Key takeaways:

-

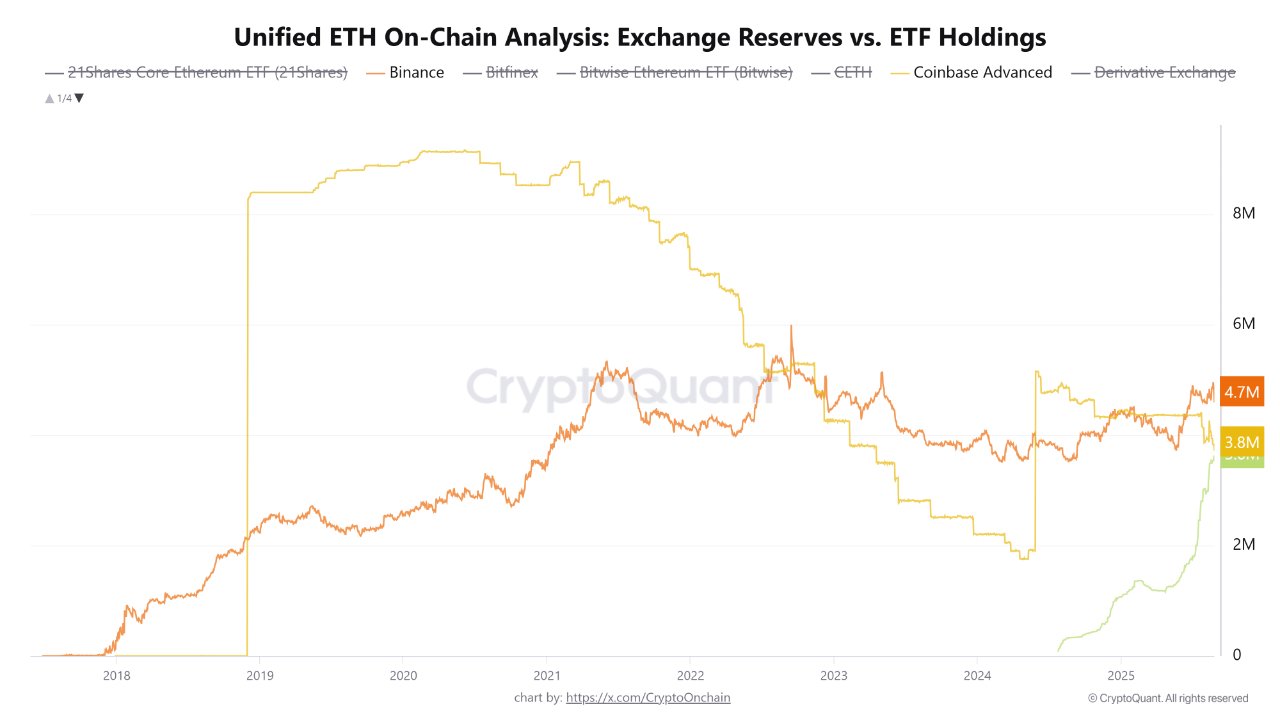

BlackRock’s iShares ETH ETF holds 3.6 million ETH, simply 200,000 behind Coinbase.

