Shares of Nasdaq-traded actual property asset supervisor Caliber shot up because the agency introduced its pivot to a Chainlink treasury, regardless of an ongoing trade probe.

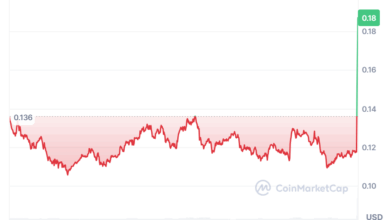

Based on a Thursday announcement, Caliber’s board of administrators has authorised establishing a digital asset treasury technique targeted on Chainlink (LINK). Underneath its new coverage, the corporate intends to allocate a portion of its funds to amass LINK tokens.

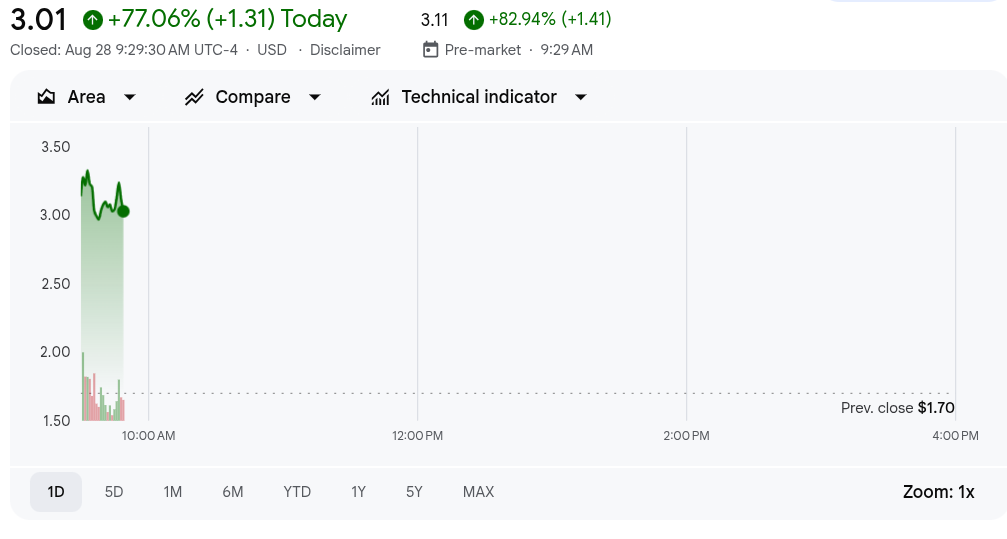

Caliber’s board additionally appointed a crypto advisory board tasked with guiding administration on digital asset technique, coverage and associated initiatives. The information seems to be well-received by market contributors, with Google Finance information exhibiting that the corporate’s inventory rose by 77% in pre-market buying and selling and maintained this newly acquired worth into the early buying and selling day.

This updraft got here regardless of Caliber reporting that on Wednesday, the corporate obtained written discover from Nasdaq that it “is now not in compliance with Nasdaq Itemizing Rule 5550(b)(1).” Establishing a Chainlink treasury could also be a technique to try to treatment the difficulty earlier than being faraway from the trade.

Associated: Monster week for crypto treasury companies with $8B shopping for blitz

Why Caliber faces Nasdaq delisting

The rule in query requires corporations to keep up a stakeholder fairness of no less than $2.5 million to make sure continued itemizing on the trade. The corporate has 45 days to submit a plan and, if accepted, as much as 180 days to remedy this lack.

A Securities and Alternate Fee submitting from the second quarter of this yr reveals that Caliber had a stockholders’ fairness deficit of $17.6 million. If the corporate fails to fill that gap, it’s going to lose its standing as a publicly traded firm. If Caliber manages to lift capital for its newly created Chainlink treasury, it might grow to be compliant with itemizing guidelines as soon as once more.

Associated: Are struggling companies utilizing crypto reserves as a PR lifeline?

The rise of company altcoin treasuries

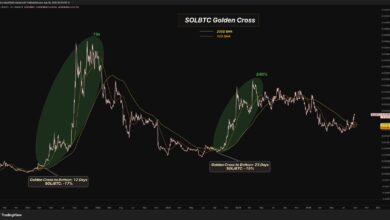

After being created by Technique, the primary Bitcoin (BTC) treasury, previously often known as MicroStrategy, the development of growing company crypto treasuries initially targeted totally on Bitcoin. Nonetheless, now an growing variety of corporations are as a substitute focusing their treasury initiatives on altcoins.

Earlier this week, Trump Media and Expertise Group, the proprietor of US President Donald Trump’s Fact Social platform, introduced the institution of the Trump Media Group CRO Technique to construct a treasury of no less than $6.42 billion of Cronos (CRO). Equally, shares of Sharps Expertise practically doubled Monday after the medical tech agency introduced a $400 million Solana (SOL) treasury.

Nonetheless, these corporations are removed from assured success. Earlier this month, Windtree Therapeutics, a biotech firm that established a BNB treasury technique final month, fell 77% on Wednesday after Nasdaq mentioned it will be delisted.

Journal: How Ethereum treasury corporations may spark ‘DeFi Summer time 2.0’