- The Pound Sterling ticks up round 1.3500 towards the US Greenback forward of the second estimate of US Q2 GDP.

- Fed’s Williams sees the necessity for rate of interest cuts amid worries over financial development.

- BoE’s Mann helps holding rates of interest at their present ranges for longer.

The Pound Sterling (GBP) extends its profitable streak for the third buying and selling day towards the US Greenback (USD) on Thursday. The GBP/USD pair rises to close 1.3520 because the US Greenback declines, following dovish feedback on rates of interest from New York Federal Reserve (Fed) Financial institution President John Williams on Wednesday.

On the time of writing, the US Greenback Index (DXY), which tracks the Buck’s worth towards six main currencies, drops to close 97.90

Fed’s Williams mentioned in an interview with CNBC that slowing Gross Home Product (GDP) development and the truth that the economic system goes via an adjustment section are paving the best way for rate of interest cuts. Williams didn’t explicitly endorse decreasing rates of interest within the September assembly, stating that officers have to see extra financial information earlier than reaching a conclusion. “Dangers are extra in stability. We’re going to simply should see how the information play out,” Williams mentioned.

In the meantime, Fed’s Williams refused to touch upon the termination of Fed Governor Lisa Cook dinner, who has introduced that she’s going to file a lawsuit towards her removing by US President Donald Trump. Earlier this week, Trump launched the termination letter of Cook dinner over mortgage allegations.

Each day digest market movers: BoE’s Mann assist holding rates of interest for longer

- The Pound Sterling faces slight promoting stress towards its main friends, besides North American currencies, on Thursday, at the same time as merchants count on that the Financial institution of England (BoE) is unlikely to chop rates of interest within the the rest of the yr. The rationale behind merchants shedding confidence in additional financial coverage enlargement by the central financial institution is elevated inflationary pressures.

- Inflationary pressures in the UK (UK) have been rising at a sooner tempo each month since Could. The UK headline Shopper Value Index (CPI) rose 3.8% on an annualized foundation in July.

- On Tuesday, BoE Financial Coverage Committee (MPC) member Catherine Mann additionally acknowledged that rates of interest ought to stay at their present ranges for an extended interval, citing that worth pressures seem like persistent.

- Going ahead, the main set off for the GBP/USD pair would be the second estimate for Q2 Gross Home Product (GDP) information, which can be revealed at 12:30 GMT. The US Bureau of Financial Evaluation (BEA) is anticipated to indicate that the economic system grew at a sooner tempo of three.1% on an annualized foundation in comparison with the preliminary estimates of three.0%.

- Traders may also deal with the US Preliminary Jobless Claims information for the week ending August 23. Economists count on the variety of people submitting for jobless claims for the primary time to come back in decrease at 230K towards the prior studying of 235K.

- This week, the US (US) Private Consumption Expenditures Value Index (PCE) information for July can be the main set off of the US Greenback, which is scheduled for Friday.

- Economists count on the US core PCE inflation, which is carefully tracked by Federal Reserve officers because it strips out unstable objects comparable to meals and power, to have risen at a sooner tempo of two.9% on yr towards 2.8% in June, with month-to-month figures rising steadily by 0.3%.

- Traders can pay shut consideration to the US inflation information as it should affect market expectations for the Fed’s financial coverage outlook. In keeping with the CME FedWatch software, there may be an 87% probability that the Fed will minimize rates of interest within the September financial coverage assembly.

Pound Sterling Value In the present day

The desk under reveals the proportion change of British Pound (GBP) towards listed main currencies immediately. British Pound was the weakest towards the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.28% | -0.22% | -0.34% | -0.19% | -0.35% | -0.25% | -0.41% | |

| EUR | 0.28% | 0.11% | -0.05% | 0.08% | -0.04% | 0.06% | -0.11% | |

| GBP | 0.22% | -0.11% | -0.14% | 0.03% | -0.14% | -0.03% | -0.19% | |

| JPY | 0.34% | 0.05% | 0.14% | 0.17% | -0.05% | -0.19% | -0.03% | |

| CAD | 0.19% | -0.08% | -0.03% | -0.17% | -0.16% | -0.06% | -0.12% | |

| AUD | 0.35% | 0.04% | 0.14% | 0.05% | 0.16% | 0.10% | -0.06% | |

| NZD | 0.25% | -0.06% | 0.03% | 0.19% | 0.06% | -0.10% | -0.15% | |

| CHF | 0.41% | 0.11% | 0.19% | 0.03% | 0.12% | 0.06% | 0.15% |

The warmth map reveals proportion adjustments of main currencies towards one another. The bottom foreign money is picked from the left column, whereas the quote foreign money is picked from the highest row. For instance, should you choose the British Pound from the left column and transfer alongside the horizontal line to the US Greenback, the proportion change displayed within the field will characterize GBP (base)/USD (quote).

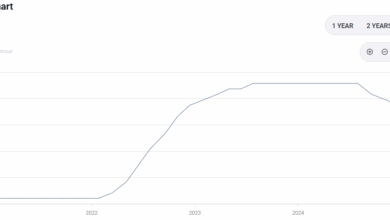

Technical Evaluation: Pound Sterling trades near 20-day EMA

The Pound Sterling trades broadly sideways round 1.3500 towards the US Greenback on Thursday. The general development of the GBP/USD pair stays sideways because it stays near the 20-day Exponential Shifting Common (EMA), which trades round 1.3468.

The Cable can also be forming an inverse Head and Shoulder (H&S) chart sample, which results in a bullish reversal after a corrective or draw back transfer. The neckline of the H&S sample is positioned round 1.3580.

The 14-day Relative Power Index (RSI) oscillates contained in the 40.00-60.00 vary, suggesting a pointy volatility contraction.

Wanting down, the August 11 low of 1.3400 will act as a key assist zone. On the upside, the July 1 excessive close to 1.3790 will act as a key barrier.

Fed FAQs

Financial coverage within the US is formed by the Federal Reserve (Fed). The Fed has two mandates: to attain worth stability and foster full employment. Its major software to attain these targets is by adjusting rates of interest.

When costs are rising too rapidly and inflation is above the Fed’s 2% goal, it raises rates of interest, growing borrowing prices all through the economic system. This leads to a stronger US Greenback (USD) because it makes the US a extra engaging place for worldwide traders to park their cash.

When inflation falls under 2% or the Unemployment Charge is simply too excessive, the Fed could decrease rates of interest to encourage borrowing, which weighs on the Buck.

The Federal Reserve (Fed) holds eight coverage conferences a yr, the place the Federal Open Market Committee (FOMC) assesses financial situations and makes financial coverage choices.

The FOMC is attended by twelve Fed officers – the seven members of the Board of Governors, the president of the Federal Reserve Financial institution of New York, and 4 of the remaining eleven regional Reserve Financial institution presidents, who serve one-year phrases on a rotating foundation.

In excessive conditions, the Federal Reserve could resort to a coverage named Quantitative Easing (QE). QE is the method by which the Fed considerably will increase the circulate of credit score in a caught monetary system.

It’s a non-standard coverage measure used throughout crises or when inflation is extraordinarily low. It was the Fed’s weapon of alternative through the Nice Monetary Disaster in 2008. It entails the Fed printing extra {Dollars} and utilizing them to purchase excessive grade bonds from monetary establishments. QE normally weakens the US Greenback.

Quantitative tightening (QT) is the reverse technique of QE, whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing, to buy new bonds. It’s normally optimistic for the worth of the US Greenback.