In in the present day’s Crypto for Advisors e-newsletter, Samantha Bohbot, accomplice and chief progress officer from RockawayX breaks down decentralized finance and the variations Bitcoin, Ethereum, and Solana carry to this house.

Then, Kevin Tam solutions questions on institutional funding in crypto ETFs and notes some world tendencies in “Ask an Professional.”

– Sarah Morton

Webinar alert: On September 9 at 11:00am ET be part of Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices as they talk about constructing a sustainable enterprise within the cyclical markets of crypto. Register in the present day. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

Occasion alert: CoinDesk: Coverage & Regulation in Washington D.C. on September tenth. The agenda contains senior officers from the SEC, Treasury, Home, Senate, and OCC, plus non-public roundtables and unparalleled networking alternatives. Use code COINDESK15 to avoid wasting 15% in your registration. http://go.coindesk.com/4oV08AA.

Sectors Past Bitcoin: Ethereum, Solana and On-Chain Economies

Bitcoin could dominate the crypto dialog as probably the most established digital asset, however in the present day’s panorama presents many compelling alternatives to buyers.

Exterior of Bitcoin, blockchains energy purposes that delight world customers, generate significant revenues, and are rising impressively.

Bringing World Finance On-Chain

Tokenized real-world belongings (RWAs) consult with the issuance and buying and selling of conventional devices like shares, bonds, commodities, and various belongings on blockchains. The perks of doing so are substantial. Settling asset trades on-chain is almost instantaneous; anybody, wherever can take part (if the issuer permits it), and transactions are clear, making them simpler to trace and automate.

Right now, almost $300 billion in tokenized belongings are on-chain. Boston Consulting Group predicts the market will attain $600 billion by the tip of the 12 months and $19 trillion by 2030. Latest RWA deployments are showcasing blockchains’ potential to remodel conventional markets.

In bridging conventional belongings and on-chain use, blockchains act as marketplaces, with typical “hen and egg” dynamics. Particularly, issuers wish to go the place the lively customers are, and customers flock to the location of the brand new and greatest merchandise.

Ethereum was the pure place to begin. Stablecoins like USDC and USDT first launched there, giving Ethereum the deepest pool of tokenized {dollars} and the vast majority of in the present day’s on-chain RWA worth.

