The next is a visitor submit and evaluation from Vincent Maliepaard, Advertising and marketing Director at Sentora.

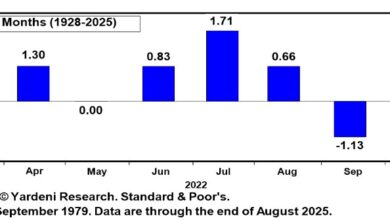

2025 has marked a turning level for XRP, combining explosive value positive factors with transformative shifts in its core narrative. In July, the token hit an all-time excessive of $3.58, propelled partially by decisive authorized victories. Past value motion, Ripple’s launch of the RLUSD stablecoin has gained important traction, and the community is now doubling down on increasing XRP’s footprint within the DeFi ecosystem.

The inspiration of XRP’s breakout was laid when the SEC dropped its lawsuit in opposition to Ripple, eradicating a big regulatory overhang that had suppressed institutional curiosity for years. This authorized decision in addition to the Trump administration’s crypto-friendly coverage framework, together with the GENIUS Act, catalyzed a broader bull market throughout digital belongings.

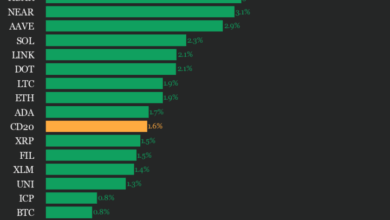

The token has additionally benefited from a strategic revaluation as institutional traders engaged in speculative rotation towards under-owned large-cap cryptocurrencies, recognizing XRP as a professional capital layer fairly than a speculative buying and selling car.

This thesis was strengthened by Ripple’s launch of the RLUSD stablecoin in late 2024, which rapidly scaled to a $600 million market cap and demonstrated real-world utility in driving adoption momentum. The ecosystem growth has continued with the launch of the XRPL EVM sidechain, enhancing interoperability and good contract performance, whereas anticipation builds across the potential approval of an XRP ETF that would additional speed up institutional adoption.

Let’s dive in for a breakdown of XRP’s progress and momentum, new gamers within the ecosystem and XRP’s breakthrough in DeFi.

XRP’s Progress and Momentum

XRP’s focus dynamics reveal a mature institutional possession construction that mirrors conventional monetary belongings, with the highest 10 wallets controlling roughly 41% of circulating provide, increasing to 50% among the many prime 20 holders and over 70% inside the prime 100. This focus sample signifies institutional capital allocation fairly than retail hypothesis, which helps XRP’s evolution into an institutional asset class.

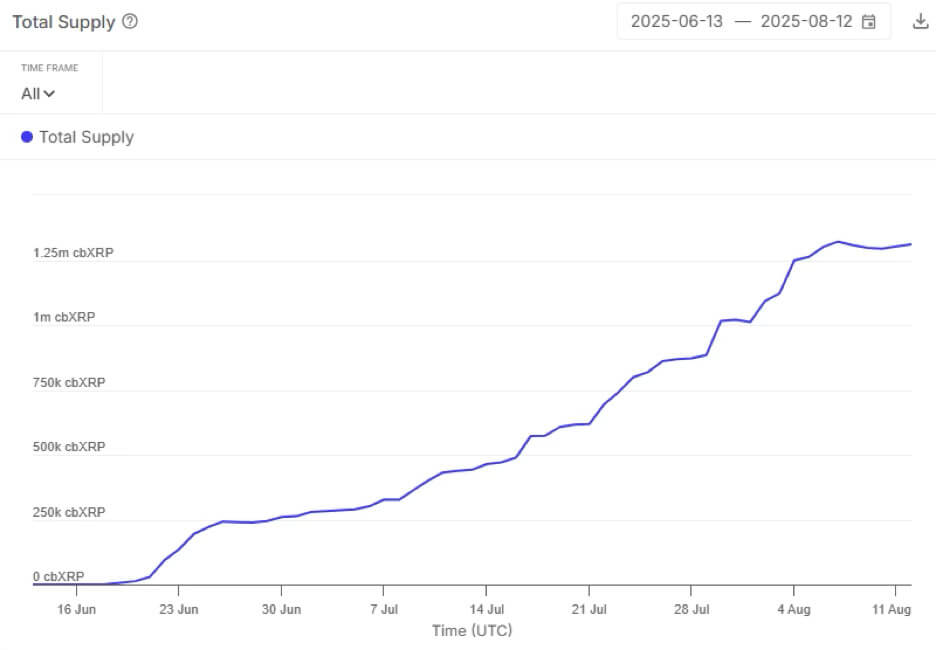

The token’s transformation from a earlier cycle laggard to a favourite gained important validation via Coinbase’s integration. In July, the alternate launched cbXRP, a wrapped token backed 1:1 by XRP particularly designed for cross-chain performance. This infrastructure improvement instantly unlocked new use circumstances, with Moonwell changing into the primary main DeFi protocol to assist cbXRP, enabling neighborhood members to lend and borrow the wrapped token inside the platform’s DeFi ecosystem.

Progress of cbXRP on Moonwell has been regular, regularly rising to over $1.2 million in liquidity since its launch in June. Whereas this can be removed from XRPs typical multi-billion greenback headlines, it marks an necessary milestone in XRP’s DeFi journey.

These developments sign a elementary shift in how conventional exchanges and DeFi protocols are positioning XRP, transferring past easy buying and selling options. The mixture of concentrated institutional possession, enhanced technical infrastructure via wrapped tokens, and increasing lending markets demonstrates that XRP is experiencing adoption momentum as capital flows more and more acknowledge its utility as a cross-border settlement layer and institutional-grade digital asset.

Increasing into DeFi

The growth of XRP into decentralized finance represents a pure development for what Gabriel Halm of Sentora describes as a blockchain that has “efficiently established itself as a digital fee community,” with DeFi improvement being “an intuitive subsequent step in making a complete finance ecosystem for XRP.” This evolution addresses a crucial hole in XRP’s utility, because the token traditionally lacked the basic DeFi primitives.

Flare Community has emerged as one such infrastructure supplier for XRPFi, via the introduction of FAssets—which upon launch, permits XRP holders to transform their tokens into FXRP, a wrapped model of XRP. This operates in a non-custodial, trust-minimized framework which makes use of good contracts for cross-chain verification.

Upcoming Yield Alternatives for XRP in DeFi

Whereas customers can at the moment earn a modest yield (round 0.1% at the moment) by supplying cbXRP on Moonwell, considerably increased returns could also be on the horizon with the upcoming launch of the Firelight Protocol on Flare.

Firelight goals to convey economic safety and yield era to the XRP ecosystem, very similar to how EigenLayer has unlocked extra staking yield for Ether. By leveraging staked XRP for financial safety, Firelight’s structure may allow progressive DeFi functions—comparable to on-chain insurance coverage—that had been beforehand not possible.

As Hugo Philion, Co-Founding father of Flare Community, explains:

“Firelight provides on-chain XRP yield alternatives, each for establishments and retail holders, bettering capital effectivity for XRP and additional bolstering its utility.”

Wanting Forward

XRP’s progress story is shifting from short-term value cycles to long-term structural evolution. The convergence of regulatory readability, institutional adoption, and DeFi growth, pushed by platforms like Base, Moonwell, Flare, and Firelight, broadens XRP’s utility and doubtlessly establishes it as a yield-bearing asset.

Whereas it might not but be a dominant power in DeFi, these developments may strengthen XRP’s position as a bridge between conventional finance and rising on-chain alternatives.