The native token of Hyperliquid (HYPE) surged to a recent all-time excessive early Wednesday, persevering with its meteoric climb this 12 months because the decentralized change greatest identified for on-chain perpetual buying and selling has attracted document exercise.

The token broke by way of the $50 mark for the primary time, gaining about 8% up to now 24 hours. HYPE is now up 430% since its April nadir and up roughly 15x because it started buying and selling in late November at round $3.

The rally has been fueled by document buying and selling exercise throughout the change and its automated buyback mechanism, which steadily absorbs tokens from the market and reduces circulating provide.

Learn extra: Hyperliquid Now Dominates DeFi Derivatives, Processing $30B a Day

Buying and selling growth

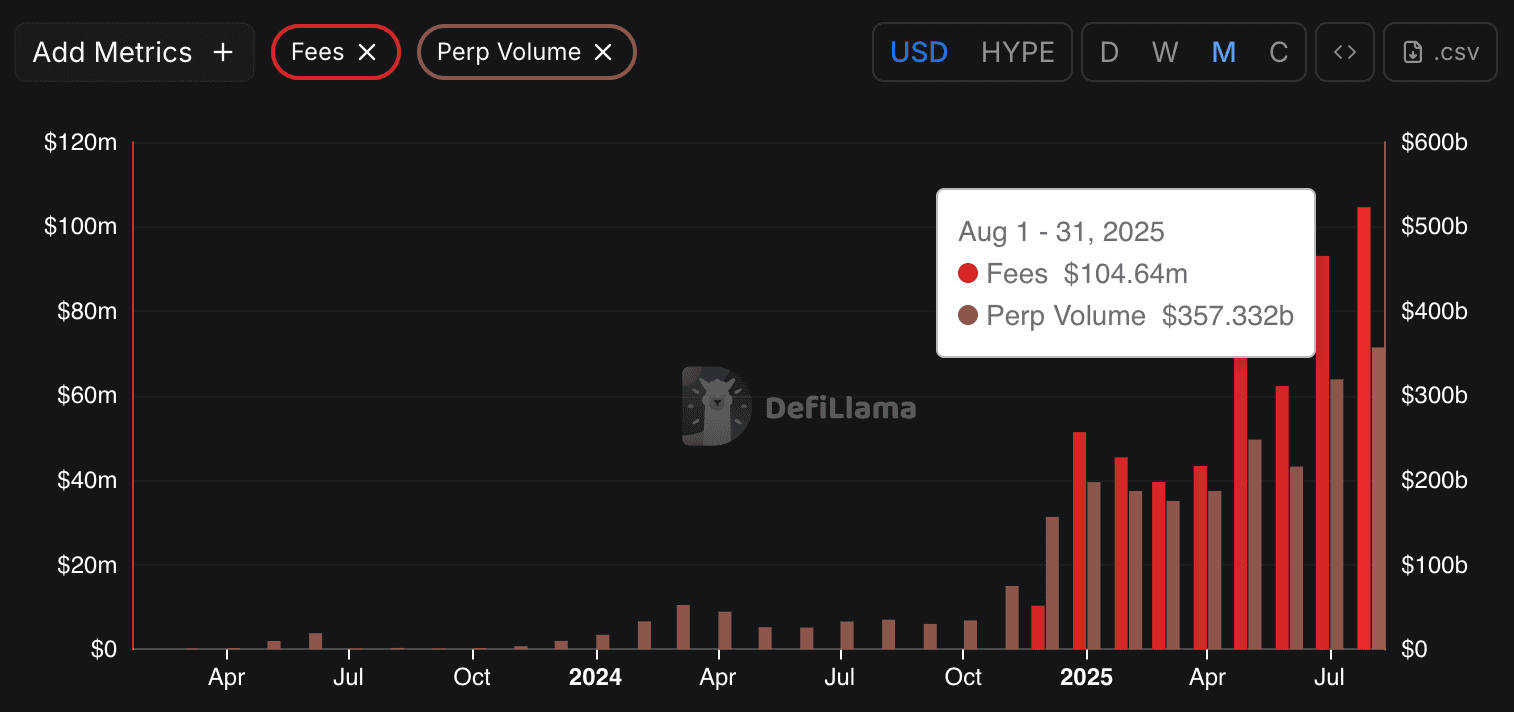

The decentralized change recorded greater than $357 billion in derivatives quantity in August, in response to DefiLlama information, up from $319 billion in July and practically ten instances greater than a 12 months in the past. Spot buying and selling volumes additionally set a document, surpassing $3 billion for the week ending Aug. 24, Blockworks information reveals.

These flows translated right into a windfall for the protocol. Hyperliquid booked $105 million in buying and selling charges throughout August, the best this 12 months, per DefiLlama information.

A lot of these earnings are funneled immediately into buying HYPE available on the market by way of Hyperliquid’s Help Fund. The power is an automatic on-chain mechanism that buys again tokens on the open market, creating sustained purchase strain for HYPE and successfully lowering the circulating provide.

Since its launch in January, the fund’s holdings ballooned from 3 million tokens to 29.8 million HYPE, now value over $1.5 billion, fueling the token’s rally.

On the information entrance, digital asset custodian BitGo added assist on Tuesday for the HyperEVM community, which underpins the Hyperliquid ecosystem, unlocking institutional entry to HYPE and associated purposes.

Analysts flag dangers amid robust fundamentals

In a current analysis be aware, ByteTree analysts Shehriyar Ali and Charlie Morris described Hyperliquid as a “powerhouse” that has develop into the most important decentralized perpetual futures venue.

“All issues thought of, HyperLiquid is among the many most compelling protocols in DeFi as we speak,” they wrote. “Its robust fundamentals, record-breaking payment era and dominant market share make it inconceivable to disregard.”

Regardless of the bullish fundamentals, the report additionally flagged considerations in regards to the token’s valuation. HYPE at the moment trades at a totally diluted valuation (FDV) of over $50 billion, with solely about third of provide in circulation with a 16.8 billion market capitalization.

Scheduled token unlocks beginning in November might additionally introduce promoting strain, probably testing the energy of demand, the report famous.

“Though the token has already seen a pointy run-up in current months, its sturdy on-chain exercise continues to underpin its valuation,” the analysts mentioned.

Learn extra: XPL Futures on Hyperliquid See $130M Wiped Out Forward of the Plasma Token’s Launch