-

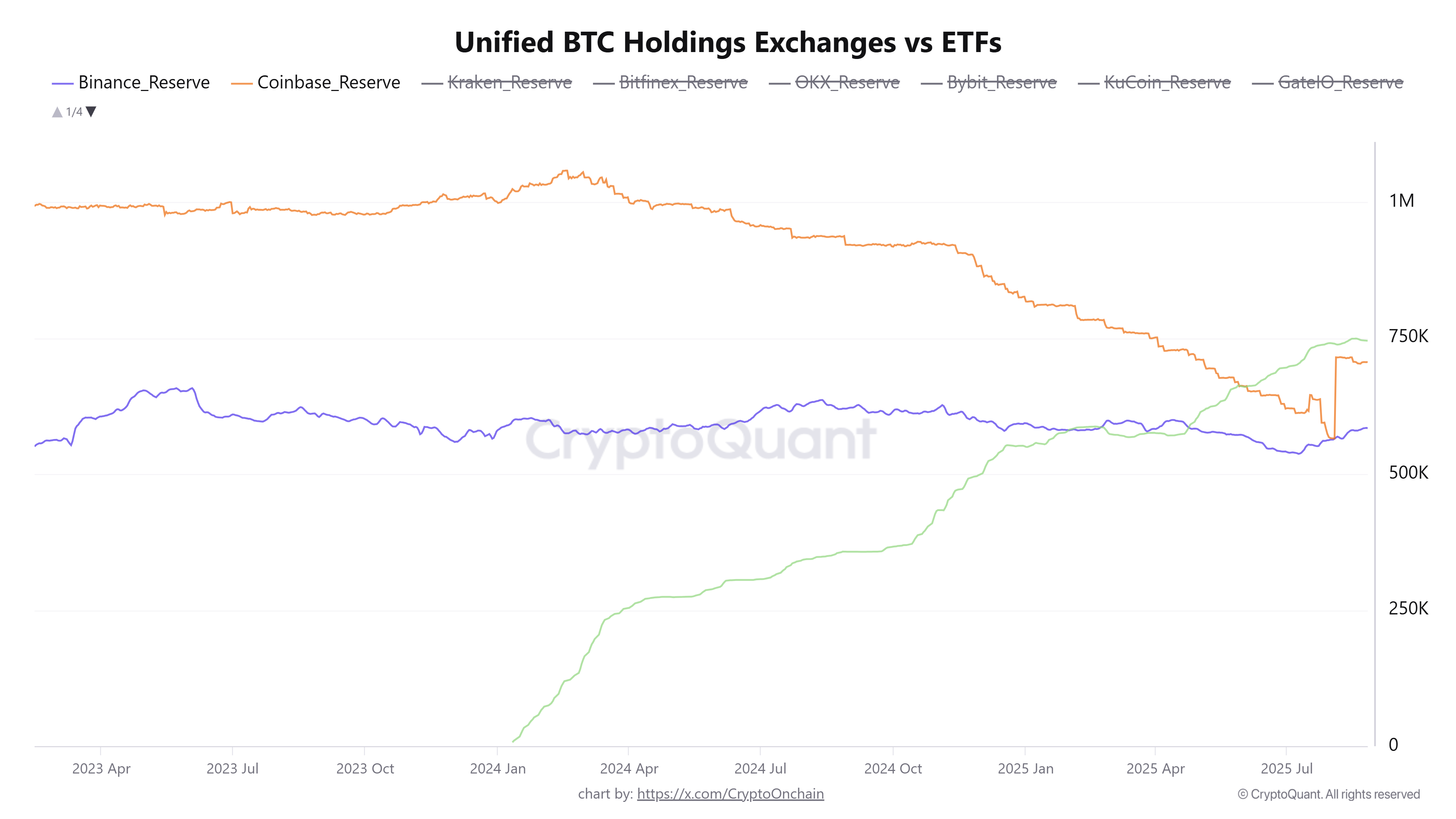

IBIT’s 745,000 BTC already surpasses Coinbase and Binance reserves.

-

Falling Bitcoin and Ether inflows sign tightening provide and decreased promoting stress.

BlackRock’s iShares Ethereum ETF is on the verge of overtaking Coinbase because the world’s second-largest Ether (ETH) custodian, narrowing the hole to only 200,000 ETH. With holdings now at 3.6 million ETH, iShares has added 1.2 million ETH in beneath two months.

At this tempo, it might surpass Coinbase by year-end and scale back Binance’s dominance to a margin of simply 1.1 million ETH.

The shift highlights a significant divergence in custody tendencies. Binance nonetheless leads with 4.7 million ETH, up from 2.5 million in 2019, although development has consolidated. Coinbase, as soon as the most important Ether custodian with greater than 8 million ETH in 2019, has seen reserves fall to three.8 million ETH, a 52% decline in six years.

BlackRock’s speedy accumulation indicators a structural realignment in crypto markets, as establishments more and more favor regulated ETFs over alternate custody. The acceleration of ETF holdings reduces liquid provide and factors to deeper institutional conviction in Ether. ,

This momentum can also be not restricted to ETH. Newest onchain information reveals IBIT’s Bitcoin (BTC) holdings have elevated to about 745,357 BTC, eclipsing Coinbase at 706,150 BTC and Binance at 584,557 BTC.

