Key factors:

-

Bitcoin merchants reveal the important thing BTC value factors for a bullish restoration.

-

The chance of a “double high” for value stays, with $102,000 on the radar ought to assist fail.

-

The Bitcoin bull market doesn’t have a lot time left — if historical past is a information.

Bitcoin (BTC) neared $113,000 after Wednesday’s Wall Avenue open as patrons sought to cement a market bounce.

BTC value outlook hinges on $112,000

Information from Cointelegraph Markets Professional and TradingView confirmed native highs of $112,646 on Bitstamp.

Now up over $3,000 from multiweek lows seen the day prior, BTC/USD continued to separate opinions over the place it would head subsequent.

“$BTC has reclaimed its EMA-100 stage,” fashionable dealer BitBull wrote in a publish on X, referring to the 100-day exponential transferring common at $110,850.

“This has been very essential for backside formation, and for now bulls are nonetheless in management. If BTC holds this stage, I would not be stunned to see a rally in the direction of $116K-$117K stage.”

Whereas sustaining a bearish bias, fellow dealer Roman, who this week referred to as time on the Bitcoin bull market completely, emphasised the significance of the $112,000 mark.

“Appears like a breakdown & bearish retest for now. If 112k assist is really misplaced, 102k assist ought to be subsequent. Additionally seems to be like a double high is confirming right here,” he informed X followers on the day.

“I count on decrease over the following few days – until we utterly regain 112k assist.”

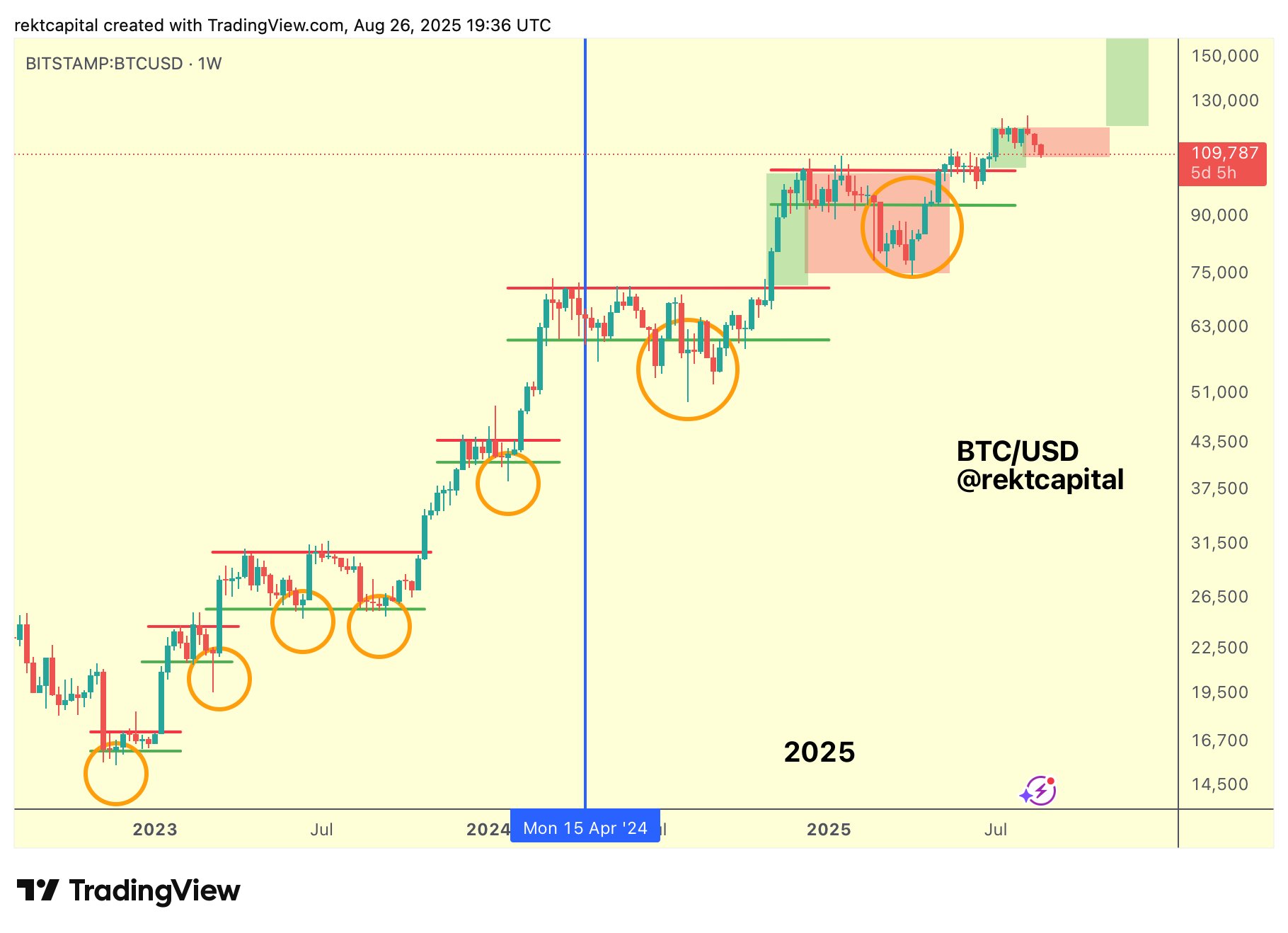

Standard dealer and analyst Rekt Capital, in the meantime, reiterated similarities between the present BTC value pullback and former bull markets.

“Historical past does not at all times repeat nevertheless it usually rhymes,” he summarized, confirming that value had entered its second “value discovery correction.”

“Bitcoin ended up rallying into new All Time Highs by Week 6 earlier than transitioning into Worth Discovery Correction 2. Historical past suggests this pullback will possible be shallower & shorter than previous ones.”

Is time operating out for the bull market?

Debate additionally centered across the longevity of the bull market, with market contributors equally torn over how lengthy it would final.

Associated: Bitcoin can nonetheless hit $160K by Christmas with ‘common’ This autumn comeback

For Rekt Capital, historical past calls for that October type the deadline for a bearish development change.

The earlier bull market lasted 152 weeks

That is ~1064 days

Nearly 3 years

We’re already 144 weeks into this Bull Market$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) August 27, 2025

This contrasts hopes that the following Bitcoin bear market continues to be years off — a view put ahead by David Bailey, the devoted Bitcoin adviser to US President Donald Trump.

“There’s not going to be one other Bitcoin bear marketplace for a number of years,” Bailey argued on X on the weekend, pointing to institutionalization of BTC as an asset.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.