The rising variety of “purchase the dip” calls following Bitcoin’s 5% drop over the previous week might sign extra draw back forward for the crypto market, in line with sentiment platform Santiment.

“Clearly, general, within the markets, individuals are getting antsy and looking for some entry spots now that costs have cooled down a bit,” Santiment analyst Brian Quinlivan mentioned in a video printed on YouTube on Saturday.

Santiment mentioned in a separate report printed on the identical day that social media mentions of “purchase the dip” have elevated considerably amid the crypto market downturn, which can be a warning signal for the market.

“Don’t interpret ‘purchase the dip’ chatter as a definitive backside sign. A real market flooring usually coincides with widespread concern and a scarcity of curiosity in shopping for,” Santiment mentioned.

“An actual backside usually varieties when the gang loses hope and turns into afraid to purchase,” Santiment added.

Sentiment is recovering as merchants anticipate altcoin season

The full crypto market capitalization is $3.79 trillion on the time of publication, down roughly 6.18% over the previous seven days, in line with CoinMarketCap.

In the meantime, Bitcoin (BTC) is buying and selling at $108,748 on the time of publication, down roughly 5% over the identical interval. On Aug. 14, Bitcoin reached new a brand new excessive of $124,128.

It’s usually echoed amongst crypto analysts that costs transfer reverse to what retail merchants count on, and historical past reveals that when extra folks assume the market has reached a backside, it may well truly sign additional draw back.

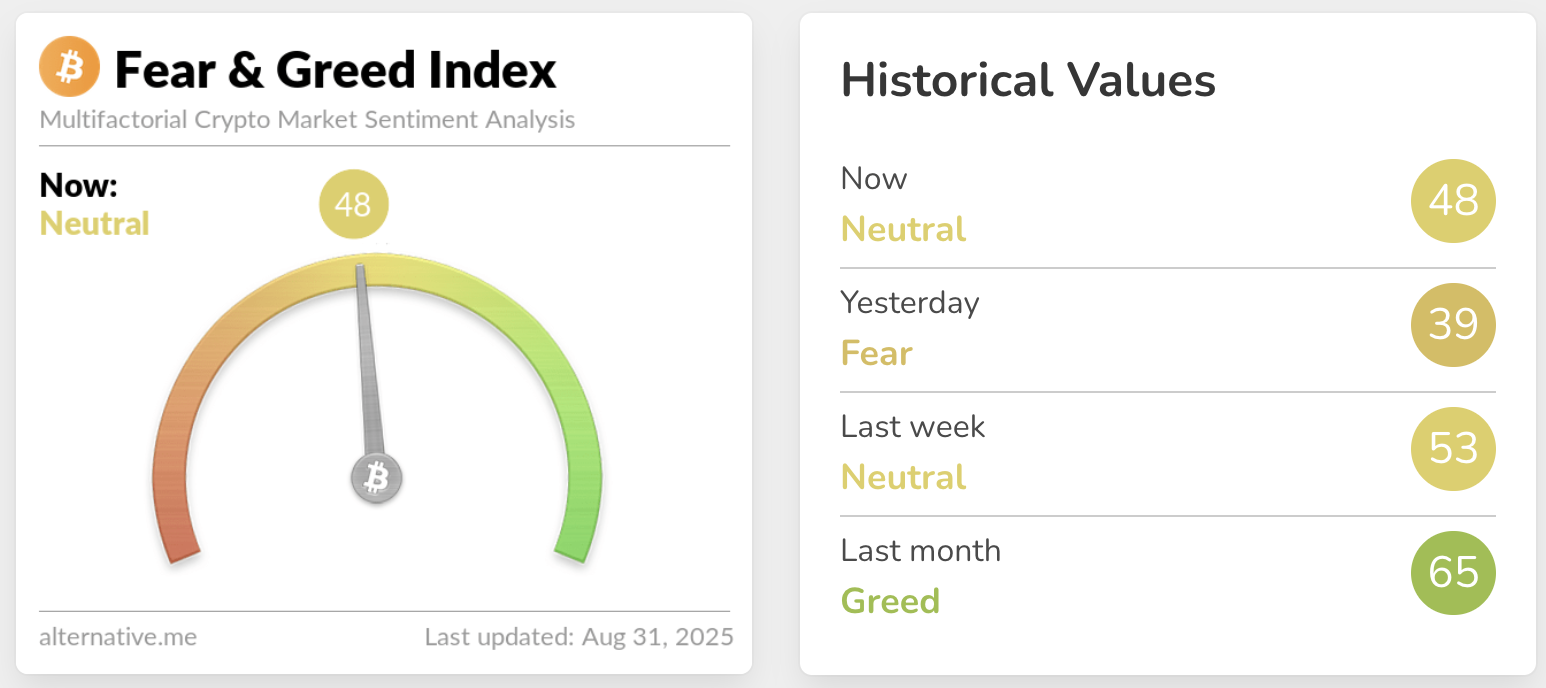

Market sentiment is slowly recovering, with the Crypto Worry & Greed Index climbing again to “Impartial” at 48 out of 100 on Sunday, after dipping into “Worry” at 39 out of 100 the day prior to this.

Some merchants are speculating that the crypto market’s pullback from Bitcoin’s latest highs could possibly be an indication that the long-awaited altcoin season is approaching.

“Mega altseason” could also be approaching, says dealer

Crypto dealer Ash Crypto identified in an X publish on the identical day that “Altcoins at the moment are probably the most oversold ever.”

“Even throughout the Covid crash, FTX collapse or tariff wars, they weren’t this oversold,” the dealer mentioned, suggesting it could possibly be an indication of a “mega altseason” just like the massive rallies of 2017 and 2021.

Associated: ‘No query Bitcoin hits $1M’ — Eric Trump at BTC Asia 2025

On Thursday, CoinMarketCap’s Altcoin Season Index shifted from “Bitcoin Season” to “Altcoin Season,” reaching a rating of 60 out of 100 on the time of publication.

In the meantime, crypto dealer Ak47 mentioned, with a “potential Fed price lower and altcoin ETF approval this fall, the following rally could possibly be big.”

CME’s FedWatch Instrument reveals market individuals see an 86.4% probability of the US Federal Reserve slicing rates of interest for the primary time this 12 months in September, which is often seen as a bullish sign for crypto as traders search for larger returns in riskier property.

Journal: The one factor these 6 world crypto hubs all have in widespread…