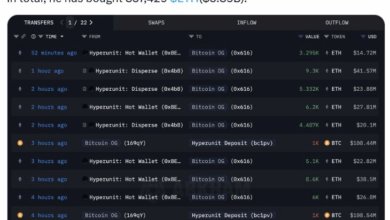

The Bitcoin OG whale bought one other 4,000 $BTC to purchase $ETH.

In lower than 2 weeks, this whale has bought over 32,000 BTC and purchased over 870K Ethereum value $3.8 billion.

He nonetheless holds 50K+ BTC, which can most definitely be bought for $ETH. pic.twitter.com/AC3iyhoM4a

— Ted (@TedPillows) August 31, 2025

Notable transfers and promoting from long-dormant whale-sized Bitcoin wallets and the conversion of the proceeds to Ether (ETH), declining inflows to the spot BTC ETFs, and end-of-week weak point within the DOW, S&P500, and Nasdaq are all weighing on investor sentiment. Including to the stress are US President Trump’s back-and-forth rhetoric on tariffs, and the markets’ response to the president’s makes an attempt to take management of the Federal Reserve board.

Some longer-out positives are market individuals’ expectations that the Fed will begin reducing rates of interest in late September or October, however these hopes haven’t been sufficient to enhance short-term investor sentiment.

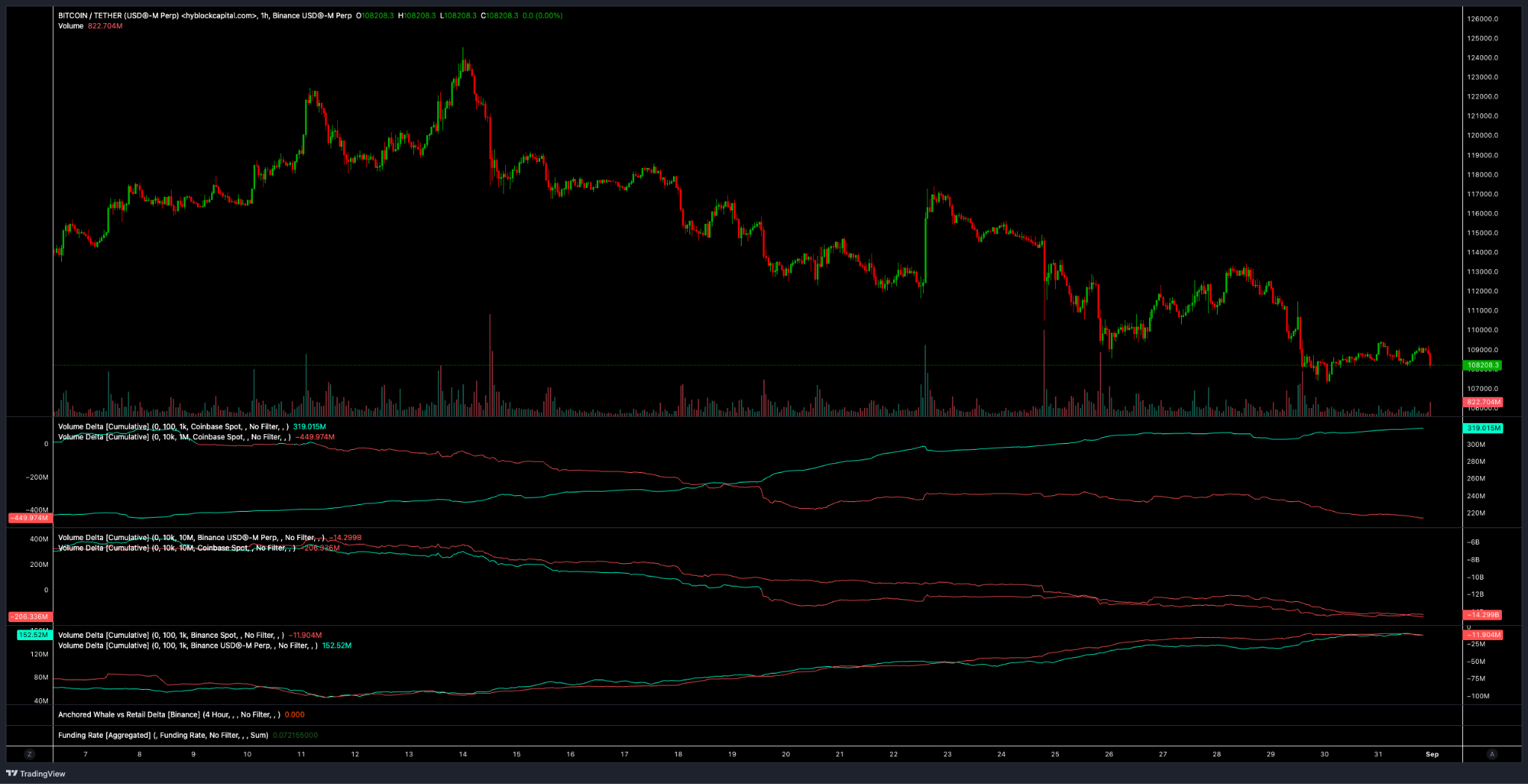

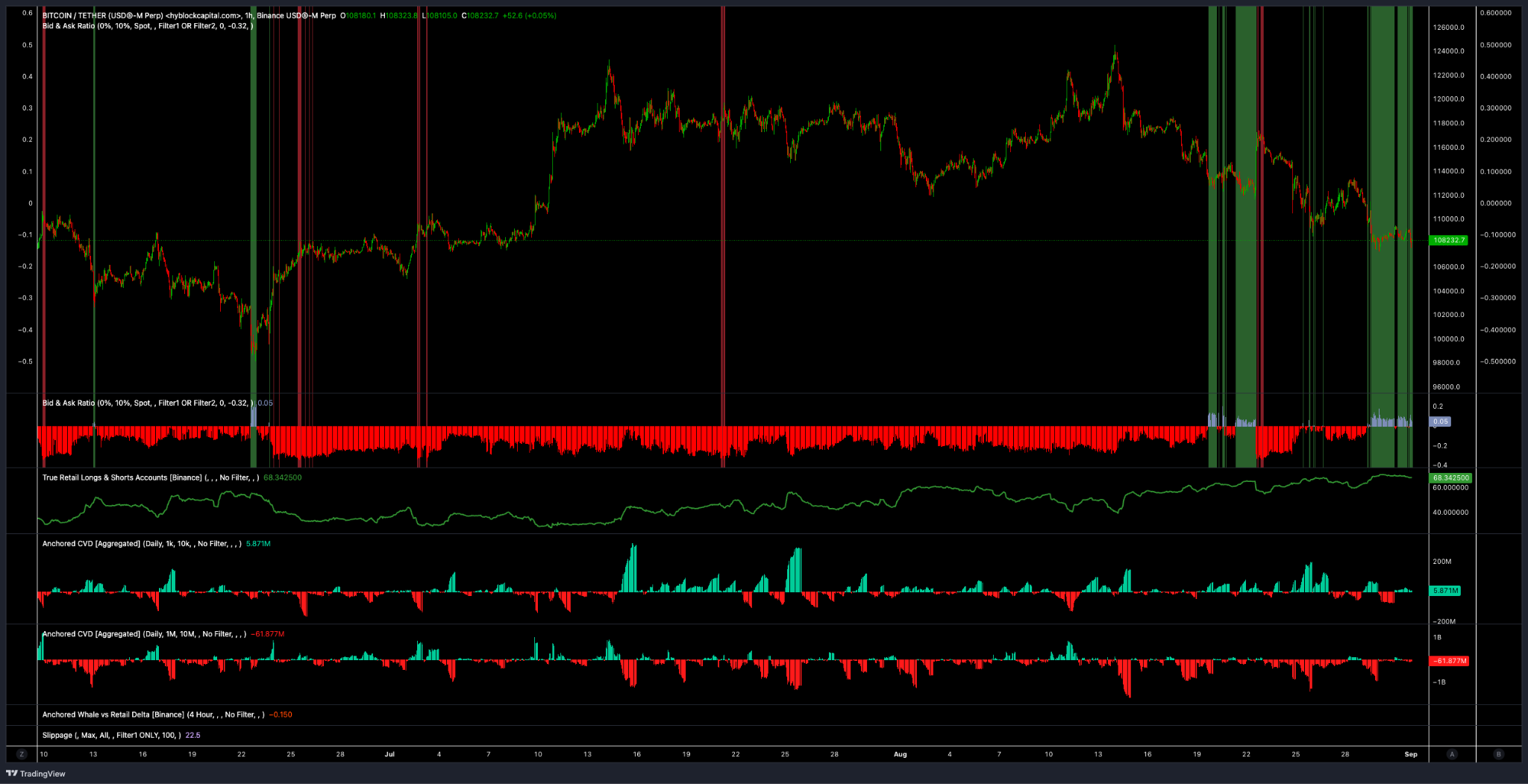

From a technical standpoint, Bitcoin’s intraday value motion continues to be primarily pushed by exercise within the perpetuals futures market, the place the cumulative quantity delta exhibits promoting from the ten,000 to 10 million Binance cohort far outpacing shopping for within the spot and futures market at Binance and Coinbase.

Whereas promoting in futures continues to suppress Bitcoin value breakouts, and knowledge exhibits quick positions thickening up at every failed assist resistance flip try, spot patrons within the retail-size cohort (100 to 10K) are shopping for every new low.

Associated: Will Bitcoin value drop in September?

