In our earlier analysis report titled Bitcoin’s Liquidity Trifecta: Unpacking Liquidity Throughout On-Chain Knowledge, Market Microstructure and Macro Drivers, we explored how numerous liquidity indicators might reveal underlying capital flows and liquidity situations for bitcoin. Making use of that very same framework to ether (ETH) offers us helpful perception into its present liquidity profile — each on-chain and within the broader market. On this replace, we additionally spotlight the rising position of digital asset treasuries (DATs) which have emerged as a key driver behind ETH’s current rally.

Webinar alert: On September 9 at 11:00am ET be a part of Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices as they talk about constructing a sustainable enterprise within the cyclical markets of crypto. Register right now. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

Occasion alert: CoinDesk: Coverage & Regulation in Washington D.C. on September tenth. The agenda consists of senior officers from the SEC, Treasury, Home, Senate and OCC, plus non-public roundtables and unparalleled networking alternatives. Use code COINDESK15 to save lots of 15% in your registration. http://go.coindesk.com/4oV08AA.

1. Realized cap: measuring new capital inflows

Realized cap tracks the web USD-denominated capital invested in a token, reflecting the cumulative value foundation of all holders. Because the cycle low in November 2022, ETH has absorbed over $81 billion in recent capital inflows, pushing its realized cap to a brand new all-time excessive of $266 billion as of August eighth, 2025.

For context, this represents a 43% improve for ETH over the interval — substantial, however nonetheless effectively under bitcoin’s 136% rise in realized cap. The slower progress price means that whereas ETH has been attracting significant new funding, there should be ample room for enlargement as institutional curiosity accelerates.

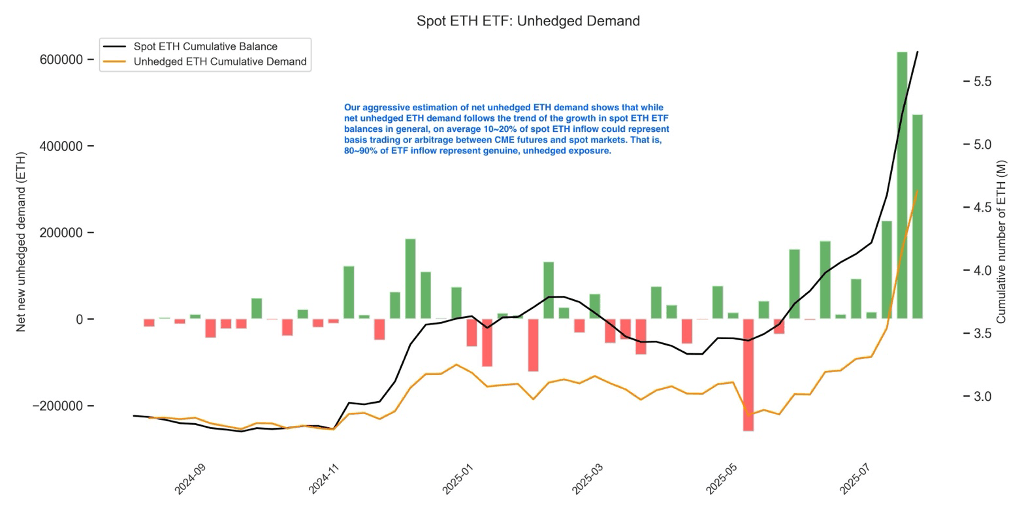

2. Unhedged spot ETH ETF demand: monitoring institutional allocation

In our bitcoin research, we developed a way to estimate real institutional demand by isolating ETF inflows not tied to hedged arbitrage trades. Making use of this framework to ETH reveals that 80–90% of spot ETH ETF inflows are possible real institutional allocations, with the rest pushed by arbitrage methods — lengthy spot positions hedged by way of CME futures to seize value differentials.

