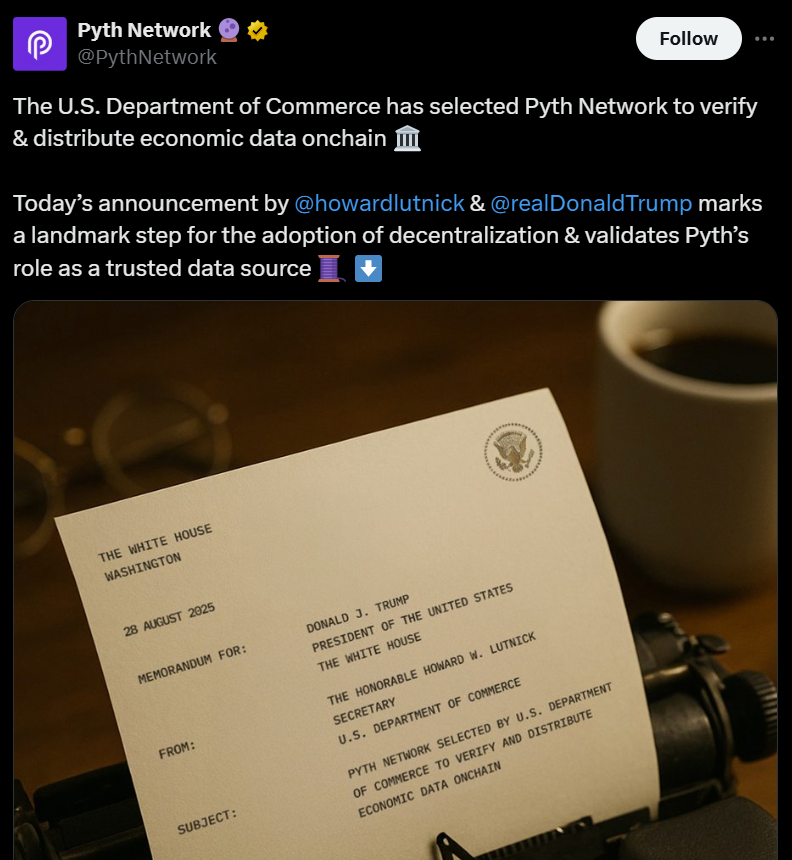

The native token of the Pyth Community surged on Thursday after the mission confirmed it had been chosen by the US Division of Commerce to confirm and distribute financial knowledge onchain — a transfer that locations blockchain know-how on the middle of official authorities processes and highlights the vital position of knowledge oracles.

In keeping with CoinMarketCap, the PYTH token peaked simply above $0.20, marking a day by day achieve of greater than 70%. It was final buying and selling just under $0.19, nonetheless up about 62% on the day.

The rally propelled PYTH to its highest stage since February, lifting its market capitalization above $1 billion, whereas buying and selling volumes skyrocketed greater than 2,700% prior to now 24 hours.

PYTH was the one token to report such huge beneficial properties, although the Commerce Division announcement confirmed that quarterly GDP figures can be printed throughout 9 blockchains, together with Bitcoin, Ethereum, Solana, Tron, Stellar and Avalanche. Chainlink was additionally named alongside Pyth Community as a key oracle companion in disseminating the info.

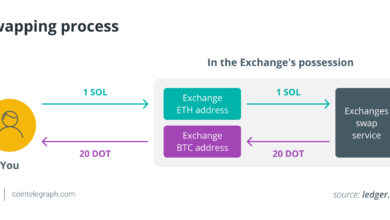

The place Pyth and Chainlink stand out is of their coordinated position as oracles, making certain that the government-published knowledge is additional disseminated and secured throughout blockchain networks.

Pyth Community is a decentralized oracle system that delivers real-time monetary market knowledge immediately onto blockchains. Like Chainlink, it offers infrastructure to carry offchain knowledge — resembling inventory costs, overseas alternate charges and commodities — onchain to be used in decentralized finance (DeFi) purposes.

Associated: US Authorities faucets Chainlink, Pyth to publish financial knowledge onchain

Trump administration’s pro-crypto push intensifies

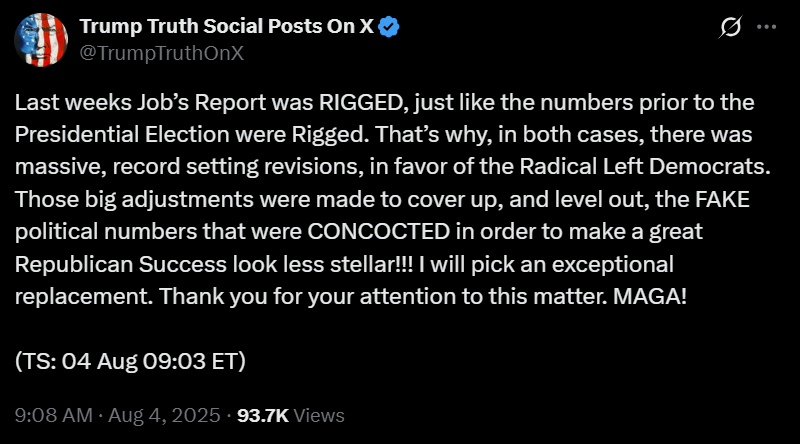

US President Donald Trump’s administration’s embrace of blockchain know-how comes amid sharp criticism of official authorities statistics, significantly employment market knowledge printed by the Bureau of Labor Statistics (BLS).

That stress reached a peak earlier this month after a significant downward revision of employment numbers, which prompted Trump to say the figures had been “rigged” for political functions. Shortly after, Trump fired BLS Commissioner Erika McEntarfer.

The administration’s blockchain initiative is a part of a broader effort to prioritize digital asset adoption and innovation. This agenda has already produced the current passage of the GENIUS Stablecoin Act and approval within the Home of Representatives of each a complete market construction invoice and an anti-CBDC invoice, which now head to the Senate.

In parallel, Trump has presided over a markedly pro-crypto Securities and Alternate Fee. The company has authorised a number of cryptocurrency exchange-traded funds (ETFs) and clarified that sure liquid staking actions fall exterior its jurisdiction, which means they shouldn’t be handled as securities.

Journal: Can privateness survive in US crypto coverage after Roman Storm’s conviction?