Welcome to The Protocol, CoinDesk’s weekly wrap of an important tales in cryptocurrency tech growth. I’m Margaux Nijkerk, a reporter at CoinDesk.

On this challenge:

- Bitcoin Mining Faces ‘Extremely Tough’ Market as Energy Turns into the Actual Forex

- Bitcoin Liquid Staking Good points Momentum as Lombard Launches BARD Token and Basis

- Optimism Faucets Flashbots to Supercharge OP Stack Sequencing

- Hemi Labs Raises $15M to Increase Bitcoin Programmability

Community Information

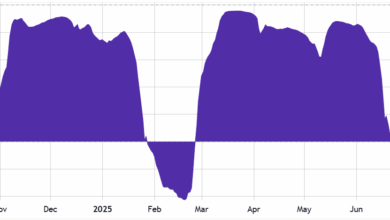

BITCOIN MINING PLAYERS FACE CHALLENGING MARKET: Bitcoin miners have lengthy been outlined by the boom-and-bust rhythm of the four-year halving cycle. However the sport has now modified, among the trade’s most outstanding executives stated on the SALT convention in Jackson Gap earlier this week. The rise of exchange-traded funds, surging demand for energy and the prospect of synthetic intelligence (AI) reshaping infrastructure wants imply miners should discover methods to diversify or threat being left behind. “We used to come back right here and speak about hash price,” stated Matt Schultz, CEO of Cleanspark. “Now we’re speaking about the right way to monetize megawatts.” For years, mining firms — whose income derived primarily from producing bitcoin — lived and died by the halving cycle. Each 4 years, rewards have been slashed in half and miners scrambled to chop prices or scale as much as survive. In line with these executives, that rhythm not defines the enterprise. “The four-year cycle is successfully damaged with the maturation of bitcoin as a strategic asset, with the ETF and now the strategic treasury and whatnot,” Schultz stated. “The adoption is driving demand. In case you learn something about the latest ETF, they’ve consumed infinitely extra bitcoin than have been generated to date this 12 months.” Cleanspark, which now operates 800 megawatts of vitality infrastructure and has one other 1.2 gigawatts in growth, has begun turning its consideration past proof-of-work. “Our pace to market with the electrical energy has created alternatives such that now we will take a look at methods to monetize energy past simply bitcoin mining,” he stated. “With 33 places, we now have an amazing deal extra flexibility than we ever did earlier than.” Schultz just isn’t alone in calling the trade’s shift in enterprise mannequin. Patrick Fleury, CFO of Terawulf, echoed the sentiment and didn’t sugarcoat the revenue squeeze the miners are feeling. “Bitcoin mining is an extremely troublesome enterprise,” he stated. He broke down the economics of bitcoin mining in easy phrases: with electrical energy costing 5 cents per kilowatt hour, it at present prices round $60,000 to mine a single bitcoin. At a bitcoin worth of $115,000, meaning half the income is consumed by energy alone. As soon as company bills and different working prices are factored in, the margins tighten rapidly. In his view, profitability in mining hinges virtually totally on securing ultra-low-cost energy. — Helene Braun Learn extra.

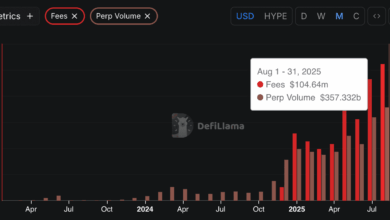

BITCOIN LIQUID STAKING RISES: For many of its historical past, bitcoin has been touted by its supporters as digital gold: an asset to carry reasonably than use. That passivity has left trillions of {dollars}’ value of BTC sitting idle in wallets, disconnected from the yield methods and composability that outline decentralized finance (DeFi). The rise of liquid staking tokens guarantees to alter that, positioning bitcoin not solely as a retailer of worth however as a productive asset built-in into on-chain capital markets. Liquid staking permits customers to supply their crypto to assist safe a community and obtain in return a liquid, tradable token that represents the staked property and can be utilized throughout DeFi whereas the unique tokens proceed incomes staking rewards. Lombard Finance has emerged as one of many outstanding initiatives in bitcoin liquid staking. Its flagship product, LBTC, is a yield-bearing token backed 1:1 by BTC. When BTC is deposited into the Lombard protocol, the underlying cash are staked, primarily by way of Babylon, a protocol enabling trustless, self-custodial bitcoin staking. Customers obtain LBTC in return, which could be deployed throughout DeFi ecosystems whereas the unique bitcoin earns staking rewards. This twin performance is vital. Holders can preserve publicity to bitcoin whereas utilizing LBTC in lending, borrowing and liquidity provision throughout protocols equivalent to Aave, Morpho, Pendle and Ether.fi. Designed for interoperability, LBTC strikes throughout Ethereum, Base, BNB Chain and different networks, stopping liquidity fragmentation and making certain bitcoin can take part in a multi-chain DeFi surroundings. — Jamie Crawley Learn extra.

