Good Morning, Asia. Here is what’s making information within the markets:

Welcome to Asia Morning Briefing, a day by day abstract of prime tales throughout U.S. hours and an summary of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

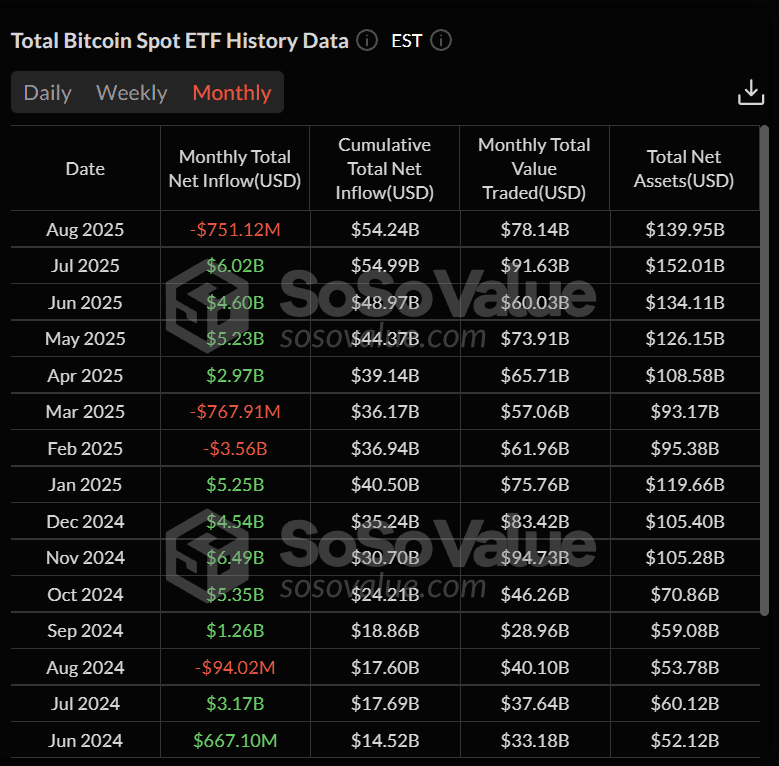

August delivered a uncommon reversal within the ETF tide: Bitcoin spot funds shed $751 million in web outflows simply weeks after powering the asset to a $124,000 all-time excessive, whereas Ethereum ETFs quietly absorbed $3.9 billion, based on market knowledge.

The divergence is hanging as a result of it marks the primary time since each merchandise launched that BTC ETFs have misplaced floor, whereas Ethereum ETFs have posted sturdy inflows in the identical month, suggesting that institutional buyers could also be rebalancing their publicity.

On-chain knowledge underscores Bitcoin’s fragility. A latest report from Glassnode exhibits BTC slipping under the associated fee foundation of 1- and 3-month holders, leaving short-term buyers below water and elevating the danger of deeper retracement. A sustained transfer beneath the six-month value foundation close to $107,000 may speed up losses towards the $93,000–$95,000 assist zone, the place a dense cluster of long-term holders final gathered.

Prediction markets are echoing that warning. Polymarket merchants now assign a 65% probability that BTC revisits $100,000 earlier than $130,000, whereas solely 24% anticipate it to hit $150,000 by year-end. That shift suggests buyers see the July rally as overextended with out renewed ETF demand to again it.

Ethereum, in the meantime, has benefited from steadier inflows. ETH ETFs have logged constructive web subscriptions in 10 of the final 12 months, and August’s $3.9 billion haul helped the token notch a 25% acquire over 30 days regardless of a tough week.

With Bitcoin’s ETF tide flowing out, Ethereum’s steadier institutional bid could also be rising as a quiet ballast and maybe the beginning of a rotation story heading into year-end.

Market Actions:

BTC: Market observers say crypto charts look so bearish they could possibly be bullish, based on prior CoinDesk reporting, as BTC trades under 108k, with compelled liquidations clearing leverage and a rebound doubtless after the Fed’s Sept. 17 determination.

ETH: Polymarket merchants see Ethereum holding above $3,800 into September 5 with over 90% odds, whereas longer-term bets give it a 71% probability of ending 2025 above $5,000 and slimmer odds of $10,000 or increased.

Gold: Gold climbed towards document highs as merchants priced in Fed fee cuts, a weaker greenback, and political uncertainty following challenges to the central financial institution’s independence.

Nikkei 225: The Nikkei 225 regarded set to open decrease as buyers weighed a U.S. court docket ruling in opposition to Trump’s tariffs, China-India ties, and upcoming manufacturing knowledge.

Elsewhere in Crypto:

- Justin Solar eyes ‘Swift’ for digital asset sector, praises Hong Kong crypto strikes (SCMP)

- Trump-Backed USD1 to Supplant Tether, USDC as Prime Stablecoin by 2028: Blockstreet (Decrypt)

- WLFI derivatives quantity jumps 400% forward of World Liberty’s first token unlock on Monday (The Block)