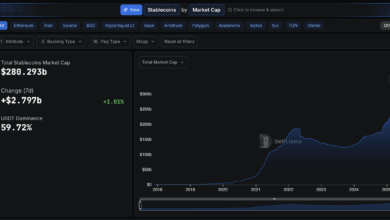

US tokenized treasury merchandise reached a brand new all-time excessive of $7.45 billion on Aug. 27, surpassing the earlier peak of $7.42 billion registered on July 15.

Based on rwa.xyz information, the milestone caps a 14% restoration over two weeks following a market correction that bottomed out at $6.51 billion on Aug. 13. The tokenized treasury sector skilled a 12% decline from its mid-July peak.

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) maintains market management with $2.38 billion in property, representing 32% of whole tokenized treasury market capitalization.

Prime 30-day performers

Internet stream information for the 30 days ending Aug. 28 reveals WisdomTree Authorities Cash Market Digital Fund (WTGXX) main inflows with $440 million, adopted by Circle’s USD Coin (USYC) at $253 million.

OpenEden Greenback (TBILL) captured $95 million in new deposits through the restoration interval.

Libeara and Ondo Finance additionally contributed to the rebound, with their ULTRA and OUSG merchandise attracting $36 million and $24 million, respectively.

These inflows offset outflows from Franklin Templeton’s OnChain U.S. Authorities Cash Fund (BENJI), which recorded $78 million in redemptions, and Centrifuge (JTFSY) with $49 million in internet outflows.

The 5 largest tokenized treasury merchandise by market capitalization symbolize a concentrated market share of 73.6%.

WisdomTree ranks second at $931 million, down from current highs, whereas Franklin Templeton’s BENJI holds $744 million. Ondo’s OUSG and USDY merchandise spherical out the highest 5 with $732 million and $689 million, respectively.

Market construction evolution

The restoration demonstrates rising institutional urge for food for blockchain-based treasury publicity regardless of conventional fixed-income market volatility. Most of those funds have excessive minimal funding thresholds, resembling BUILD’s $5 million minimal deposit.

Tokenized treasuries present 24/7 buying and selling capabilities and programmable options that aren’t obtainable in standard authorities bond markets. The liquidity mannequin, obtainable at any time, prompted a 256% year-over-year development in tokenized US treasuries.

Regardless of the elevated urge for food for tokenized real-world property, they nonetheless have an extended solution to go.

Max Gokhman, Deputy Chief Funding Officer for Franklin Templeton Funding Options, lately acknowledged that almost all fund managers will not be excited by cryptocurrency.

Nonetheless, training and yield-related strikes, resembling approving crypto exchange-traded funds with staking, may assist drive extra adoption amongst these traders.