Curiously, the proportion of arbitrage-related flows is way increased for ETH than bitcoin, the place solely round 3% of spot ether ETF inflows are estimated to be arbitrage-based. This highlights that institutional allocation to ETH nonetheless lags behind BTC, although we count on this hole to shut step by step with the current inflow of institutional curiosity within the cryptocurrency.

Knowledge supply: Avenir, CFTC, Glassnode

3. Futures and choices open curiosity: gauging derivatives progress

As of July twenty first, mixed open curiosity (OI) in ETH futures and choices stood at $71 billion. Nonetheless, in contrast to bitcoin — the place OI in perpetual futures and choices is sort of balanced — ETH choices OI stays lower than half of perpetual futures OI.

On condition that choices are extra usually utilized by skilled merchants and establishments, this imbalance signifies that institutional derivatives participation in ETH nonetheless has vital room to develop.

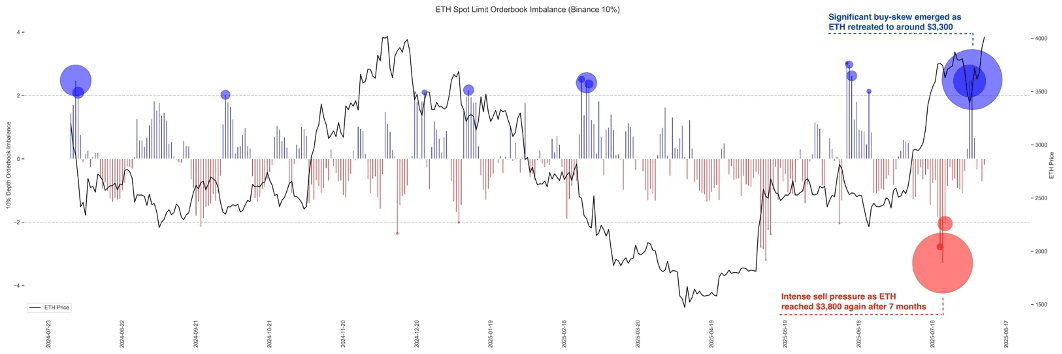

4. Restrict order e book imbalance: studying market sentiment

Order e book evaluation reveals notable sentiment shifts. When ETH regained $3,800 in July after 7 months, a robust sell-side skew emerged on the restrict order books (LOB), suggesting intense, long-awaited profit-taking. However as the worth retraced towards $3,300, buy-side depth elevated considerably, signaling “buy-the-dip” conduct at that degree. Since then, the order e book has proven a extra balanced supply-demand profile, suggesting no excessive positioning from the market at current.

Knowledge supply: Avenir, Binance

5. Digital asset treasuries (DATs): rising structural consumers of ETH

A brand new and more and more necessary supply of demand for ETH comes from DATs — firms that diversify into ETH by holding it on their stability sheets. For instance, Bitmine and Sharplink are two of probably the most notable representatives of this pattern.

Since April, DATs have amassed roughly 4.1 million ETH ($17.6 billion), representing about 3.4% of the circulating provide; Bitmine alone accounts for 1.3%. For context, U.S. spot ETH ETFs at the moment maintain 5.4% of ETH complete provide. This highlights the dimensions of those structural allocations from DATs.

What units DAT flows aside is their long-duration nature. Not like futures merchants or ETF arbitrage inflows, treasury allocations are much less prone to rotate capital ceaselessly, making them a supply of sticky structural demand.

Conclusion

Throughout on-chain and off-chain liquidity metrics, one theme is obvious: ETH’s institutional participation remains to be within the early levels in comparison with bitcoin. Realized cap progress, ETF influx composition and derivatives market construction all level to vital untapped potential.

On the similar time, DAT allocations have gotten a robust driver of sustained ETH flows, very similar to how company stability sheet methods comparable to Technique created a brand new structural demand channel that helped gasoline bitcoin’s rally in late 2024.

If institutional adoption of ETH follows a trajectory just like bitcoin’s, the approaching months might see significant capital inflows, and with them, the potential for outsized efficiency.