These developments underscore BlackRock’s emergence as the most important institutional custodian throughout each Bitcoin and Ether, cementing its affect over crypto’s market construction.

Associated: Bitcoin can nonetheless hit $160K by Christmas with ‘common’ This autumn comeback

Bitcoin and Ether inflows dip throughout exchanges

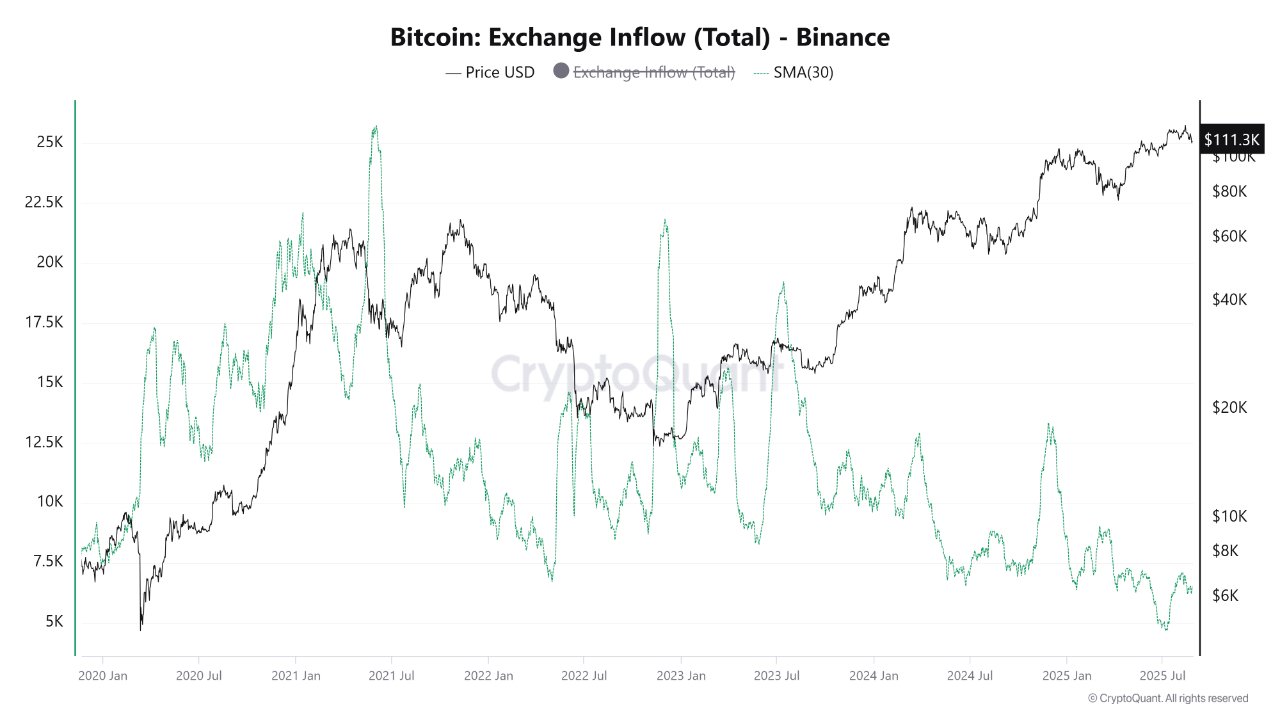

Knowledge from CryptoQuant signifies that the 30-day transferring common of BTC inflows has dropped to its lowest since Could 2023, whereas BTC trades close to $111,000. Coinbase and Binance each report traditionally low deposits, suggesting decreased promoting stress from each retail and institutional channels.

Ether inflows inform an analogous story. The 30-day SMA (easy transferring common) imply inflows have declined to their April 10 low of 25 ETH, a interval when ETH traded at $1,700, regardless of the asset now sitting close to $4,600. The absence of alternate inflows at larger costs suggests buyers are reluctant to promote, reinforcing conviction in present market positioning.

