Digital asset lender Ledn has tapped Swiss crypto financial institution Sygnum to refinance its $50 million Bitcoin-backed mortgage, in a deal that the businesses say opens the door to tokenized, Bitcoin-collateralized funding alternatives.

Whereas the refinancing matches Ledn’s $50 million syndicated mortgage from 2024, the most recent facility was twice oversubscribed, the businesses mentioned Wednesday.

An oversubscribed mortgage providing signifies that investor demand exceeds the out there mortgage allocation, typically signaling robust institutional curiosity. In such circumstances, buyers could obtain solely a fraction of their requested allocation, or the issuer could enhance the mortgage dimension to accommodate extra capital.

A portion of the mortgage was tokenized through Sygnum’s Desygnate platform, which permits non-public credit score offers to be issued as onchain funding merchandise. By leveraging tokenization, the power could be distributed extra broadly to certified buyers.

The businesses mentioned the oversubscription highlights rising investor demand for inflation-resistant revenue merchandise, particularly as yields in each conventional markets and DeFi proceed to flatten.

Earlier this 12 months, DeFi analytics firm Neutrl reported proof of flattening yields, noting that stablecoin APRs had dropped beneath 6% — a far cry from the double-digit returns buyers loved throughout the earlier market cycle earlier than the 2022 bear market.

Ledn isn’t alone within the Bitcoin lending area. In January, Coinbase reintroduced Bitcoin-backed loans for US prospects, with Morpho Labs facilitating the lending course of.

In July, Cointelegraph reported that the Cantor Fitzgerald–backed Twenty One Capital was exploring US greenback loans secured by Bitcoin collateral. In the meantime, JPMorgan Chase is reportedly contemplating its personal Bitcoin-backed mortgage merchandise, with a possible launch in 2026 — although timelines stay topic to vary.

Associated: Ledn ditches ETH, shifts to full custody mannequin for Bitcoin loans

Personal credit score powers tokenization increase

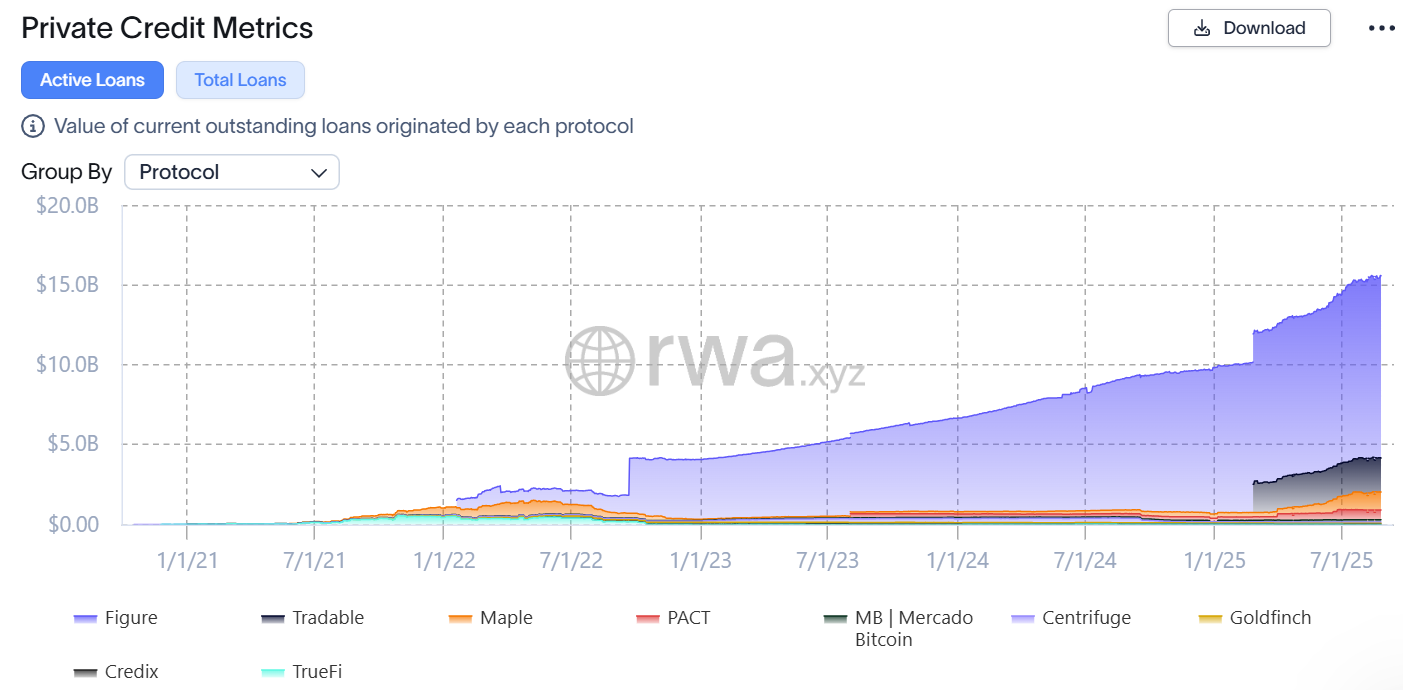

The Sygnum–Ledn facility falls inside the tokenized non-public credit score market, now the most important and fastest-growing section of asset tokenization.

Not all Bitcoin-backed loans qualify as non-public credit score, nonetheless. Retail-focused lending merchandise are usually thought-about exterior this class.

In keeping with trade information, non-public credit score at present represents greater than half of all tokenized worth onchain. As of Wednesday, onchain non-public credit score markets have been valued at $15.6 billion, accounting for 58% of the tokenized real-world asset market.

As Galaxy Digital noticed in its April report on crypto lending, onchain non-public credit score “rests on tokenization, programmability, utility, and, consequently, yield growth.”

Tokenized non-public credit score alternatives sometimes ship yields within the 8% to 12% vary, based on a June evaluation by DeFi protocol Gauntlet and trade platform RWA.xyz.

Associated: ‘Earlier than Bitcoin, my most profitable funding was shorting the Bolivar’ — Ledn co-founder