Information Background

- Between August 24–25, a whale shifted 900 million DOGE (over $200 million) into Binance wallets, sparking fears of a broader sell-off. Costs briefly fell from $0.25 to check $0.23 assist on elevated volumes.

- Regardless of this, on-chain knowledge exhibits whales collected 680 million DOGE by way of August, making a tug-of-war between distribution and accumulation.

- Futures positioning weakened, with open curiosity sliding 8% within the aftermath of the switch, highlighting diminished speculative leverage.

- Broader meme-coin sentiment stays tied to macro alerts, with Powell’s Jackson Gap remarks fueling a brief sector-wide rally.

Value Motion Abstract

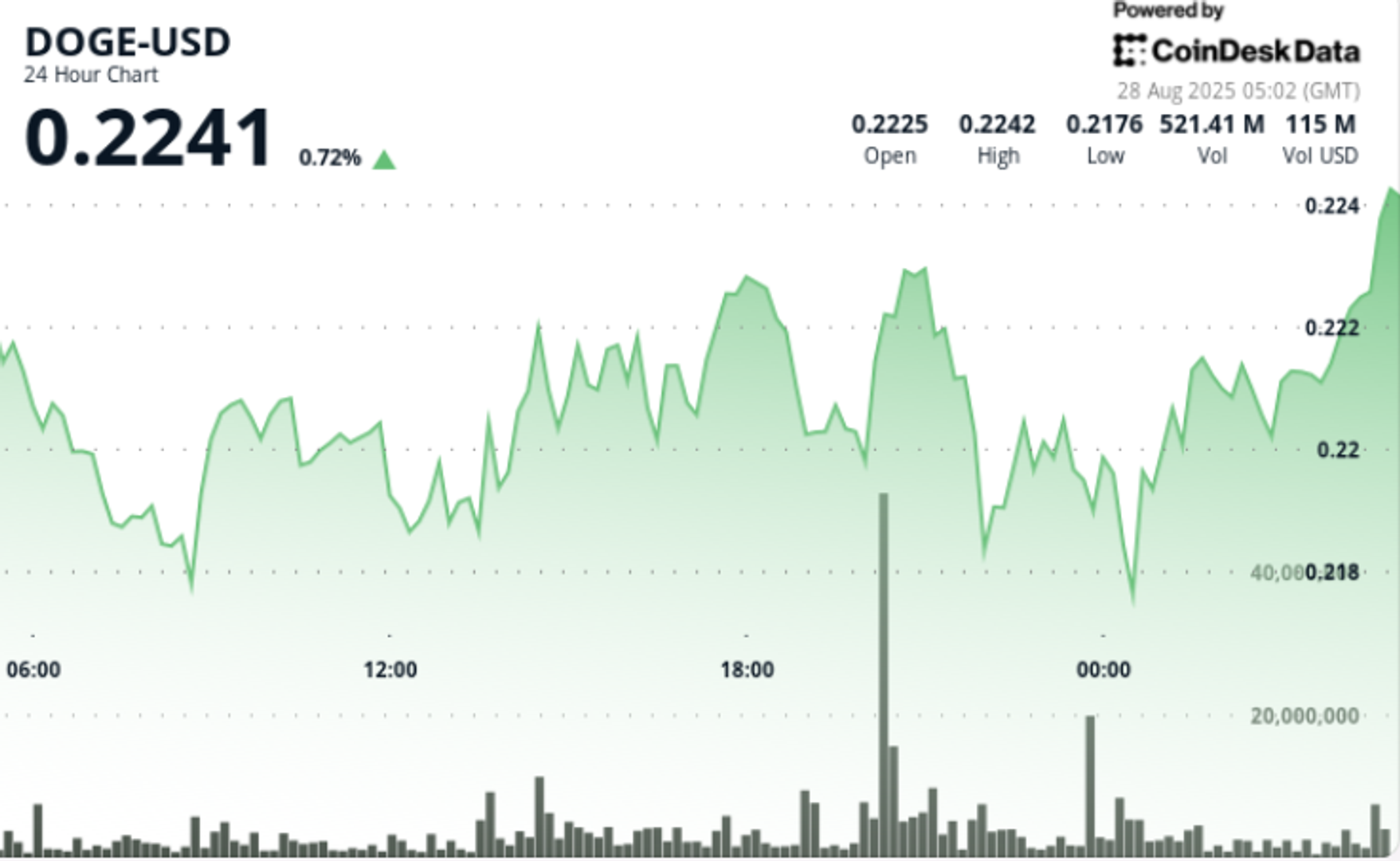

- From August 27 at 03:00 to August 28 at 02:00, DOGE traded in a decent $0.01 (3%) vary, holding round $0.22.

- Peak institutional participation got here at 20:00 GMT on August 27, when DOGE superior from $0.219 to $0.224 on 1.26 billion quantity — almost 4x the hourly norm.

- Late within the session (01:20–02:19 GMT on Aug. 28), DOGE rallied from $0.219 lows to $0.224 intraday highs earlier than profit-taking returned it to the $0.220–$0.221 band.

Technical Evaluation

- Help: Robust bid curiosity round $0.219–$0.220 has emerged as the brand new flooring.

- Resistance: $0.224–$0.225 continues to cap short-term rallies after repeated failures.

- Momentum: RSI regular within the mid-50s suggests equilibrium slightly than pattern acceleration.

- Quantity: Institutional spike to 1.26 billion tokens at $0.22 marked accumulation curiosity, however total declining exercise hints at consolidation.

- Patterns: Tight buying and selling vary signifies compression part; decision may set the stage for directional breakout.

- Danger Gauges: Futures OI down 8% alerts lighter positioning — decreasing speedy volatility but in addition tempering breakout conviction.

What Merchants Are Watching

- Whether or not $0.219 assist holds beneath additional whale distribution.

- Breakout above $0.225 as a set off towards $0.23–$0.24.

- Sustained company accumulation round $0.22 as proof of treasury desks positioning forward of broader market catalysts.

- Indicators of renewed leverage in futures markets that might amplify DOGE’s subsequent directional transfer.