Key takeaways:

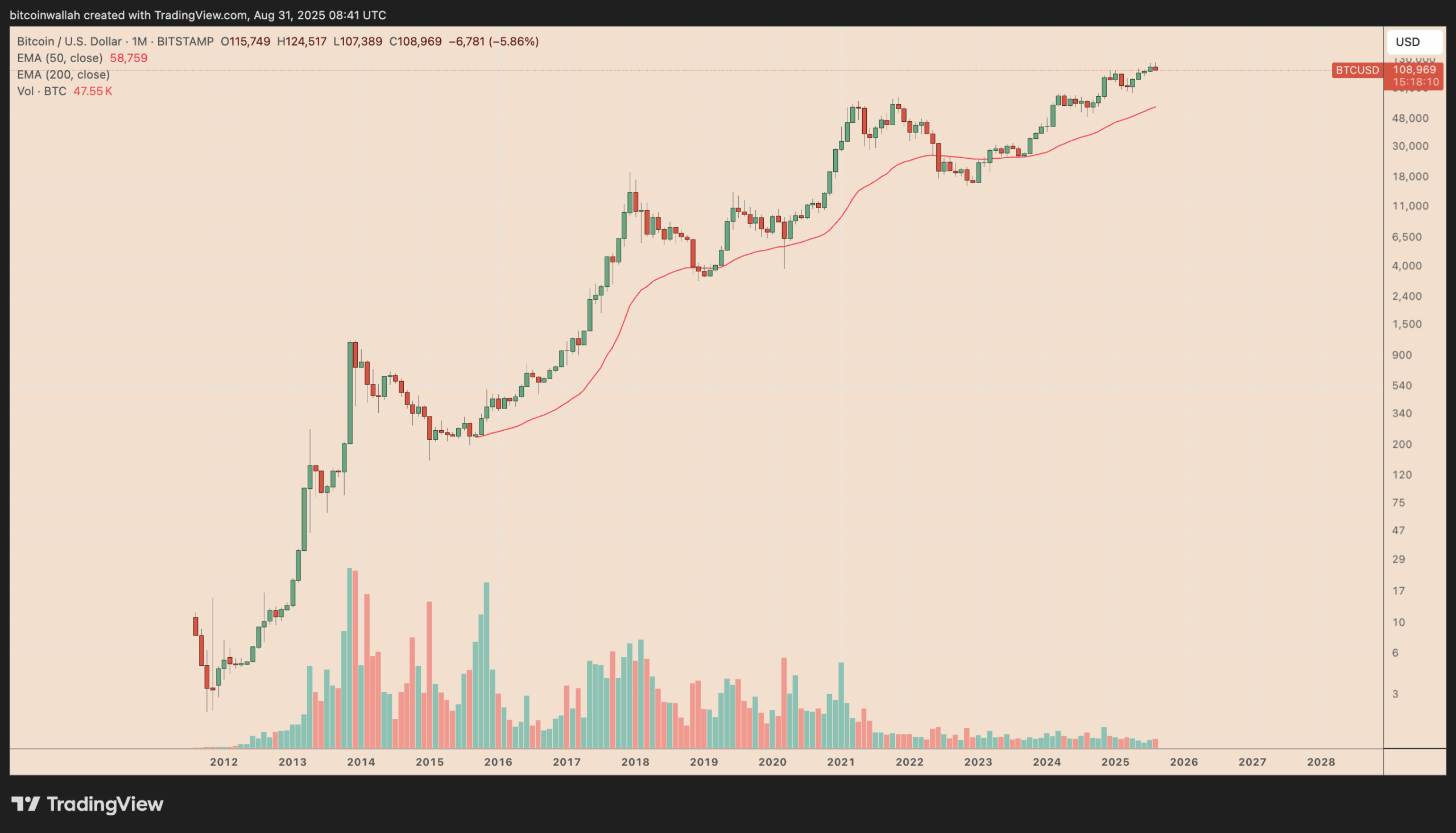

Bitcoin (BTC) is about to shut August within the purple, its first down-month since April, stoking fears that the downturn might deepen as September begins.

September is normally a nasty month for Bitcoin

Bitcoin has a well-established tendency to slip in September.

Since 2013, Bitcoin has closed within the purple for eight of the previous twelve months, with common returns slipping about −3.80%.

