VersaBank, a Canadian digital financial institution with a give attention to enterprise purchasers, has began testing a tokenized deposit that the financial institution says present a safer and extra compliant different to stablecoins.

The pilot, run by the financial institution’s U.S. subsidiary VersaBank USA, will trial a U.S. greenback model of the financial institution’s blockchain-based Digital Deposit Receipts (DDRs) tech. Every token, branded USDVB, represents one U.S. greenback held on deposit at VersaBank USA.

This system will simulate 1000’s of transactions of small worth, first internally after which with choose exterior companions. Tokens shall be managed by the financial institution’s digital vault and e-wallet platforms and issued on the Ethereum , Algorand and Stellar blockchains.

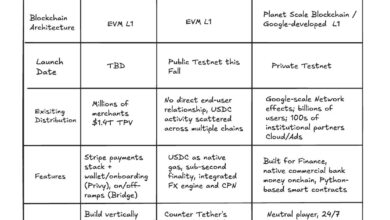

Whereas stablecoins, crypto tokens with costs tied to fiat currencies just like the U.S. greenback, have captured many of the consideration, banks are additionally exploring tokenized deposits to earn a living transfers extra environment friendly utilizing blockchain rails. A stablecoin, like Circle’s USDC or Tether’s USDT, is often issued by a non-public firm and backs the tokens’ worth with reserves held at a third-party custodian. In the meantime, a tokenized deposit is a legal responsibility of a regulated financial institution and topic to banking guidelines.

Earlier this yr, Custodia and Vantage Financial institution tokenized U.S. greenback demand deposits on Ethereum, whereas JPMorgan examined its deposit token on Coinbase’s layer-2 community Base.

In contrast to most stablecoins, VersaBank stated its tokens are federally insured and might earn curiosity, making them functionally just like conventional deposits however with the added effectivity of blockchain-based settlement.

The financial institution stated it expects to complete the pilot by the top of 2025 and can search approval from the Workplace of the Comptroller of the Foreign money (OCC) earlier than any public launch.

Learn extra: Stablecoins, Tokenization Put Stress on Cash Market Funds: Financial institution of America