Finastra, a London-based monetary tech supplier to a number of the world’s largest banks, stated Wednesday it should join its funds hub to Circle’s (CRCL) USDC stablecoin, giving banks an choice to settle cross-border transfers with the token.

The combination will start with Finastra’s International PAYplus (GPP), which processes greater than $5 trillion in day by day cross-border fee flows, the companies stated within the press launch.

The transfer underlines how stablecoins, a bunch of cryptocurrencies with costs anchored predominantly to fiat currencies just like the U.S. greenback, are more and more being examined by main monetary establishments as alternate options to conventional settlement channels. Funds giants Stripe and PayPal have already got their very own stablecoin infrastructure in place, whereas a number of main banks, giant retailers reportedly discover having their very own tokens.

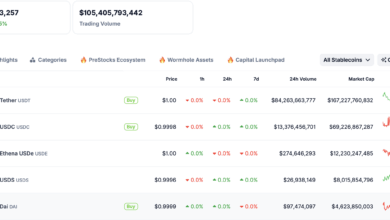

Stablecoins enable around-the-clock, near-instant settlements at decrease prices utilizing blockchain rails, proponents say. Coinbase projected the stablecoin market to develop to $1.2 trillion by 2028 from the present $270 billion, pushed by regulatory readability within the U.S. and accelerating company adoption. USDC is the second largest stablecoin available on the market, boasting a $69 billion provide.

By enabling settlement in USDC whereas maintaining directions in fiat currencies, Circle and Finastra stated banks can scale back their reliance on correspondent networks, which are sometimes criticized for top charges and sluggish processing instances.

Integrating Circle’s stablecoin rails into Finastra’s plumbing goals to provide “banks the instruments they should innovate in cross-border funds with out having to construct a standalone fee processing infrastructure,” stated Chris Walters, CEO of Finastra.

“Collectively, we’re enabling monetary establishments to check and launch modern fee fashions that mix blockchain know-how with the size and belief of the prevailing banking system,” Circle CEO Jeremy Allaire stated.

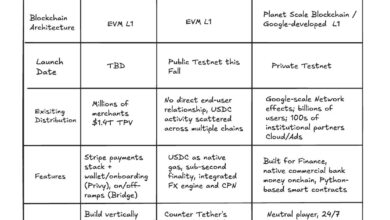

Circle went public earlier this yr, with its inventory skyrocketing as buyers sought publicity to the booming stablecoin market. The agency can be creating its personal blockchain dubbed Arc designed for funds.

Learn extra: Stablecoin Funds Projected to High $1T Yearly by 2030, Market Maker Keyrock Says