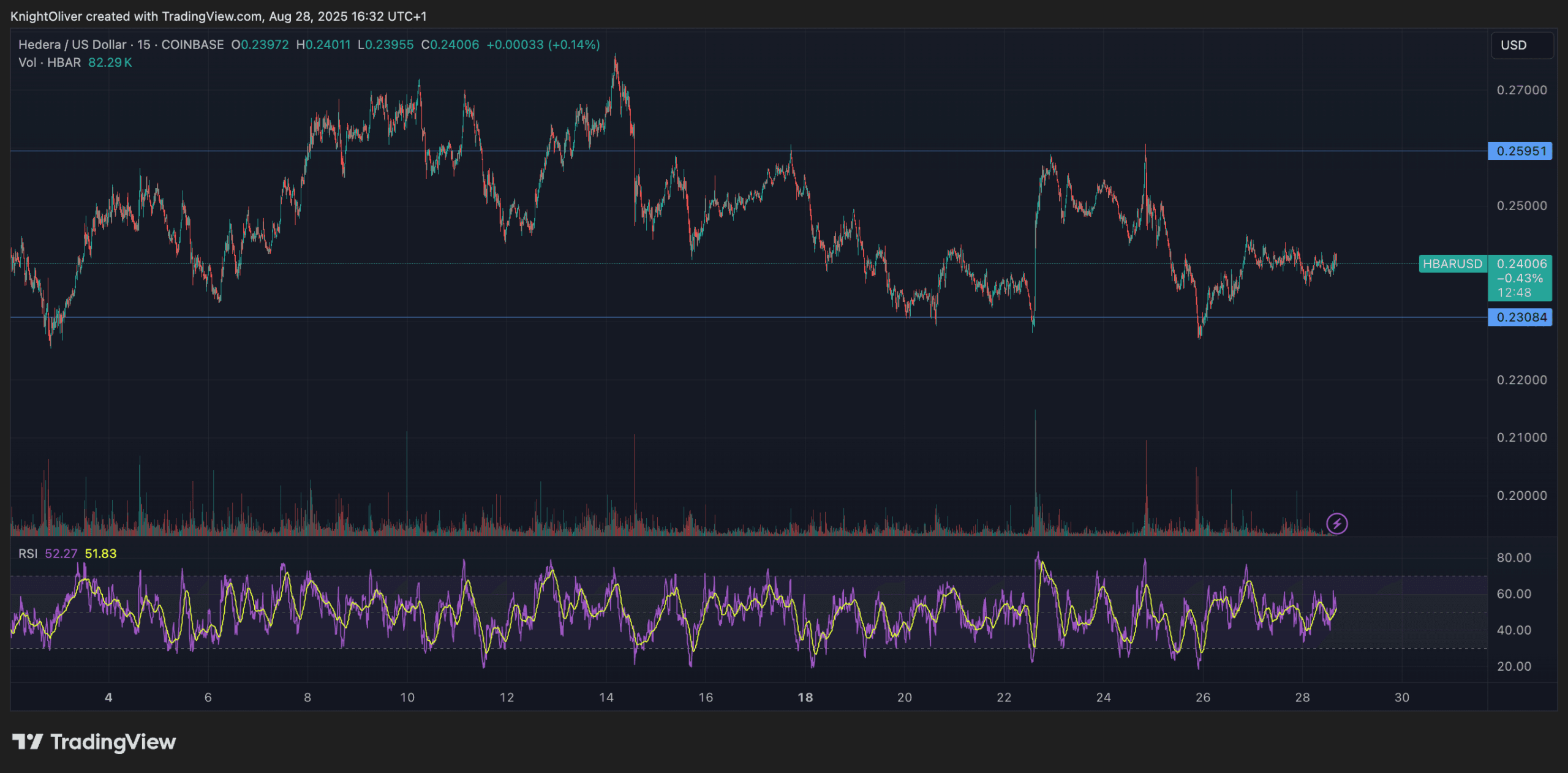

HBAR’s value motion remained tightly contained during the last 24 hours, buying and selling in a slender $0.01 band between $0.24 and $0.25. The token held agency on the $0.24 stage, a zone that market contributors view as a key space of institutional help. Buying and selling volumes surged to 179.67 million models throughout peak periods, far exceeding typical each day averages, a sign of accumulating curiosity amongst bigger buyers.

The transfer comes as Hedera’s enterprise-focused blockchain continues to achieve traction with main monetary and know-how gamers. This week, international funds big SWIFT launched operational testing of Hedera’s distributed ledger know-how for cross-border settlement infrastructure. On the similar time, Grayscale has rolled out a Delaware-based funding car offering publicity to HBAR, underscoring rising regulatory and institutional alignment across the asset.

The mixture of excessive buying and selling volumes, slender value actions, and visual company adoption has led analysts to counsel that refined buyers are strategically positioning for Hedera’s subsequent section of progress. The hashgraph-powered community can course of hundreds of transactions per second, a scalability function that appeals to enterprises similar to Google and IBM as they discover tokenization and different blockchain-based options.

Technical Indicators Breakdown

- HBAR operated inside a measured $0.01 vary through the 24-hour interval from 27 August 15:00 to twenty-eight August 14:00, fluctuating between $0.24 and $0.24 with restricted directional momentum.

- The digital asset established value help round $0.24-$0.24 ranges the place institutional shopping for emerged persistently, whereas resistance developed close to $0.24-$0.24 the place profit-taking materialized.

- Quantity evaluation revealed concentrated exercise through the 20:00 hour on 27 August with 179.67 million models transacted, considerably exceeding the 24-hour common of 41.75 million models.

- The concluding buying and selling hour demonstrated renewed institutional curiosity with HBAR settling at $0.24, indicating potential for sustained upward motion contingent on quantity upkeep above established benchmarks.

- HBAR recorded measured volatility through the remaining hour from 28 August 13:23 to 14:22, advancing from $0.24 to a session excessive of $0.24 earlier than settling at $0.24, representing a web appreciation of 0.33%.

- The interval included two notable quantity concentrations at 13:42 and 14:13 with 9.20 million and 6.81 million models respectively, corresponding with outlined value actions.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.