Chinese language fintech firm Linklogis has introduced a partnership with the XRP Ledger (XRPL) to digitize international provide chain finance, in accordance with a latest assertion.

The transfer will see Linklogis deploy its commerce finance software on XRPL’s mainnet, a step aimed toward scaling blockchain adoption for cross-border settlements.

The collaboration is designed to unlock sooner circulation of digital property tied to worldwide commerce flows. Linklogis intends to simplify settlement for exporters, importers, and financiers by linking its monetary infrastructure with XRPL.

Past the preliminary rollout, each side have dedicated to creating new merchandise on XRPL.

These embrace stablecoin-based settlement techniques and good contract platforms that may carry provide chain real-world property (RWAs) into tokenized kind.

Linklogis additionally signaled that it’ll discover utilizing synthetic intelligence with blockchain to enhance commerce finance effectivity.

In accordance with the agency, its “Go Early” and “Go Deep” enterprise applications processed greater than RMB 20.7 billion (about $2.8 billion) in cross-border property final 12 months. By anchoring these flows to XRPL, Linklogis goals to increase effectivity and transparency throughout international provide chains.

XRPL’s increasing RWA footprint

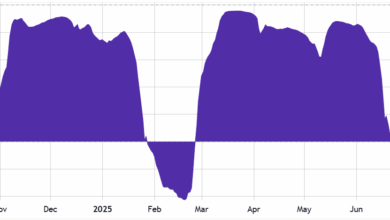

The mixing comes as XRPL accelerates its adoption throughout RWA sectors.

Information from RWA.xyz exhibits the community’s tokenized RWA quantity climbed 22.81% prior to now month, reaching roughly $305.8 million. That progress has positioned XRPL because the ninth-largest blockchain by RWA worth, supported by its increasing roster of enterprise companions.

Notably, XRPL’s latest international partnerships spotlight its rising relevance in tokenization.

The Dubai Land Division adopted the ledger to energy its actual property tokenization program earlier this 12 months in Could. A month later, RWA platform Ondo Finance launched tokenized US Treasuries on the community.

Momentum has additionally unfold to Latin America. Brazilian securitization agency VERT issued a 700 million actual ($130 million) Agribusiness Receivables Certificates on XRPL via a blockchain-based personal credit score platform.

Across the similar time, change Mercado Bitcoin disclosed plans to tokenize greater than $200 million in fixed-income and fairness merchandise on the ledger.