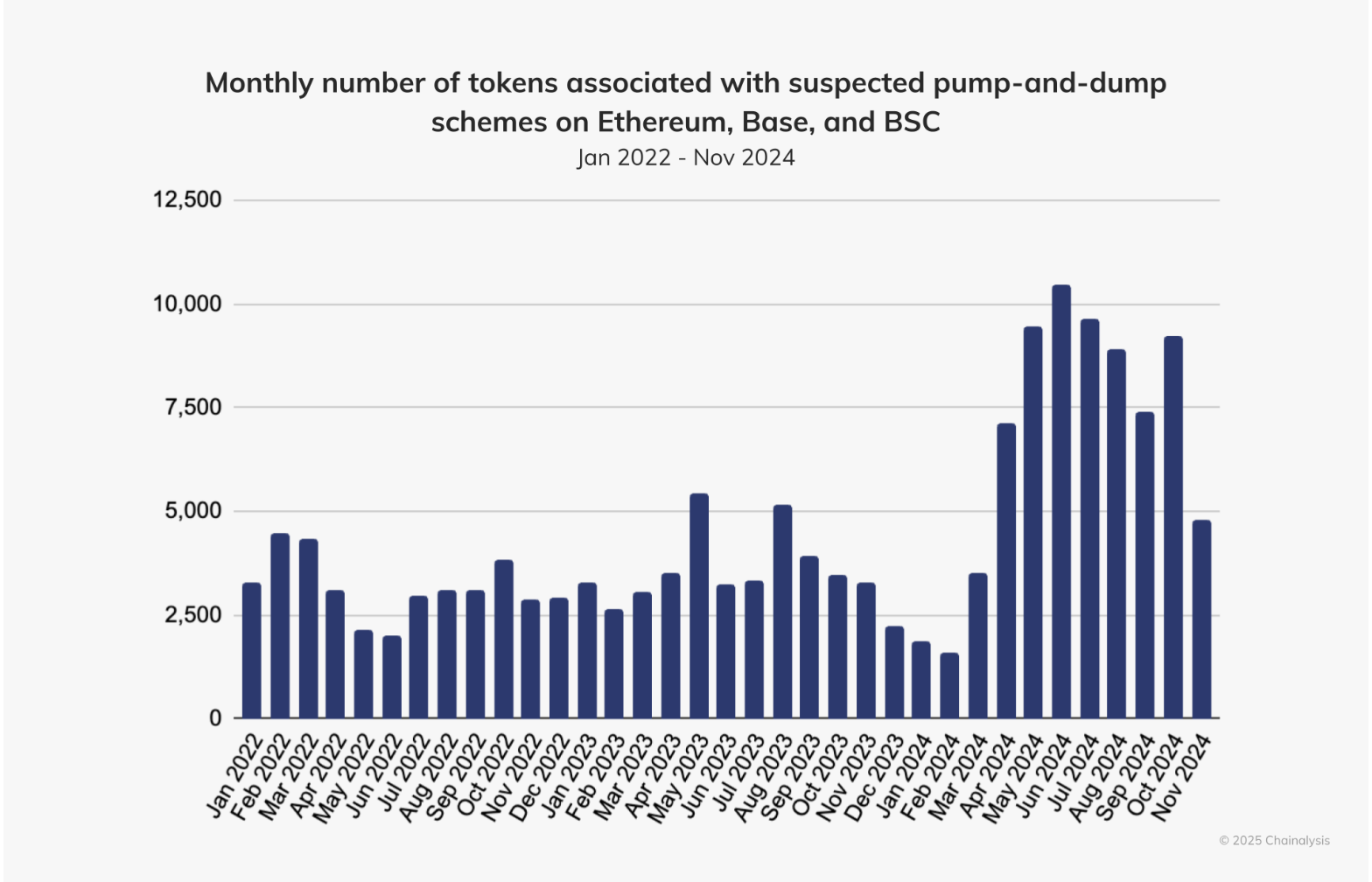

The Commodity Futures Buying and selling Fee (CFTC), a US monetary regulator, is integrating a monetary surveillance software developed by inventory alternate firm Nasdaq in a bid to overtake its Nineties infrastructure.

Nasdaq’s software program is targeted on detecting market abuse, together with insider buying and selling exercise and market manipulation in equities and crypto markets, Tony Sio, head of regulatory technique and innovation at Nasdaq, instructed Cointelegraph. He stated:

“Tailor-made algorithms detect suspicious patterns distinctive to digital asset markets. It gives real-time evaluation of order guide knowledge throughout crypto buying and selling venues and cross-market analytics that may correlate actions between conventional and digital asset markets.”

The information fed into the monitoring system might be “sourced by the CFTC by way of their regulatory powers,” Sio stated.

Monetary surveillance continues to be a hot-button challenge in crypto, with privateness advocates arguing surveillance creates situations for a digital “jail,” and others arguing that anti-money laundering strategies are essential for institutional adoption of crypto.