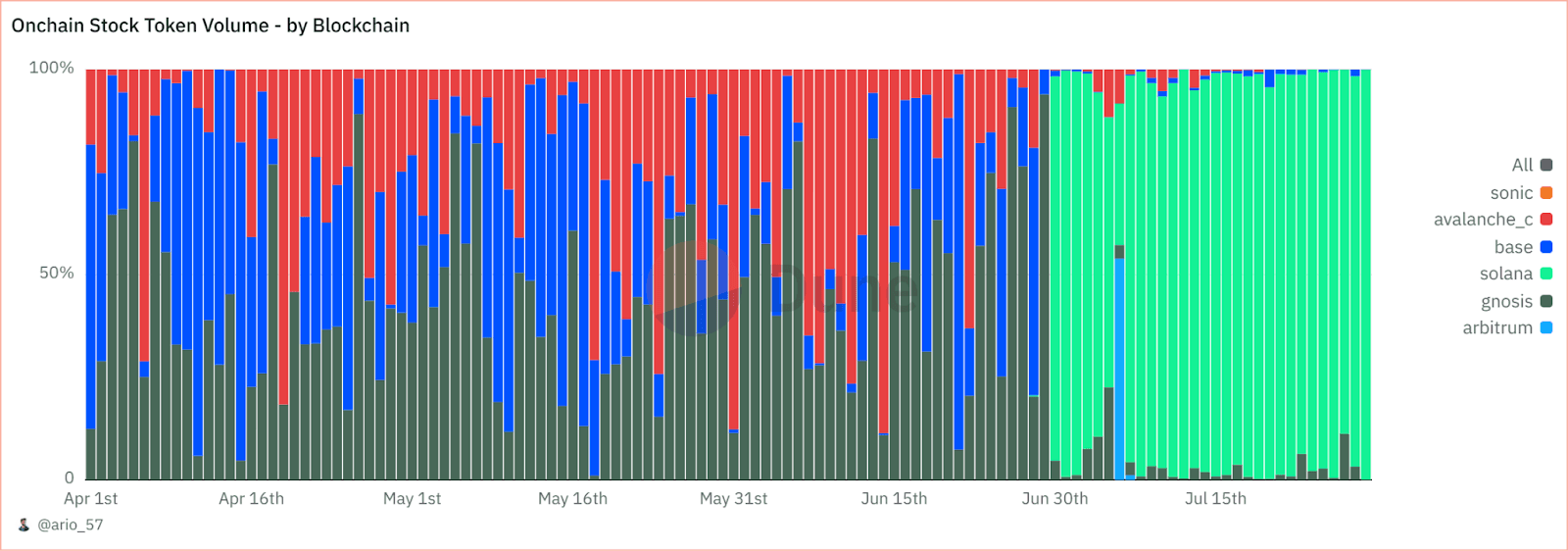

Solana is a high contender for RWA exercise, and up to date launches showcase blockchains’ potential to swiftly rework conventional markets. Kamino Finance, Solana’s main borrowing and lending utility, permits customers to simply borrow towards their holdings in xStocks, tokenized shares of Apple, Tesla, and different firms. Since xStocks launched throughout blockchains on June 30, Solana has accounted for a median of roughly 93% of every day buying and selling quantity.

On-chain inventory token quantity by blockchain | Supply: Dune Analytics

Solana’s dominance in world developer exercise and lively customers (greater than double that of the subsequent chain) provides it an edge in courting asset issuers, whereas efficiently onboarding them and unveiling new on-chain merchandise will reinforce this exercise.

Extra broadly, DeFi continues to develop, with larger range in on-chain merchandise and institutional-grade choices. Catering to classy portfolios, builders work on merchandise that combine stablecoins, RWAs, and / or yield mechanics to create attraction to totally different danger preferences.

Ethereum at the moment leads the sector, with over $94 billion in complete worth locked (TVL) and 1000’s of protocols. Whereas retaining the trade’s deepest liquidity is a bonus, there’s extra to DeFi than TVL.

The Solana DeFi protocol’s complete worth locked (TVL) lately surpassed roughly $10 billion. In an indication that the TVL displays actual and precious use, Solana’s purposes collectively earn extra on-chain charge income than all different chains mixed. Due to its velocity and low prices, solana has established itself as DeFi’s lively buying and selling hub and constantly leads ether in decentralized alternate (DEX) buying and selling volumes.

Past bitcoin’s crypto position as “digital gold,” each the Ethereum and Solana blockchains have emerged as core digital infrastructure, every with distinct benefits.

Ethereum is the unique open pc, the place builders first coded decentralized purposes and foundational institutional tasks launched.

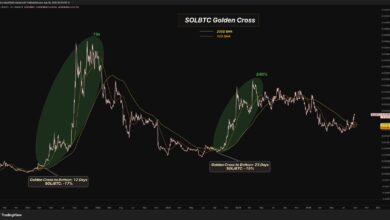

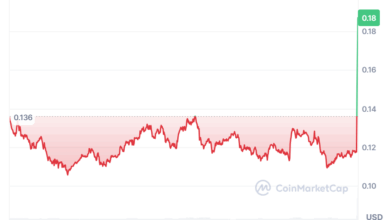

Solana’s DeFi momentum is constructing. It’s probably the most used chain on this planet already, and a hotbed for modern DeFi merchandise. Like Ethereum’s native ETH token, Solana’s SOL affords broad publicity to the ecosystem, which means buyers don’t want to choose particular person utility winners; as an alternative, they’ll take part within the general progress.

Ethereum and Solana’s long-term success relies on their being house to purposes that ship actual worth and, finally, disrupt legacy monetary methods. If they’ll pull that off, then in the present day’s costs could appear like enticing entry factors.

– Samantha Bohbot, accomplice and chief progress officer, RockawayX

Ask an Professional

Q. One 12 months into the institutional investments within the crypto ETFs development, how are Canadian banks and pension funds approaching bitcoin?

