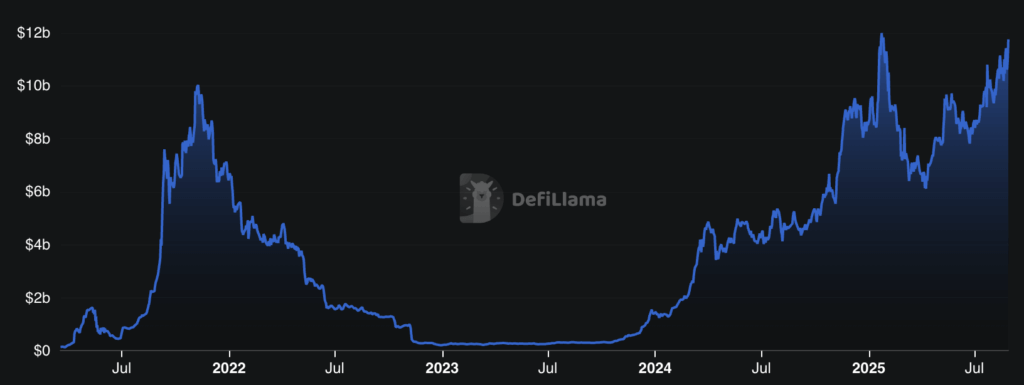

Solana DeFi TVL nears all-time excessive at $11.7B however day by day charges stay caught below $2 million

Elevated capital has clustered round Solana over the previous month, at the same time as person exercise reveals combined momentum.

Per DeFiLlama, Solana’s 24-hour DEX quantity just lately printed about $4.6 billion, with perpetuals close to $2.1 billion. Stablecoin provide sits round $12 billion, native TVL is again close to all-time highs at $11.7 billion, bridged TVL is tracked close to $57 billion, and energetic addresses hover within the low-to-mid thousands and thousands day by day.

On the similar time, 24-hour chain charges are roughly $1.6 million, and day by day transactions are about 65 million, a profile that displays deep liquidity and regular throughput slightly than acceleration in price seize. As for worth context, SOL traded round $198 at publication.

The divergence between liquidity and utilization has been constructing for the reason that second quarter. Messari reported in its Q2 State of Solana that common day by day spot DEX quantity fell 45.4% quarter over quarter to $2.5 billion after the memecoin spike light, at the same time as DeFi TVL grew, positioning Solana because the No. 2 community by TVL.

That backdrop helps clarify the present combine: order move and capital can be found when danger urge for food returns. Nevertheless, price and income progress stay delicate to the exercise composition and market cycles.

The Solana combine

Derivatives markets reinforce the liquidity image. CoinGlass reveals strong perpetual exercise in SOL.

Funding seems orderly slightly than stretched, in step with an atmosphere the place leverage is current however not overheating. This issues for microstructure; regular funding lowers the percentages of outsized compelled flows and retains depth accessible to market makers when spot leads or follows.

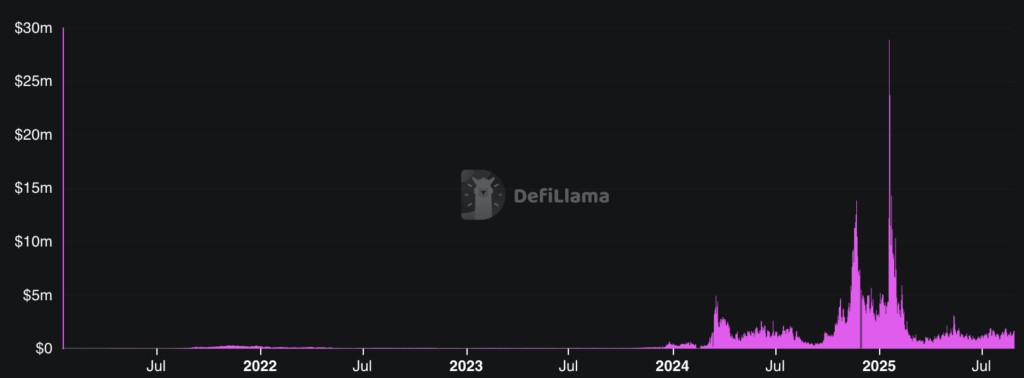

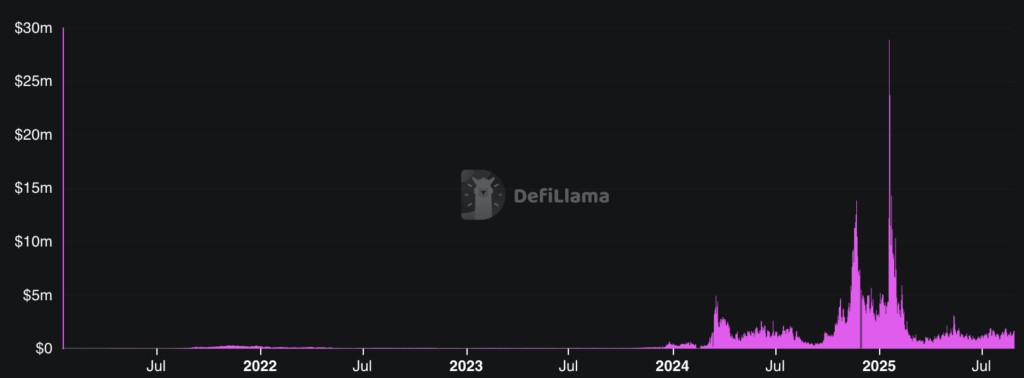

On-chain money and venues proceed to focus on Solana even with no concurrent soar in monetization. DeFiLlama’s chain dashboard lists stablecoins above $12 billion and multi-billion greenback day by day DEX turnover, whereas app charges and chain income development materially under the peaks recorded earlier within the yr.

That mixture implies customers can route massive flows by means of Solana at low marginal price, a trait that helps market making, MEV-aware routing and aggregation, and cross-venue arbitrage, but it surely doesn’t mechanically translate to larger price consumption for validators and functions.

The context from Messari’s Q2 readout provides a structural layer. The report highlights how liquidity suppliers and aggregators concentrated share through the first half as speculative bursts cooled, with protocol revenues lagging buying and selling exercise.

In the meantime, stablecoins stay a key pillar for settlement and stock administration on Solana, preserving balances on chain even when transactional depth moderates.

The near-term query is much less about catalysts and extra concerning the combine. If exercise continues to skew towards low-fee transfers and extremely environment friendly DEX routing, liquidity will stay ample, and spreads will stay tight, whereas price seize and app-level revenues may lag.

If volumes migrate towards larger price verticals, income and charges ought to re-rate with no need for incremental infrastructure.

For now, the tape reveals Solana absorbing sizable volumes with modest price progress, a profile that retains it a liquidity magnet whereas person monetization trails the move.