American Bitcoin, the mining firm partly owned by Donald Trump Jr. and Eric Trump, is making ready to go public on the Nasdaq in September, Reuters reported on Aug. 28.

The agency, launched in March, is 80% owned by Toronto-based Hut 8, considered one of North America’s largest crypto miners.

The Trump brothers collectively personal the remaining 20%, tying the enterprise to probably the most high-profile political households within the U.S.

Merger clears path to itemizing

To allow its debut, American Bitcoin is finalizing a merger with Gryphon Digital Mining.

The deal is predicted to depart present shareholders with about 98% of the mixed firm, offering continuity because the agency enters public markets.

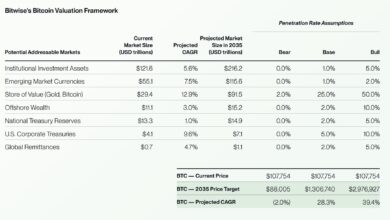

American Bitcoin raised $220 million from accredited traders earlier this yr, together with $10 million value of Bitcoin contributed on to its treasury, to broaden operations and strengthen reserves.

The funding spherical was aimed toward scaling each its mining capability and its capability to build up Bitcoin as a strategic reserve.

Increasing attain and political ties

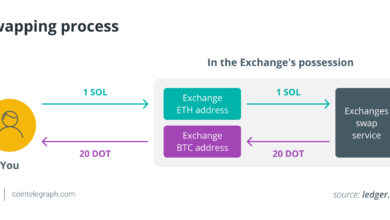

Hut 8 CEO Asher Genoot, talking on the Bitcoin Asia convention in Hong Kong, mentioned the corporate could pursue worldwide investments to broaden entry for traders who can’t immediately maintain Nasdaq-listed shares.

Such partnerships may enable publicity to Bitcoin-linked securities by way of regulated entities in different markets, the place immediately accessing crypto stays difficult.

The transfer comes because the Trump household deepens its ties to the crypto sector. Trump Media and Know-how Group, related to President Donald Trump, just lately introduced plans to situation crypto ETFs and launch a three way partnership with Crypto.com that might additionally go public by way of a particular objective acquisition car.

For Hut 8, the Nasdaq itemizing represents one other lever to determine itself as a dominant mining agency as competitors rises and vitality prices stay risky.

In the meantime, for the Trump brothers, the deal gives a foothold within the digital asset financial system at a second when Bitcoin adoption and political debate over crypto are each intensifying.

Based mostly on CryptoSlate information, Bitcoin was buying and selling at round $112,500 as of press time.