Associated: US Treasury’s DeFi ID plan is ‘like placing cameras in each lounge’

DeFi sector more and more involved with surveillance

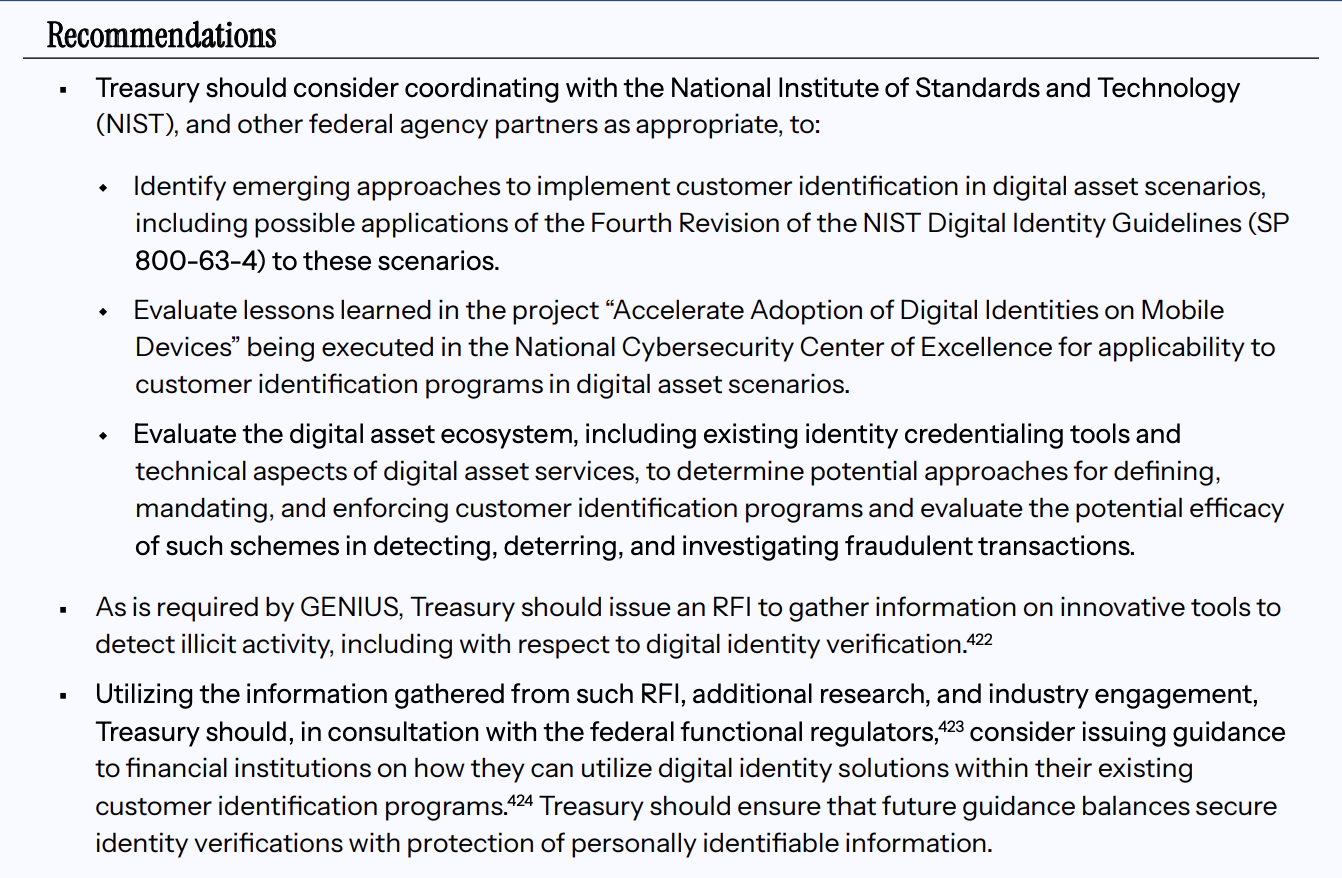

The US Treasury Division is exploring the opportunity of requiring digital identification checks embedded inside decentralized finance (DeFi) good contracts to fight illicit monetary flows.

Combatting illicit finance was one of many directives given within the White Home’s crypto report from July, which additionally included tax and market construction proposals for digital belongings within the US.

The White Home report really useful that the Treasury Division and the Nationwide Institute of Requirements and Expertise (NIST) develop further know-your-customer (KYC) parameters for digital belongings.

The report additionally really useful revising the present NIST digital identification pointers and overhauling identification credential instruments.

Critics of those proposals say that including such instruments to DeFi protocols betrays the core ethos of permissionless, decentralized structure.

“If you happen to flip a impartial, permissionless infrastructure into one the place entry is gated by government-approved identification credentials, it basically modifications what DeFi is supposed to be,” Mamadou Kwidjim Toure, CEO of funding platform Ubuntu Tribe, instructed Cointelegraph.

Journal: Can privateness survive in US crypto coverage after Roman Storm’s conviction?