Worth outlook

Our evaluation for the rest of 2025 forecasts bitcoin reaching a goal of $150,000 to $160,000 pushed by a Fed coverage pivot and charge drop expectations in the US, useful liquidity situations and the more and more constructive crypto regulatory surroundings.

The most recent announcement from the Trump administration permitting cryptos into 401(ok)s provides an additional layer to the crypto adoption narrative, and a transparent pathway to increasing the present crypto market cap by way of the estimated 9 trillion USD retirement market in the US.

Webinar alert: On September 9 at 11:00am ET be part of Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices as they talk about constructing a sustainable enterprise within the cyclical markets of crypto. Register in the present day. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

Occasion alert: CoinDesk: Coverage & Regulation in Washington D.C. on September tenth. The agenda consists of senior officers from the SEC, Treasury, Home, Senate and OCC, plus non-public roundtables and unparalleled networking alternatives. Use code COINDESK15 to avoid wasting 15% in your registration. http://go.coindesk.com/4oV08AA.

Ongoing crypto catalysts

- Liquidity situations: Ongoing liquidity injections from the PBOC and the general growth of International M2.

- Corporates & funds: Establishments are placing their stability sheets to work in bitcoin like by no means earlier than. Moreover, the variety of bitcoin and ether funds continues to quickly develop.

- ISM survey is predicted to rise above 50.0. When the ISM survey goes into constructive territory it has beforehand correlated with the beginning of “alt season.”

Quantitative fashions and dangers

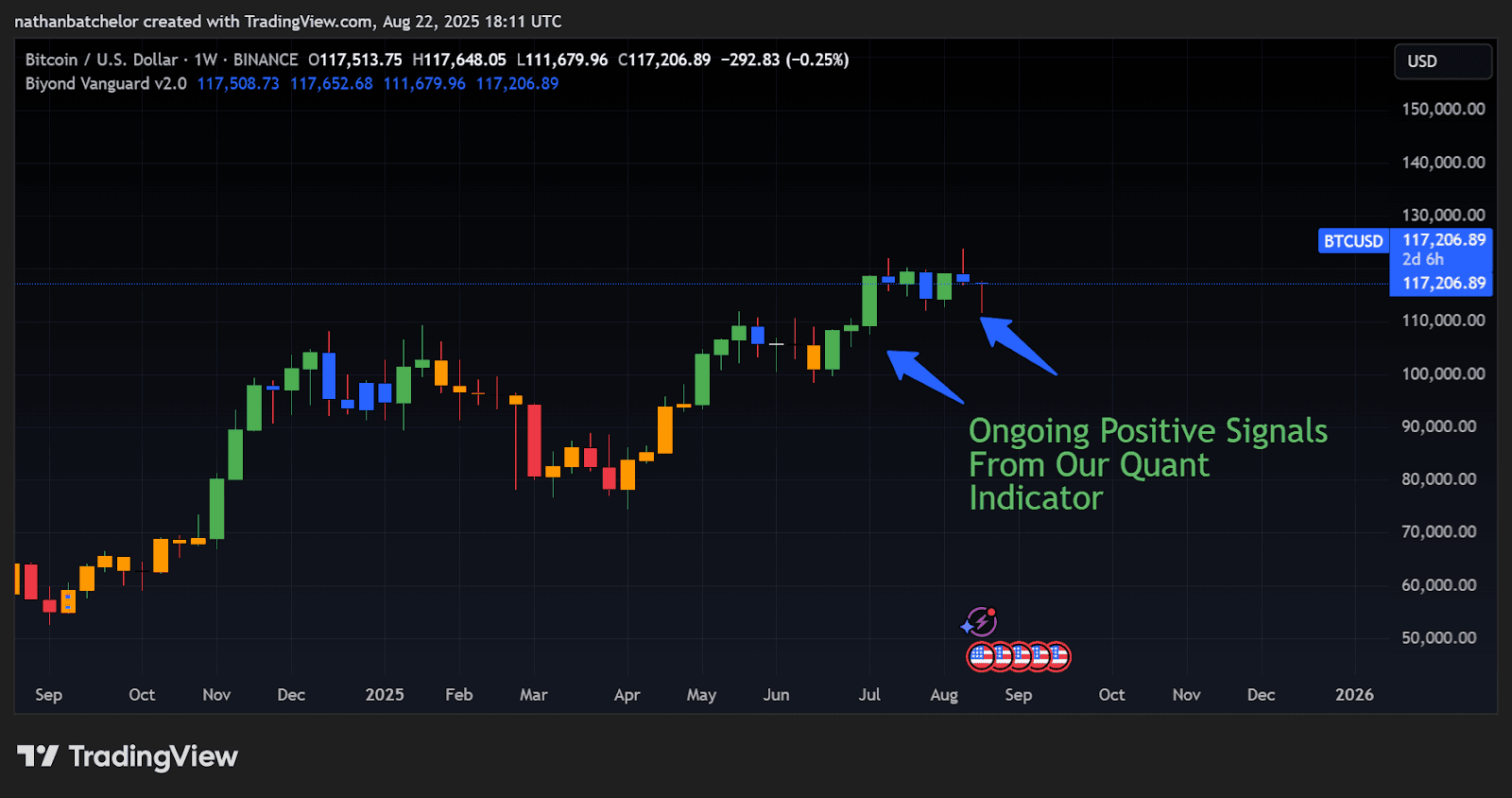

Our quantitative fashions stay constructive and present important scope for additional upside in bitcoin and the broader market:

- Our Vanguard mannequin, which is a development detection system, continues to generate lengthy conviction weekly indicators.

- Weekly value closes above $119,000 will preserve the bullish sentiment alive and cement the technical backdrop for additional upside into uncharted waters for bitcoin.