As proven within the chart under, the bid and ask ratio (set to 10% spot orderbook depth) exhibits patrons taking a chew as value dropped into the $112,000 to $111,000 zone on Aug. 19 to Aug. 22 and once more as BTC descended to $107,200 on Friday by Sunday. It’s value noting that previous to Aug. 19, the metric had not flagged an occasion of the order e-book having extra bids than promote orders since June 22, when BTC value fell under $98,000.

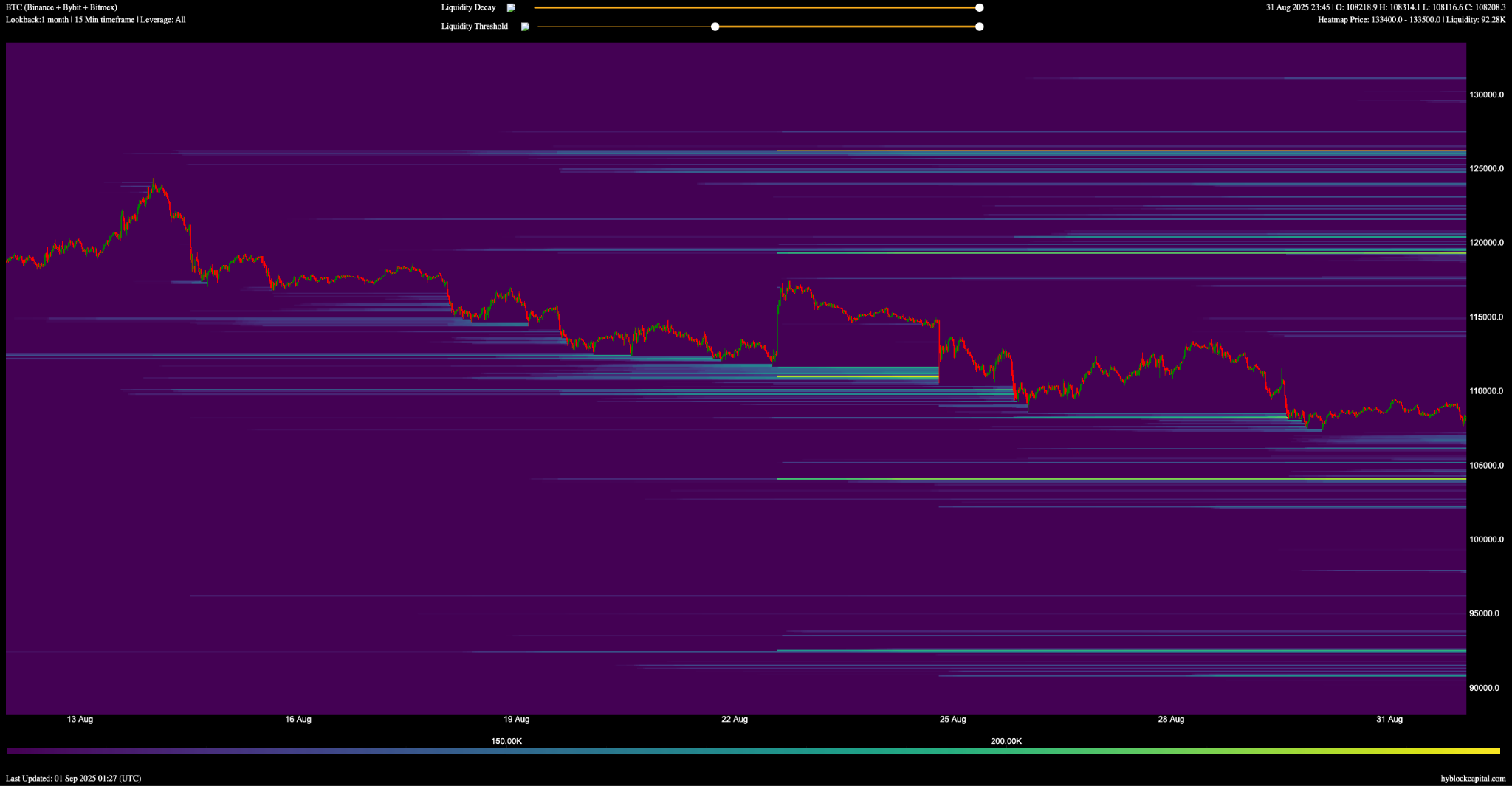

Bitcoin’s 30-day liquidation heatmap exhibits draw back liquidity persevering with to be absorbed, with probably the most distinguished cluster at $104,000.

On a shorter timeframe, the BTC/USDT 1-hour chart at TRDR.io exhibits bids displaying up at $105,000, $102,600 and $100,000. Setting the order e-book to 10% depth, bids within the $99,000 to $92,000 zone are additionally current.

Whereas patrons are proving eager to purchase dips to new lows, orderbook liquidity mixed with BTC value weak point favors draw back and sellers proceed to overpower dip patrons. Wall Avenue (and the spot BTC ETFs) shall be closed on Monday, and the unfavorable overhang of OG whales promoting within the open market is prone to proceed weighing on value within the quick time period.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.