Key takeaways:

-

The stablecoin market cap has doubled to $280 billion since 2023, with forecasts hitting $2 trillion by 2028; over half of it already runs on Ethereum.

-

Actual-world property onchain have grown 413% since early 2023 to $26.7 billion, with BlackRock, Franklin Templeton, and others main the cost on Ethereum.

-

The GENIUS Act and CLARITY Act may pave the best way for large-scale institutional adoption and strengthen Ethereum’s position.

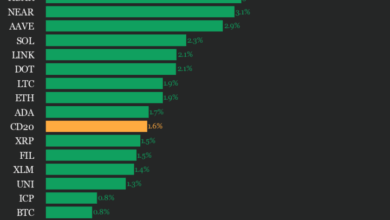

Ether (ETH) value has surged 88% in simply two months, outpacing most large-cap cryptocurrencies. Some attribute it to the much-awaited altcoin season. Others level to ETH ETFs lastly discovering their patrons, or the wave of company treasuries shopping for Ether. But all that hype feels extra like fallout than the actual driver. What’s really powering the rally is the quiet, relentless rise of institutional adoption in crypto.

By securing dominance in two sectors most coveted by conventional finance—stablecoins and tokenized real-world property (RWAs)—Ethereum is positioning itself because the good contract platform of selection. New US rules, notably the GENIUS Act and the CLARITY Act, may amplify this pattern and speed up Ethereum’s integration into institutional finance.

Stablecoins are the blood move of finance

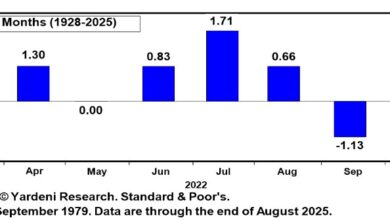

For the reason that begin of the 2023-2026 cycle, the stablecoin market cap has doubled to $280 billion, based on DefiLlama. McKinsey analysts estimate this quantity to exceed $400 billion by year-end and attain $2 trillion by 2028. As soon as solely serving as commerce pairs for different cryptocurrencies, stablecoins have grown right into a direct challenger to conventional money-transfer rails — quicker, cheaper, extra inclusive, and more and more international.

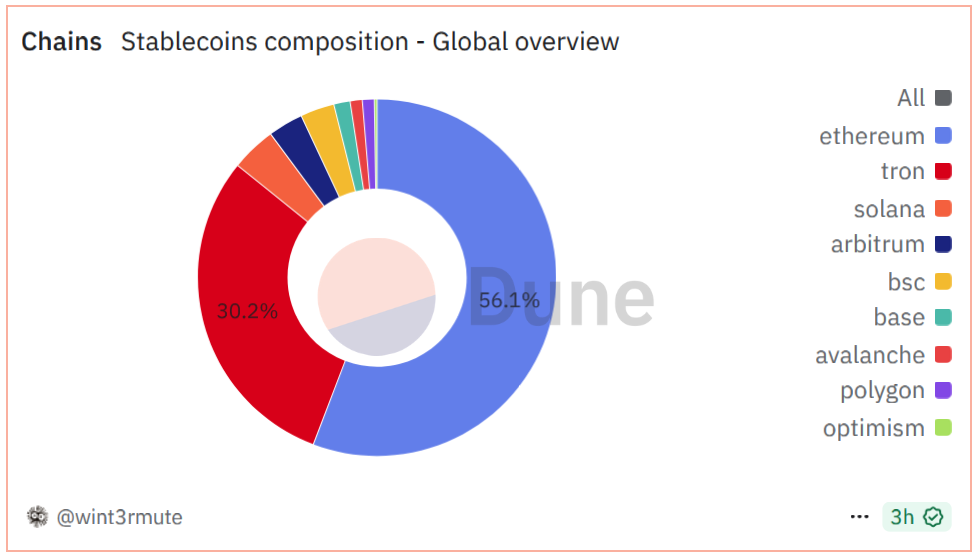

Ethereum dominates right here. Dune Analytics exhibits 56.1% of all stablecoins run on Ethereum. The maths is straightforward: the extra stablecoins take over cross-border funds, the extra Ethereum earns in transaction charges.

