Solana’s SOL outperformed the broader crypto market on Wednesday, climbing 7.68% in 24 hours to commerce at $208.24, in keeping with CoinDesk Knowledge. By comparability, the CoinDesk 20 Index (CD20) rose 2.89% and the overall crypto market cap gained simply 1.6% throughout the identical interval.

Analysts mentioned Solana’s robust efficiency displays a mixture of technical momentum and structural demand.

Scott Melker, a dealer often known as the “Wolf of All Streets,” argued that Solana is now at a vital degree towards bitcoin. He mentioned a breakout right here might make SOL the “darling” of the following altcoin cycle. His chart confirmed SOL urgent into resistance towards BTC, a pairing that usually alerts whether or not the token can outperform the broader market.

Lark Davis was extra direct, calling Solana the “catch-up commerce” for traders who missed ethereum’s breakout from $1,400 over the last cycle. He cited three drivers: the rise of SOL-based treasury corporations modeled on bitcoin accumulation companies, the prospect of a spot SOL ETF getting accepted within the close to future by the U.S. SEC and rising institutional curiosity. Davis mentioned these components might push billions of {dollars} into SOL.

Altcoin Sherpa, one other extensively adopted analyst, cautioned towards chasing the rally. He described SOL’s power as uncommon however suggested merchants to contemplate taking earnings between $205 and $215 or ready for extra readability earlier than getting into. His view displays the danger that weekend or short-term rallies usually retrace as soon as liquidity normalizes.

DeFi asset administration agency Sentora added one other perspective, noting that greater than $820 million in SOL is already held in company treasuries. For comparability, ETH treasury holdings stood at an identical degree in April earlier than increasing to almost $20 billion. They are saying the trajectory suggests SOL might comply with an identical path if adoption accelerates.

Institutional assist additionally continues to develop.

Staking service supplier Refrain One introduced the launch of a brand new Solana validator in partnership with Delphi Consulting, a part of Delphi Digital. The companies mentioned the transfer displays a perception that establishments ought to contribute not simply capital but additionally infrastructure to the networks they again. For Solana, identified for its quick throughput and developer development, new institutional-grade validators add credibility to its long-term stability.

Technical Evaluation Highlights

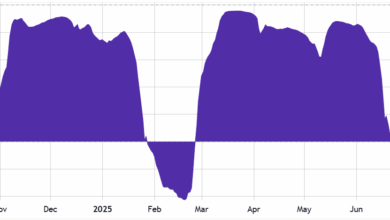

- In response to CoinDesk Analysis’s technical evaluation information mannequin, between Aug. 26 at 15:00 UTC and Aug. 27 at 14:00 UTC, SOL rose from $191.67 to $204.62, a 7% achieve, with a buying and selling vary of $190.11–$205.65.

- Heavy quantity at $193.92 through the early rebound (986,571 tokens traded) established this degree as robust assist.

- Resistance shaped close to $205.65, with repeated rejections round that hall. Sustained value motion above $202.00 suggests institutional shopping for.

- Within the closing hour of buying and selling, SOL dipped to $202.95 earlier than surging to an intraday excessive of $205.84 on robust quantity.

- Key assist is now seen close to $202.82, whereas resistance sits round $205.84, with bullish momentum pointing towards the $210.00 psychological barrier.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.