Wealthy Bitcoiners Appear to be Spending BTC on Luxurious Holidays. Is This Actually a Good Concept?

Bitcoin’s newest rally is spilling over into the posh vacation market.

The Monetary Instances (FT) reported earlier as we speak that personal jet companies, cruise traces and boutique accommodations are more and more accepting crypto funds.

Flexjet-owned FXAIR, for example, now takes tokens for transatlantic journeys costing about $80,000, whereas cruise operator Virgin Voyages sells annual passes price $120,000.

SeaDream Yacht Membership and boutique resort teams together with The Kessler Assortment have additionally added crypto checkout choices, in response to the FT.

Excessive-end journey is a pure area of interest for crypto spending. On six-figure invoices, charges and volatility matter much less, and retailers can immediately convert funds into fiat.

For purchasers, paying in bitcoin carries standing worth, echoing earlier bull-market splurges on Lamborghinis and watches. This time, the indulgence is time-saving non-public jets and one-of-a-kind cruises.

Nonetheless, whether or not it makes monetary sense is one other matter. Bitcoin’s most well-known cautionary story comes from 2010, when Florida programmer Laszlo Hanyecz spent 10,000 BTC on two pizzas, a purchase order now price over $1 billion in hindsight. At the moment’s jet bookings might invite the identical remorse if bitcoin retains climbing.

But others see logic in cashing in.

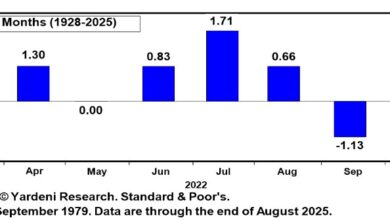

With bitcoin just lately hitting a file $124,128 on Aug. 14, some rich holders might view the current rally as a window to lock in features earlier than macro shocks ship costs decrease.

Inflationary pressures tied to the brand new U.S. import tariffs, together with wider financial uncertainty, might simply knock BTC again beneath $100,000, turning as we speak’s vacation splurges right into a rational hedge.

There are additionally tax issues.

The U.S. Inside Income Service (IRS), for example, treats crypto as property, that means that spending BTC counts as a taxable disposal and might set off capital-gains liabilities. The U.Okay.’s HMRC applies the identical precept, taxing disposals when cash are offered, swapped or spent.

The larger backdrop, in response to McKinsey information cited by the FT, is that youthful prosperous vacationers are driving a luxurious journey increase projected to almost double spending between 2023 and 2028. For that technology, crypto is not only an funding automobile but in addition a solution to pay for experiences that promise freedom and exclusivity.

Backside line: Crypto hasn’t taken over espresso retailers, however on the prime finish of the market it’s exhibiting up. Whether or not that’s sensible wealth administration or one other billion-dollar pizza mistake depends upon how lengthy this bull cycle lasts.