Metaplanet, the Tokyo-listed agency aggressively accumulating Bitcoin, is going through mounting strain as its share value tumbles, threatening the fundraising mannequin it has used to construct one of many largest company Bitcoin treasuries globally.

The corporate’s inventory has dropped 54% since mid-June, regardless of Bitcoin (BTC) gaining round 2% throughout the identical interval. The decline has put its capital-raising “flywheel” beneath stress, a mechanism depending on rising share costs to unlock funding via MS warrants issued to Evo Fund, its key investor.

With shares down sharply, exercising these warrants is now not enticing for Evo, squeezing Metaplanet’s liquidity and slowing its Bitcoin acquisition technique, in line with a Sunday report by Bloomberg.

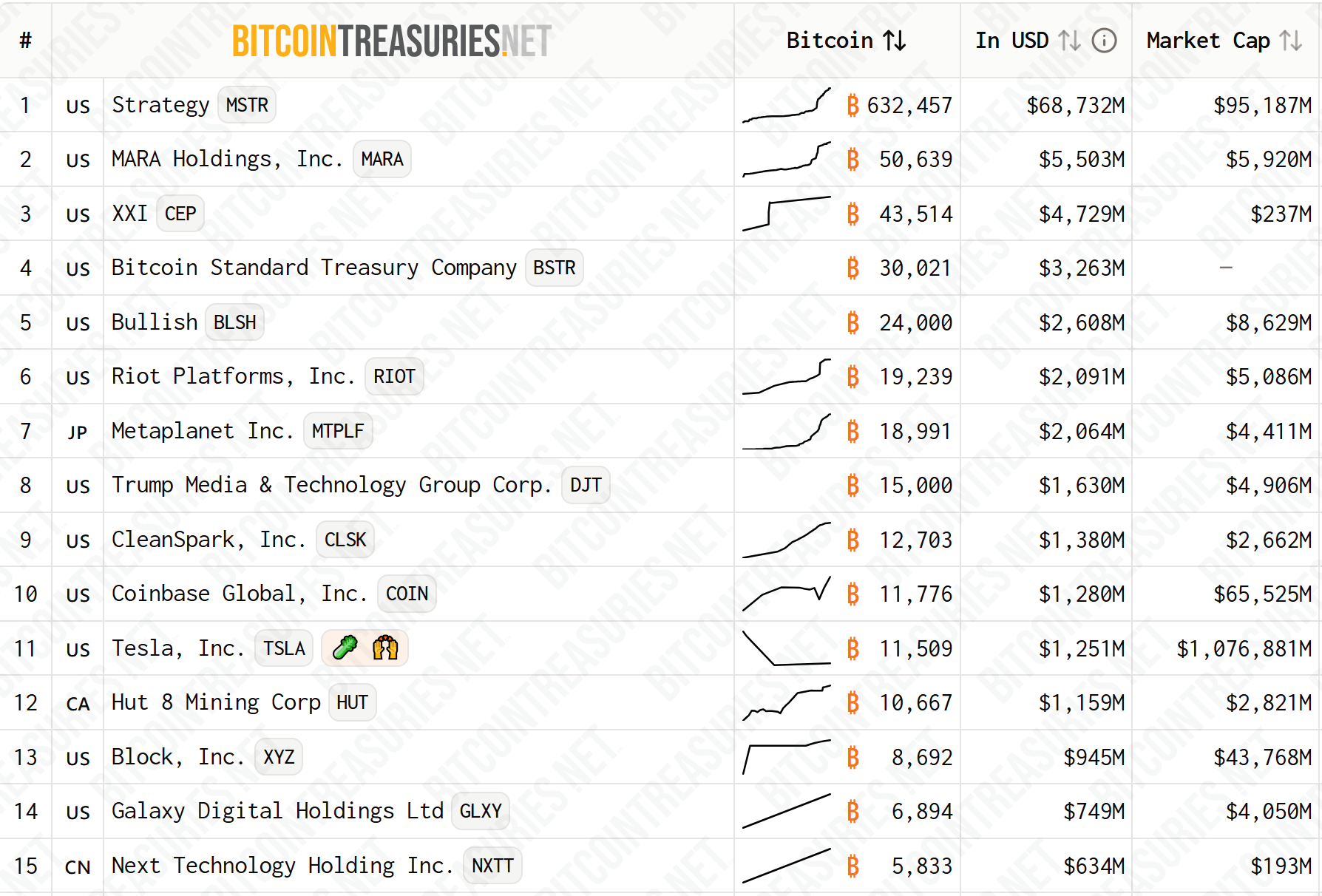

Led by former Goldman Sachs dealer Simon Gerovich, Metaplanet at present holds 18,991 BTC, making it the seventh-largest public holder, in line with BitcoinTreasuries.NET. The agency has ambitions to develop its stack to 100,000 BTC by the top of 2026, and 210,000 BTC by 2027.

Associated: Metaplanet, Smarter Net add nearly $100M in Bitcoin to treasuries

Metaplanet turns to abroad markets

With its “flywheel” technique dropping momentum, Gerovich is popping to different fundraising. On Wednesday, Metaplanet introduced plans to lift roughly 130.3 billion yen ($880 million) via a public share providing in abroad markets.

Moreover, shareholders will vote on Monday on whether or not to approve the issuance of as much as 555 million most popular shares, a uncommon instrument in Japan, which may elevate as a lot as 555 billion yen ($3.7 billion).

In an interview with Bloomberg, Gerovich referred to as the popular shares a “defensive mechanism,” permitting capital infusion with out diluting frequent shareholders if the inventory falls additional. These shares, anticipated to supply as much as 6% annual dividends and initially capped at 25% of the agency’s Bitcoin holdings, might enchantment to Japanese traders starved of yield.

Associated: Metaplanet plans to lift extra $3.7B to purchase Bitcoin

Falling Bitcoin premium places Metaplanet’s technique in danger

Nonetheless, analysts are cautious. “The Bitcoin premium is what’s going to decide the success of all the technique,” stated Eric Benoit of Natixis. That premium, the distinction between Metaplanet’s market cap and the worth of its Bitcoin holdings, has fallen from over 8x in June to simply 2x, rising the danger of dilution.

The corporate has suspended Evo’s warrant workout routines from Sept. 3 to 30, paving the best way for the popular inventory issuance. Whether or not this shift can stabilize Metaplanet’s funding technique stays to be seen.

In the meantime, Metaplanet has been upgraded from a small-cap to a mid-cap inventory in FTSE Russell’s September 2025 Semi-Annual Evaluation, incomes inclusion within the FTSE Japan Index. The transfer follows the corporate’s sturdy Q2 efficiency.

Journal: Bitcoin’s long-term safety finances downside: Impending disaster or FUD?