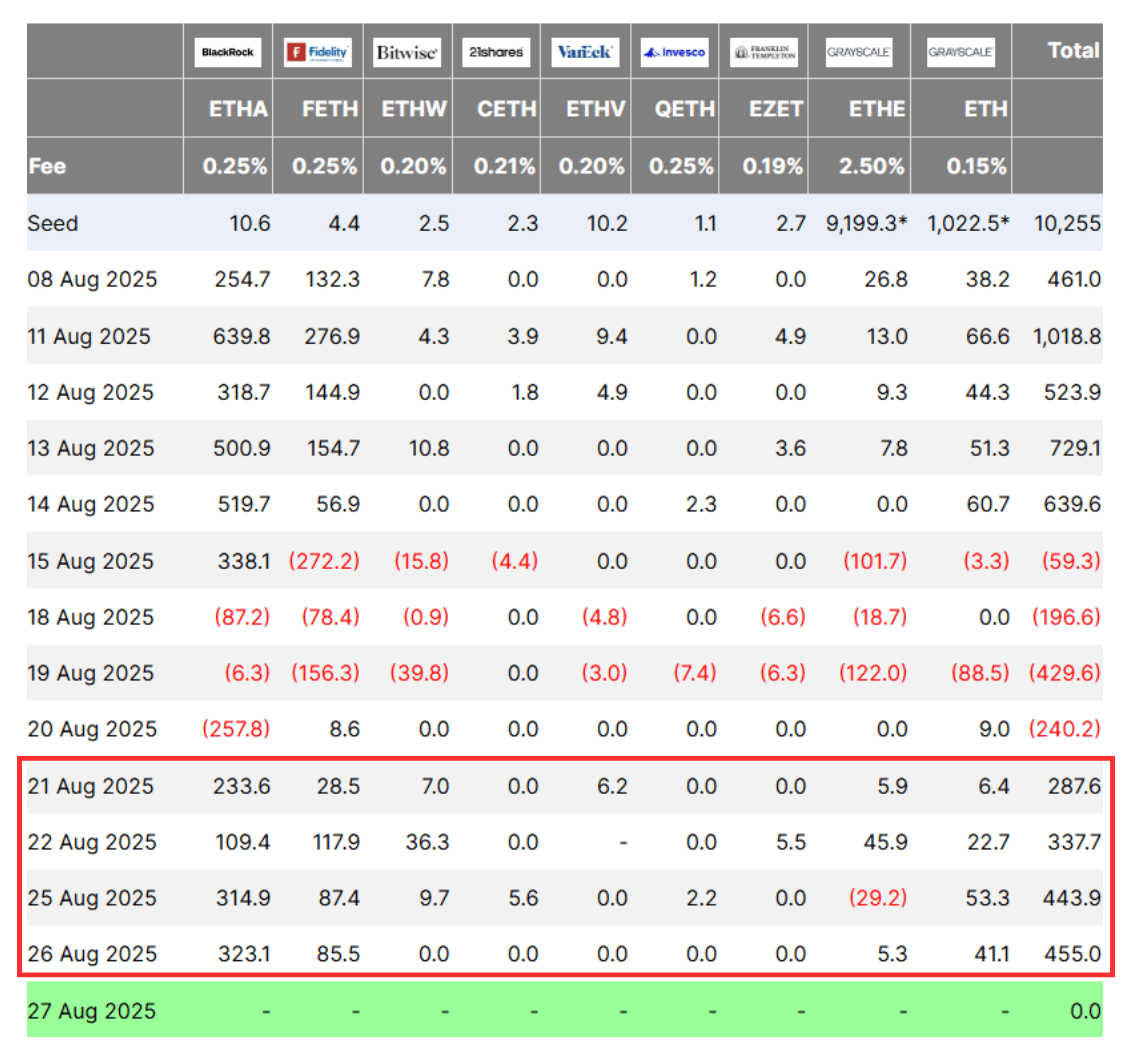

On the similar time, ETF flows spotlight the place demand is coming from. Ether ETFs have seen greater than $1.5 billion in internet inflows since final Thursday, together with $450 million in a single day yesterday.

Bitcoin ETFs posted heavy outflows of $1.17 billion final week, however shopping for stress has returned in latest classes with practically $310 million in inflows over the previous two days.

Collectively, falling alternate inflows and accelerating ETF accumulation spotlight a tightening provide backdrop for each BTC and ETH, setting the stage for sustained bullish momentum into year-end.

Associated: Ether breaks out towards BTC, however new highs depend upon $4.7K changing into assist

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.