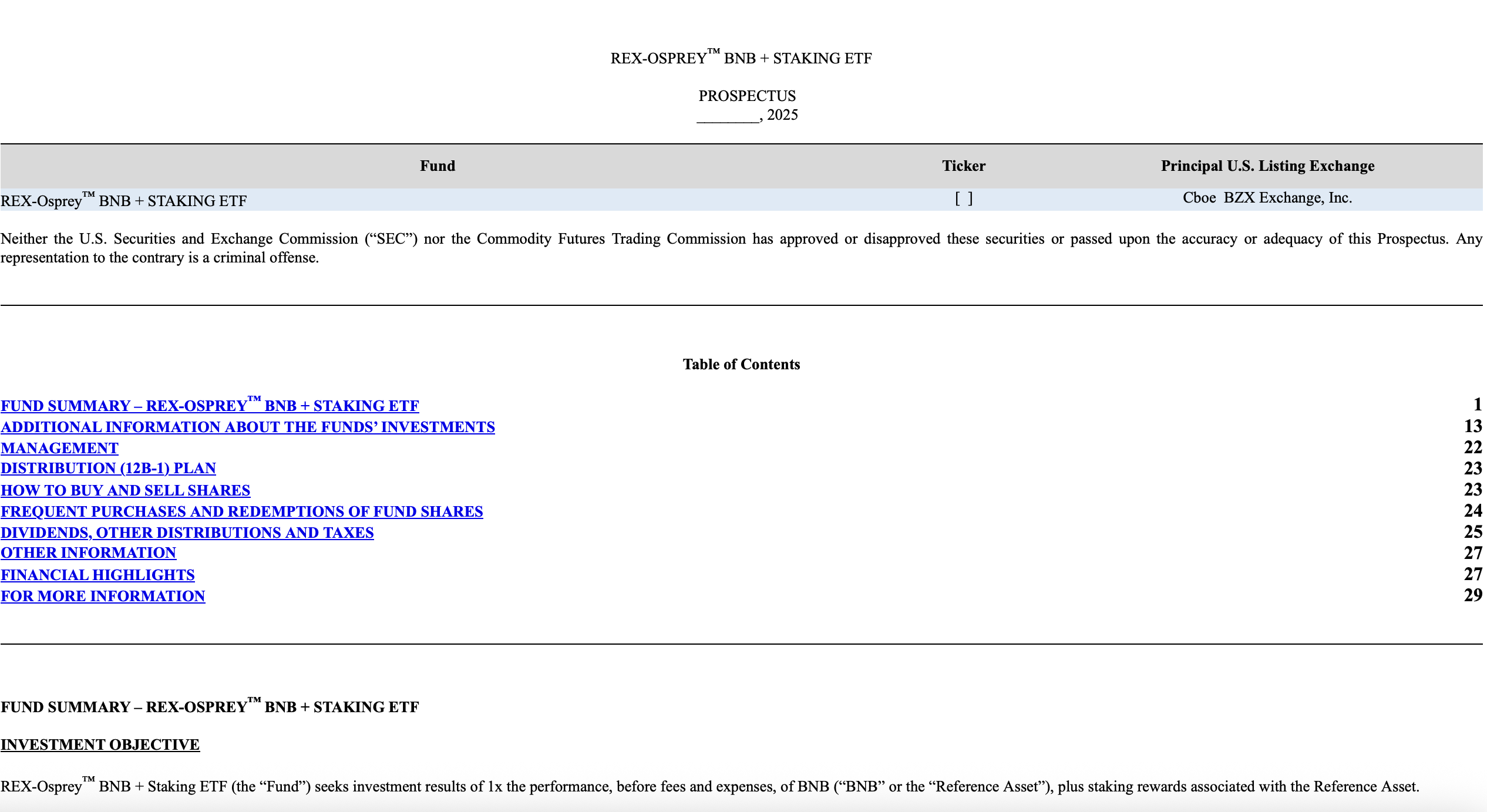

REX Shares and Osprey Funds (REX-Osprey) have filed with the US Securities and Trade Fee for a BNB exchange-traded fund (ETF) that includes staking yield. The submitting comes as asset managers step up their push into crypto ETFs and yield-generating methods.

Based on the submitting, the REX-Osprey BNB + Staking ETF would allocate at the very least 80% of its capital to BNB (BNB), the native token of the Binance ecosystem, or achieve publicity to the asset via a Cayman Islands subsidiary. The remaining property may very well be invested in different ETFs or exchange-traded merchandise providing extra BNB publicity.

BNB staked on the Binance Chain, which makes use of a proof-of-staked-authority consensus, is estimated to generate annual yields of 1.5% to three% for the community’s validators.

The brand new ETF, if authorized, could differ from the Osprey Funds’ BNB Chain Belief, launched in 2024. Whereas nonetheless providing publicity to BNB, the BNB Chain Belief is geared towards accredited traders and has a minimal buy-in of $10,000.

The fund intends to stake all of its BNB, however provided that its adviser can hold illiquid property beneath 15% of the portfolio, a regulatory threshold designed to make sure traders can nonetheless redeem their shares for money. Anchorage Digital Financial institution has been appointed custodian for the fund’s BNB, associated holdings and liquid staking tokens.

The REX-Osprey BNB + Staking ETF is just like one other BNB ETF filed in Could 2025 by asset supervisor VanEck — the primary BNB fund proposed in the US. VanEck can be searching for permission to seize BNB’s staking yield.

Cointelegraph contacted Osprey for remark however had not acquired a response at time of publication.

Associated: Bitwise first in line to file for spot Chainlink ETF

ETF motion picks up

Based on SoSoValue.com, investor buying and selling inside US crypto ETFs has picked up prior to now few months. Bitcoin (BTC) ETFs have seen month-to-month inflows starting from $3 billion in April to $6 billion in July. In the meantime, Ether (ETH) ETFs noticed a $5.4 billion influx in July and a $3.7 billion influx to date in August.

Throughout the week of Aug. 15, Bitcoin and Ether ETFs posted their highest mixed buying and selling quantity up to now. Ether ETFs alone recorded about $17 billion in trades — a determine that, in accordance with a Bloomberg ETF analyst, amounted to “blowing away document.”

As many crypto fanatics await “altcoin season,” Bitfinex analysts say a major rally amongst such tokens could solely occur if extra crypto ETFs are authorized within the US.

Altcoins featured in ETFs awaiting a call from the SEC embody Solana (SOL), Official Trump (TRUMP), and Sui (SUI).

Journal: Altcoin season 2025 is nearly right here… however the guidelines have modified