Supply: Biyond.co, August 2025

Dangers

- An acceleration of destructive knowledge factors in the US, resulting in stagflation fears and risk-off over fears of a worldwide slowdown.

- A big pullback within the S&P 500 in Q3, probably from the 6,660 stage, which stays a main goal.

- Unfavorable tariff headlines, and extra particularly, a breakdown in Sino-U.S. commerce talks.

- Intensive revenue taking from ETF holders if bitcoin crosses $150,000 and even $160,000

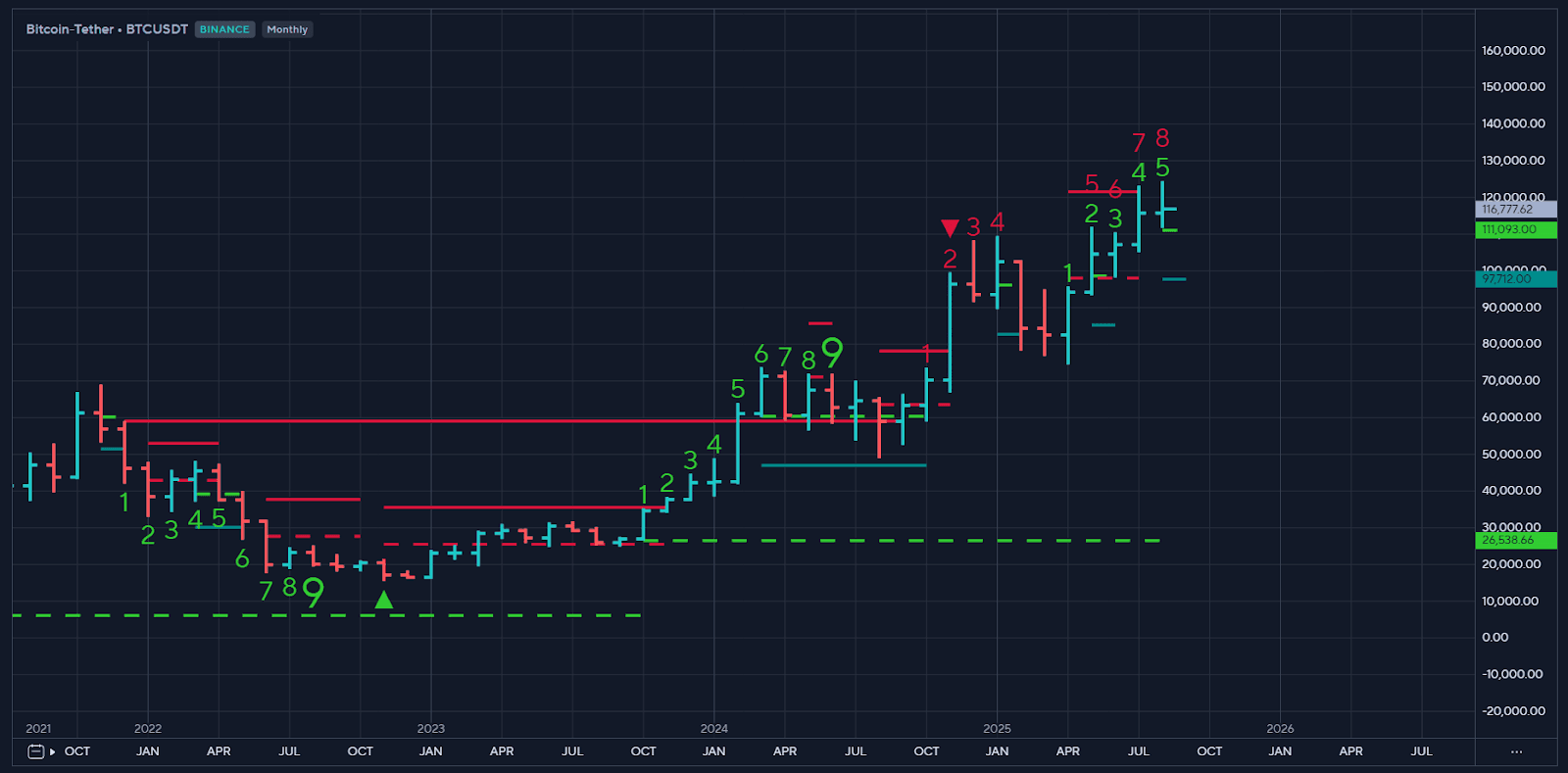

Insights from Demark indicator

Demark TD sequential month-to-month chart is pointing to a attainable high on the finish of the 12 months with the index transferring in direction of setup 9 and countdown 13. When the Demark indicator has approached 9 or 13 beforehand, it has signalled sturdy overbought exhaustion.

Supply: Symbolik Demark TD Sequential

Crypto whole market cap

The potential breakout of the crypto whole market capitalization chart presents one other dynamic to the continued and beforehand talked about bullish catalyst for the crypto market. Specifically:

- An preliminary Q3 goal of 5 trillion USD.

- A broad-based crypto market rally encompassing the highest 150 cryptos.

- Restricted scope for draw back underneath 4 trillion USD as soon as a definitive chart breakout happens.

Conclusion

Bitcoin and the cryptocurrency market are well-placed to blow up to new buying and selling highs, with projections anticipated to succeed in between $150,000-160,000, and a 5 trillion USD market capitalization.

Key upcoming threat occasions embrace increased CPI readings within the coming months and a halt in commerce negotiations between the US and China, though we really feel it’s way more possible a “kicking of the can” down the highway and an extension of ongoing commerce talks to appease markets.

Primarily based on all of the constructive developments surrounding bitcoin and technical indicators, a robust case could be made for additional sturdy value appreciation operating into year-end.