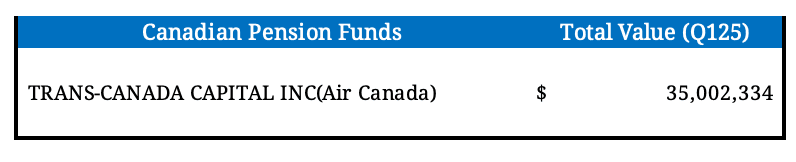

A. This quarter’s 13F filings reveal that Montreal-based Trans-Canada Capital has made notable investments in digital belongings. It manages the pension belongings for Air Canada, as one of many largest company pension plans within the nation. The pension fund added $55 million in a spot bitcoin ETF.

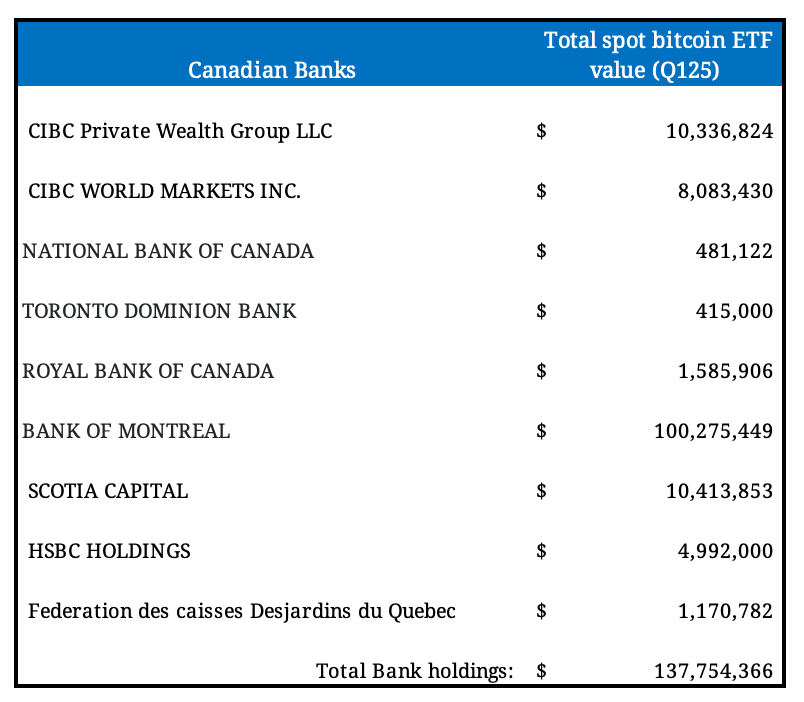

Institutional adoption of bitcoin has accelerated over the previous 12 months, pushed by clearer regulatory steering, the launch of spot ETFs and growing recognition of bitcoin as a strategic asset. Schedule 1 banks in Canada are holding greater than $139 million in bitcoin exchange-traded funds, underscoring rising institutional demand and long-term positioning.

Q. How may institutional accumulation have an effect on bitcoin’s market dynamics?

A. Final 12 months, ETFs bought roughly 500,000 bitcoin, whereas the community produced 164,250 new bitcoin by way of its proof-of-work consensus. This implies ETF demand alone was thrice the newly minted provide. Moreover, private and non-private firms bought 250,000 bitcoins. As governments take into account together with bitcoin of their strategic reserves, different entities are exploring the addition of bitcoin to their company treasuries.

Q. How will the Monetary Conduct Authority (FCA) greenlighting retail entry to crypto ETNs within the U.Ok. speed up the retail & institutional adoption?

A. This marks an essential second for crypto merchandise within the retail market as an asset class that displays a broader shift within the U.Ok.’s regulatory stance towards digital belongings. It’s a full reversal from a 2020 determination when the FCA banned crypto exchange-traded notes. ETNs will must be traded on an FCA-approved funding alternate. The U.Ok. is shifting its strategy to crypto as the federal government seeks to develop the financial system and help a digital belongings trade, sending a powerful sign to institutional buyers that the U.Ok. is positioning itself as a competing participant within the world crypto market.

– Kevin Tam, digital asset analysis specialist