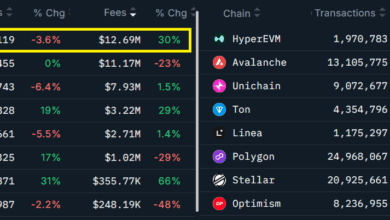

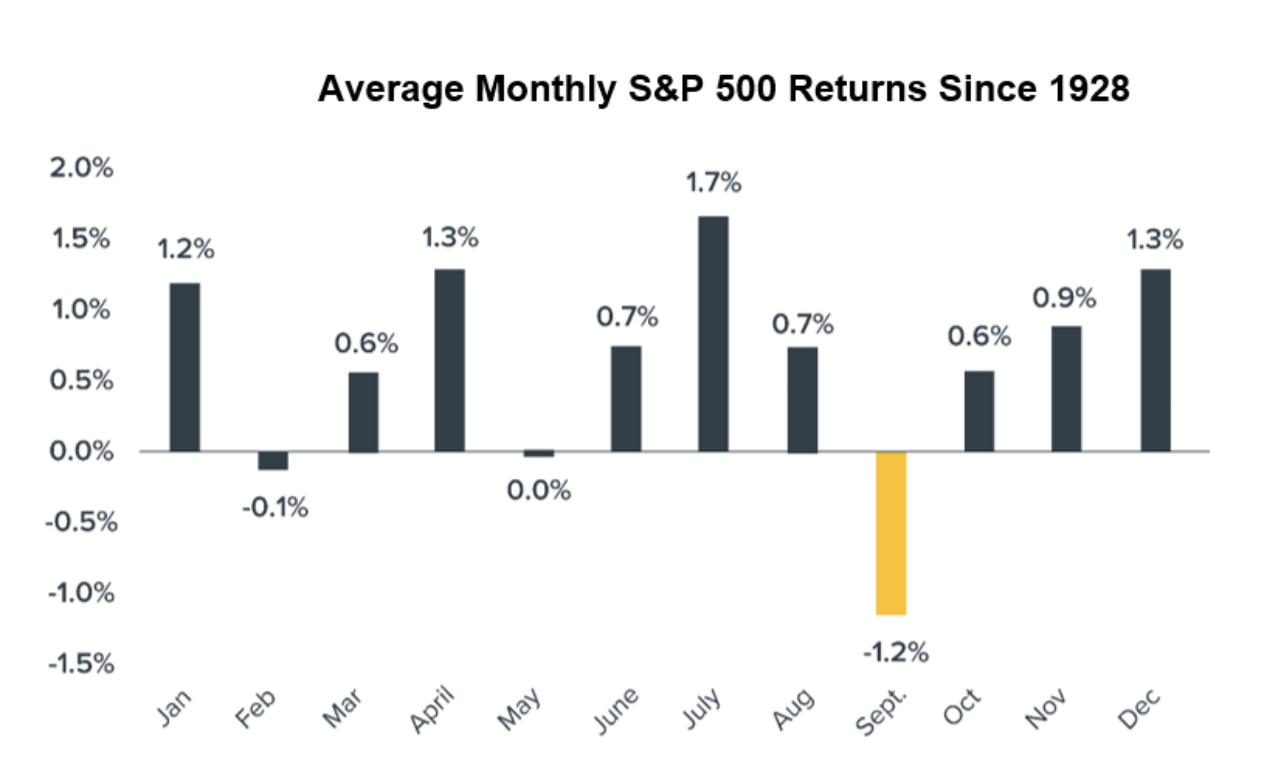

Market veterans name it the “September Impact,” a month when merchants are likely to lock in income after summer season rallies or reposition portfolios forward of This autumn. Since 1928, for example, the S&P 500 index’s returns in September have averaged round -1.20%.

Typically buying and selling in sync with broader threat property, Bitcoin can turn out to be a sufferer of this seasonal drag.

Nevertheless, since 2013, each inexperienced September for Bitcoin has come solely after a bruising August, a sample that hints of sellers front-running.

Associated: Bitcoin value loses key multiyear help trendline: A traditional BTC fakeout?

