Spot Ether exchange-traded funds are promoting like sizzling desserts within the US, attracting greater than ten occasions the inflows of their spot Bitcoin counterparts over the previous 5 buying and selling days.

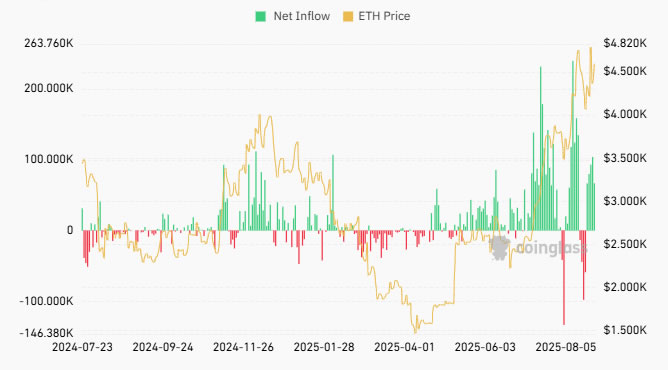

Since final Thursday, spot Ether ETFs have seen a whopping $1.83 billion in inflows, whereas Bitcoin funds took solely a tenth of that with $171 million in inflows, based on CoinGlass.

The most recent buying and selling day on Wednesday continued the development, with 9 Ether (ETH) funds reaching $310.3 million in inflows on the day, whereas the eleven-spot Bitcoin (BTC) funds noticed simply $81.1 million compared.

Ether has recovered a lot sooner than Bitcoin this week, with ETH costs climbing 5% from their Tuesday low, whereas Bitcoin solely managed to realize 2.8% over the identical interval.

The huge shift to Ether was not missed by business observers comparable to Ethereum educator and investor Anthony Sassano, who described it as “brutal.”

In the meantime, NovaDius Wealth Administration President Nate Geraci added the spot Ether ETFs are actually near $10 billion in inflows for the reason that begin of July.

Spot Ether ETFs have been buying and selling for 13 months and have seen $13.6 billion in whole mixture inflows, the vast majority of which has come within the final couple of months.

Spot Bitcoin ETFs have been round for for much longer, buying and selling for 20 months with an mixture influx of $54 billion.

The Wall Road token

The momentum has seemingly been shifting to Ethereum following the passing of the GENIUS Act stablecoin laws in July, because the community has the biggest market share of stablecoins and tokenized real-world property.

Associated: Funding advisers ‘dominating’ with $18.3B in Bitcoin, Ether ETFs

“It’s very a lot what I name the Wall Road token,” mentioned VanEck CEO Jan van Eck, talking on Fox Enterprise this week.

In the meantime, Bloomberg ETF analyst James Seyffart reported that funding advisers had been the highest holders of Ether ETFs with $1.3 billion in publicity. In line with SEC filings, Goldman Sachs is the highest holder with $712 million in publicity.

ETH was buying and selling down 1.2% on the day at $4,560 on the time of writing, based on CoinGecko.

Journal: 3 individuals who unexpectedly turned crypto millionaires… and one who didn’t