Good Morning, Asia. Here is what’s making information within the markets:

Welcome to Asia Morning Briefing, a day by day abstract of high tales throughout U.S. hours and an outline of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

China’s rising concentrate on stablecoins is much less about embracing crypto and extra about defending its foreign money from U.S. greenback dominance, says Dr. Vera Yuen of Hong Kong College’s Enterprise Faculty, who argues the shift highlights offshore alternatives but additionally deep home limits.

Beijing’s shift comes as Washington moved first to create a regulatory framework for the stablecoin trade within the U.S. Reuters not too long ago reported that China’s State Council is reviewing a roadmap for yuan-backed stablecoins later this month, with Hong Kong and Shanghai anticipated to fast-track adoption.

In an earlier interview, Animoca Group president Evan Auyang informed CoinDesk the set off was the U.S. GENIUS Act, which cements dollar-pegged tokens as a part of international finance.

He stated the legislation is “pressuring China to behave so much quicker,” pushing Beijing to contemplate stablecoins not as speculative devices, as as soon as described by the Folks’s Financial institution of China, however as crucial infrastructure to maintain tempo in international commerce and settlement.

Yuen stated the federal government first prioritized the e-CNY, its Central Financial institution Digital Foreign money, as a result of it supplied management, traceability, and seigniorage income — options that regulators valued over these of privately issued tokens. However she famous that stablecoins have a transparent edge in worldwide use.

“Many CBDCs are developed for home use, so for worldwide use of CBDCs, there’s a large downside of interoperability of various methods. Stablecoins are designed for use internationally, so it may be a greater choice for cross-border transactions,” she informed CoinDesk.

“Specializing in stablecoins permits China to reply proactively to international regulatory debates and technological advances, guaranteeing it stays aggressive and ready because the digital foreign money panorama evolves,” Yuen continued.

Capital controls nonetheless imply any yuan token will keep offshore, with Hong Kong’s new regime offering the testing floor. Nevertheless, restricted CNH liquidity underscores how slender the runway is for China’s internationalization push.

“This is able to restrict the issuance of offshore renminbi stablecoins, constraining its attractiveness as a way of fee,” Yuen stated.

China can be not shifting in isolation.

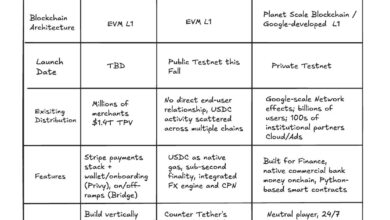

In Japan, Monex Group is making ready to concern a yen-backed stablecoin tied to authorities bonds, becoming a member of different home gamers comparable to SBI and JPYC.

Not like China, nevertheless, the place capital controls push experimentation offshore, Japan’s regulators are laying the groundwork for stablecoins to flow into at dwelling, signaling Asia’s broader race to maintain tempo with U.S. greenback tokens.

For now, Beijing’s stablecoin experiment appears to be like much less like a substitute for the e-CNY and extra like a cautious complement, a strategy to lengthen the yuan’s attain overseas with out loosening its grip at dwelling.

Market Actions

BTC: BTC held at $111K as Nvidia posted robust earnings.

ETH: ETH is buying and selling at $4,500, and historical past reveals {that a} inexperienced August typically precedes a 60% year-end rally, although usually after a September dip.

Gold: Gold traded Wednesday at $3,443 per ounce, up 1.6% from Tuesday’s shut, extending a 37% year-over-year rally, although costs slipped in early buying and selling as consideration turned to Nvidia earnings and Trump’s Fed feud.

S&P 500: The S&P 500 rose 0.2% Wednesday, pushing Wall Road to a brand new all-time excessive forward of Nvidia’s earnings.

Elsewhere in Crypto

- Former Polymarket exec raises $15 million from Coinbase and USV for rival prediction platform (The Block)

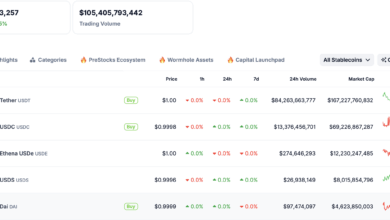

- Finastra Faucets Circle to Deliver USDC Settlement to $5T World Cross-Border Funds (CoinDesk)

- Know Your Issuer’: This Tech Combats Counterfeit Cash, Beginning With USDC and PYUSD (Decrypt)