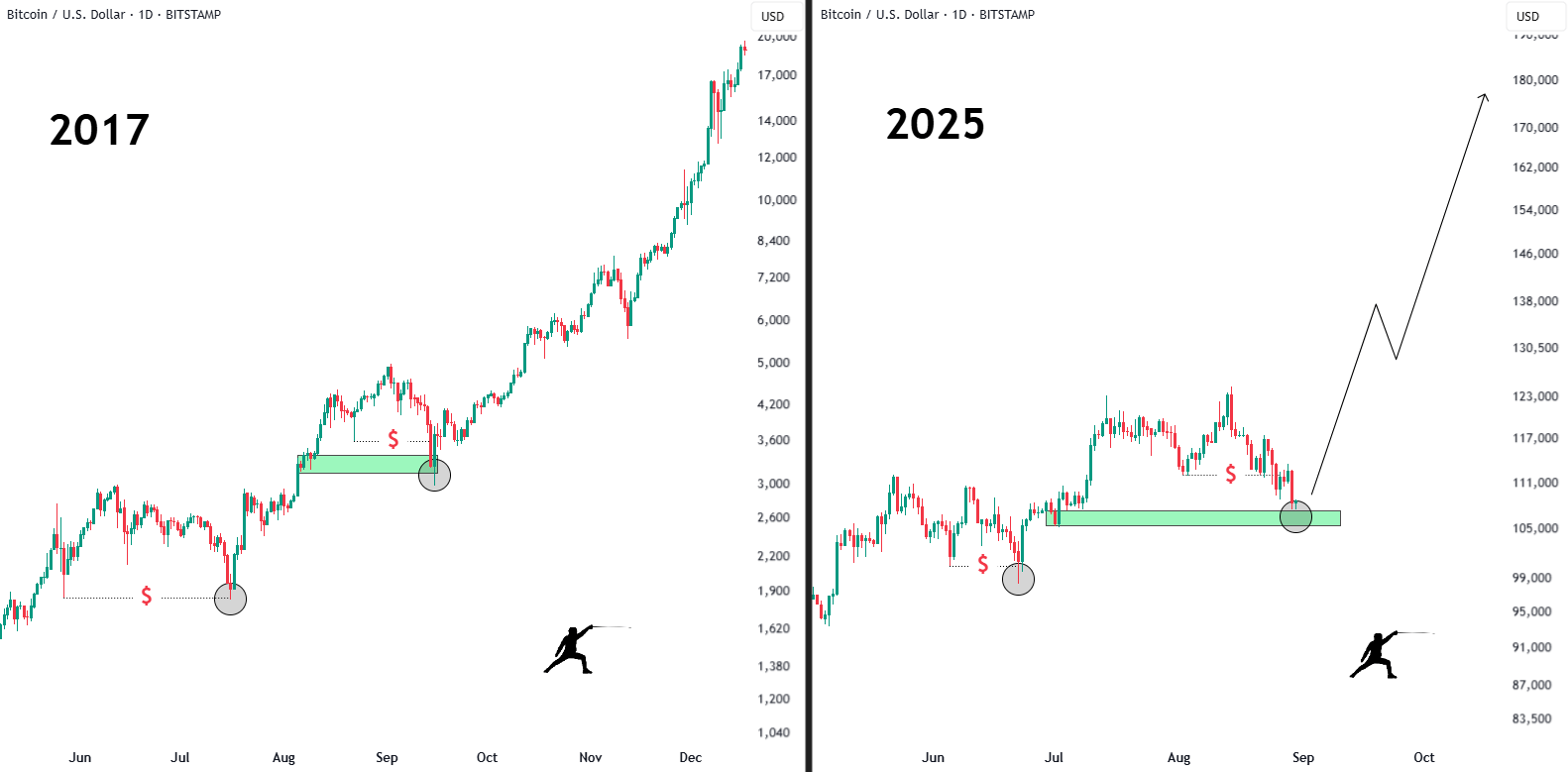

Analyst Rekt Fencer says {that a} “September dump just isn’t coming” this yr, citing Bitcoin’s efficiency in 2017.

The chart overlay of 2017 and 2025 reveals a near-mirror picture. In each cycles, Bitcoin slipped sharply in late August, discovered footing at a key help zone, after which reversed greater.

Again in 2017, that retest marked the ultimate shakeout earlier than BTC value rocketed to $20,000.

Quick-forward to at present, and Bitcoin is as soon as once more hovering close to a multimonth base between $105,000 and $110,000, a stage that could possibly be the launchpad for an additional parabolic leg upward.

Bitcoin might retest its report excessive in 4-6 weeks

The $105,000–$110,000 zone acted as resistance earlier within the yr, however it has now flipped into help, a traditional bullish construction in technical evaluation.

One vital upside sign comes from the so-called “hidden bullish divergence.” Although Bitcoin’s value has dropped, its relative energy index (RSI), a well-liked momentum indicator, hasn’t fallen as a lot.

That normally means the market just isn’t as weak as the worth chart suggests, hinting that patrons are quietly stepping again in.

Analyst ZYN means that Bitcoin could possibly be on monitor for a contemporary all-time excessive above $124,500 throughout the subsequent 4–6 weeks, owing to those technical patterns that justify a possible rally in September.