Regulation now offers this progress authorized tooth. The GENIUS Act, signed in July 2025, units the primary federal framework for stablecoins. It mandates one-to-one backing with {dollars} or short-term Treasurys, public reserve disclosures, and retains stablecoins out of securities regulation. That makes issuing and utilizing them safer and extra predictable, and it ties their progress to US Treasurys and the greenback itself.

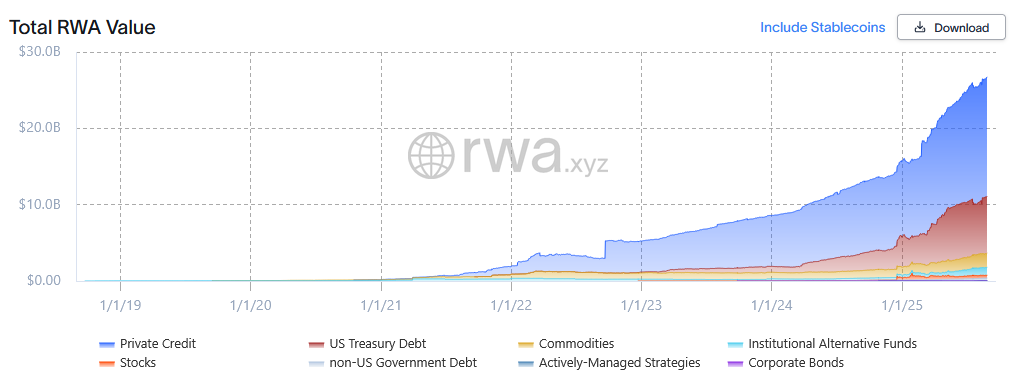

RWAs are the subsequent step in bringing monetary property onchain

Tokenized real-world property have develop into the poster little one of this cycle. The sector is exploding as banks and asset managers uncover how a lot quicker it’s to maneuver tokenized property than to wrangle with TradFi mechanisms. Analytics web site RWA.xyz places its progress at 413% since early 2023 — from $5.2 billion to $26.7 billion at this time.

Main gamers are driving this shift. BlackRock’s BUIDL, WisdomTree’s WTGXX, and Franklin Templeton’s BENJI now share the identical area as crypto-native issuers’ property, like Tether’s XAUT, Paxos’ PAXG, and Ondo’s OUSG and USDY. This convergence exhibits how quickly the road between crypto and conventional finance dissolves.

Ethereum once more leads the pack, internet hosting over $7.6 billion in tokenized real-world property and capturing 52% of the whole RWA market.

Associated: Ether ETFs seize 10x extra inflows than Bitcoin in 5 days

Ethereum is essentially the most “mature blockchain”

Ethereum’s benefit lies not solely in market share but in addition in its credibility. It has earned institutional belief because the oldest good contract platform with 100% uptime and broad decentralization. Cointelegraph has beforehand highlighted that TradFi more and more views Ethereum as essentially the most battle-tested and credibly impartial community. Mockingly, these identical qualities now make Ethereum much more engaging to TradFi than the “non-public” blockchains as soon as hailed because the finance-ready future.

In a formidable flip of occasions, the US regulatory shift now places that distinction into legislation. The CLARITY Act, handed by the Home on July 17 and now awaiting its flip within the Senate, introduces the idea of a “mature blockchain” and attracts the road between property regulated as commodities by the CFTC and people falling beneath the SEC’s securities oversight. The implications are sweeping for crypto finance and RWAs specifically: any chain assembly the maturity take a look at may host tokenized variations of almost any asset.

To qualify, no single entity can management the community or personal greater than 20% of its tokens; the code have to be open-source, governance clear, and participation broad. Ethereum simply clears this bar, making it the plain selection for establishments making ready to convey the immensity of real-world property onchain.

As regulation builds the bridge between DeFi and TradFi, Ethereum isn’t simply well-positioned; it’s turning into the rails of selection. Consider ETH not as a speculative asset however as a chunk of core monetary infrastructure. And that sort of actuality shift doesn’t simply rework ecosystems — it modifications value trajectories.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.