OPTIMISM AND FLASHBOTS TEAM UP: Optimism is teaming up with Flashbots to revamp how transactions are processed throughout its OP Stack ecosystem, aiming to make a few of Ethereum’s hottest layer-2 networks quicker and extra customizable. The partnership facilities on sequencing, the behind-the-scenes course of that determines how rapidly a transaction confirms, which trades are prioritized, and the way a lot customers finally pay. Optimism says Flashbots’ infrastructure, which is already chargeable for constructing greater than 90% of Ethereum’s blocks, will now convey near-instant confirmations and user-friendly transaction ordering to each chain within the so-called Superchain.This issues as a result of the OP Stack underpins greater than 60% of all Ethereum layer-2 exercise, the Optimism group claims, together with among the most well-known layer-2 chains like Base, Unichain, World Chain, Ink and Soneium. Till now, superior sequencing options equivalent to ultra-fast settlement, frontrunning safety and customized compliance guidelines have been obtainable solely to the most important chains with sources to construct them in-house. With Flashbots on board, these options might be obtainable by way of instruments for any challenge constructing on Optimism’s OP stack. — Margaux Nijkerk Learn extra.

HEMI LABS RAISES $15 MILLION: Hemi Labs, the Bitcoin programmability community based by Jeff Garzik, raised $15 million in funding to speed up growth and broaden its ecosystem. The spherical included YZi Labs (previously Binance Labs), Republic Digital, HyperChain Capital, Breyer Capital, Huge Mind Holdings, Crypto.com and others, in accordance with an emailed announcement.The corporate stated the funds will assist functions for borrowing, lending and buying and selling on Bitcoin whereas additional creating its Hemi Digital Machine (hVM), a layer that embeds a Bitcoin node inside an Ethereum VM — the time period for a decentralized system that may execute sensible contracts and course of transactions on Ethereum. — Jamie Crawley Learn extra.

In Different Information

- Aave Labs launched Horizon, a brand new platform devoted for institutional debtors to entry stablecoins utilizing tokenized variations of real-world property (RWAs) like U.S. Treasuries as collateral. At launch, establishments will be capable to borrow Circle’s USDC, Ripple’s RLUSD and Aave’s GHO towards a set of tokenized property, together with Superstate’s short-duration U.S. Treasury and crypto carry funds, Circle’s yield fund, and Centrifuge’s tokenized Janus Henderson merchandise. The platform goals to supply certified traders short-term financing on their RWA holdings and permit them to deploy yield methods. — Kristzian Sandor Learn extra.

- Google Cloud is shifting ahead with plans to launch its personal layer-1 blockchain, positioning the community as impartial infrastructure for world finance at a time when fintech rivals are creating their very own distributed ledgers. In a LinkedIn publish printed Tuesday, Wealthy Widmann, Google’s head of Web3 technique, offered contemporary particulars on the challenge, generally known as the Google Cloud Common Ledger (GCUL). He described the platform as a credibly impartial, high-performance blockchain designed for establishments, supporting Python-based sensible contracts to make it extra accessible to builders and monetary engineers. “Any monetary establishment can construct with GCUL,” Widmann stated, arguing that whereas firms like Tether could also be unlikely to undertake Circle’s blockchain and fee corporations like Adyen might hesitate to make use of Stripe’s, Google’s impartial infrastructure removes these obstacles. — Siamak Masnavi Learn extra.

Regulatory and Coverage

- The crypto trade’s Washington lobbyists try to attract a line within the sand over the market construction invoice that is steaming by the U.S. Senate, saying they can not again a regulation that would not absolutely shield software program builders from being held chargeable for unhealthy actors abusing their know-how. The trade made its case to the Senate’s Banking and Agriculture committees “with one voice,” sending a letter Wednesday signed by Coinbase, Kraken, Ripple, a16z, Uniswap Labs and greater than 100 different crypto companies and organizations, together with virtually all the main U.S. lobbying teams. This unified effort comes the week earlier than the Senate will get again to work, and is more likely to rekindle full negotiations on the language of the laws that represents the trade’s high U.S. objective. — Jesse Hamilton Learn Extra.

- The U.S. Commodity Futures Buying and selling Fee is about to drop to a single commissioner when Democrat Kristin Johnson leaves the company subsequent week, and the one different individual ready within the wings to affix the regulator is President Donald Trump’s chairman nominee, Brian Quintenz. As of Sept. 3, the five-member fee will drop to at least one, as a result of that is when Johnson plans to exit. “In advancing an agenda within the title of development, it’s essential to not dismantle the foundational resilience that helps monetary stability and protects the broader economic system,” she stated in a farewell assertion encouraging the company to stay to the basics as new applied sciences come on board. — Jesse Hamilton Learn extra.

Calendar

- Sept. 22-28: Korea Blockchain Week, Seoul

- Oct. 1-2: Token2049, Singapore

- Oct. 13-15: Digital Asset Summit, London

- Oct. 16-17: European Blockchain Conference, Barcelona

- Nov. 17-22: Devconnect, Buenos Aires

- Dec. 11-13: Solana Breakpoint, Abu Dhabi

- Feb. 10-12, 2026: Consensus, Hong Kong

- Could 5-7, 2026: Consensus, Miami