A weaker greenback may help Bitcoin bulls in September

Forex merchants are turning bearish on the greenback as a slowing US financial system and anticipated Fed charge cuts weigh on sentiment. They see the buck sliding one other 8% this yr, a decline compounded by Donald Trump’s criticizing the Fed.

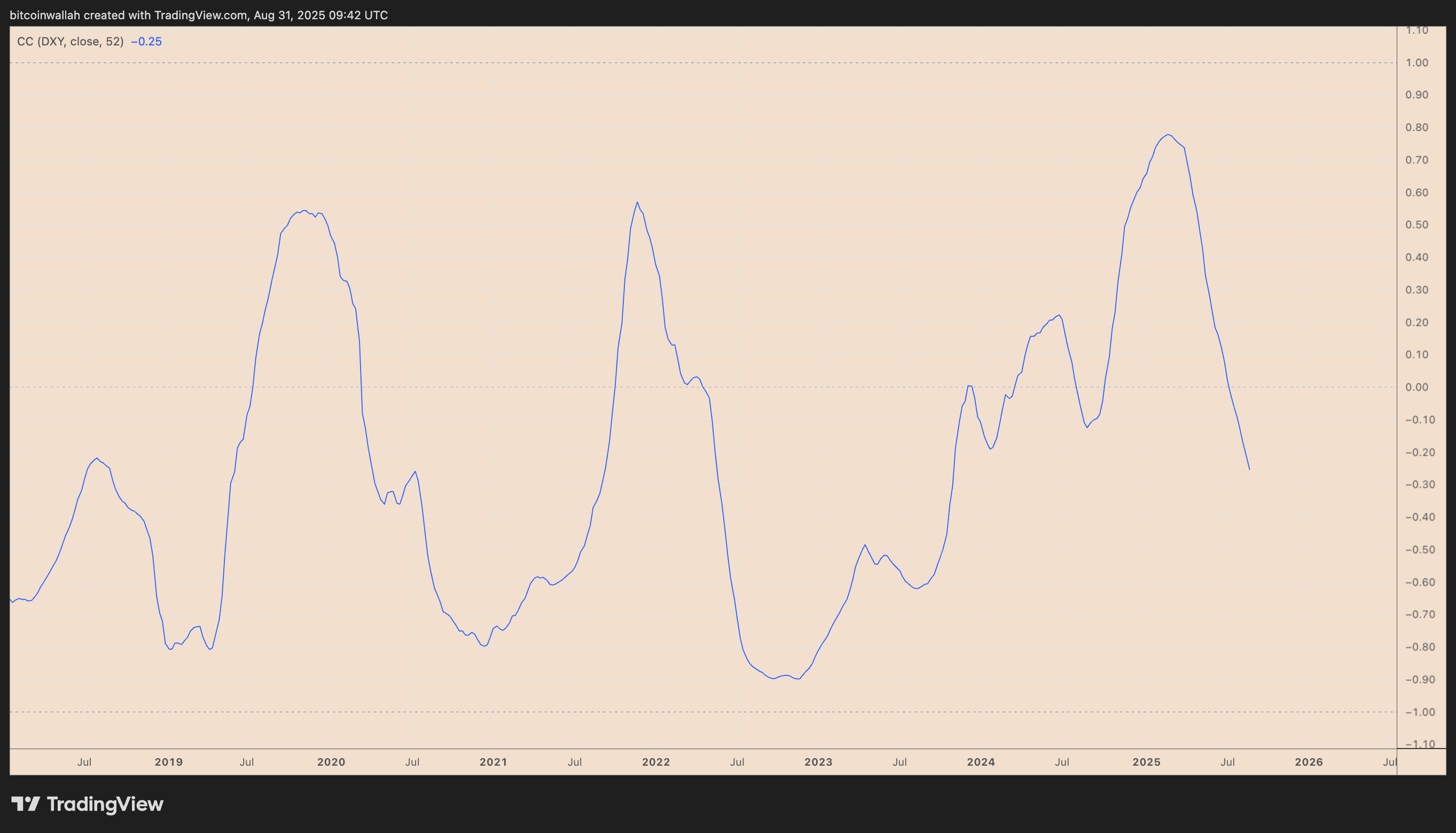

As of Sunday, the 52-week correlation between Bitcoin and the US Greenback Index (DXY) had slipped to −0.25, its weakest stage in two years.

That shift improves Bitcoin’s, in addition to the broader crypto market’s, odds of climbing in September if the greenback’s stoop continues.

“The Fed will begin the cash printers in This autumn of this yr,” analyst Ash Crypto mentioned final week, including:

“Two charge cuts imply trillions will move into the crypto market. We’re about to enter a parabolic part the place Altcoins will explode 10x -50x.”

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.