Rates of interest stay the principle driver of the Foreign exchange (overseas alternate) market. Greater than another issue, it’s the selections of central banks that drive forex values.

In latest weeks, investor consideration has targeted on Jackson Gap, the place Federal Reserve (Fed) Chair Jerome Powell opened the door to a primary charge minimize in 2025 as early as September. A robust sign that’s already shaking up the US Greenback (USD) and the foremost Foreign exchange pairs.

Why rates of interest dictate Foreign exchange

The mechanisms are comparatively easy: greater rates of interest appeal to overseas capital, as they provide a extra enticing return on Bonds and deposits denominated within the forex involved.

Conversely, decrease rates of interest make the forex much less enticing. On this method, rate of interest differentials clarify why one forex strengthens or weakens in opposition to one other.

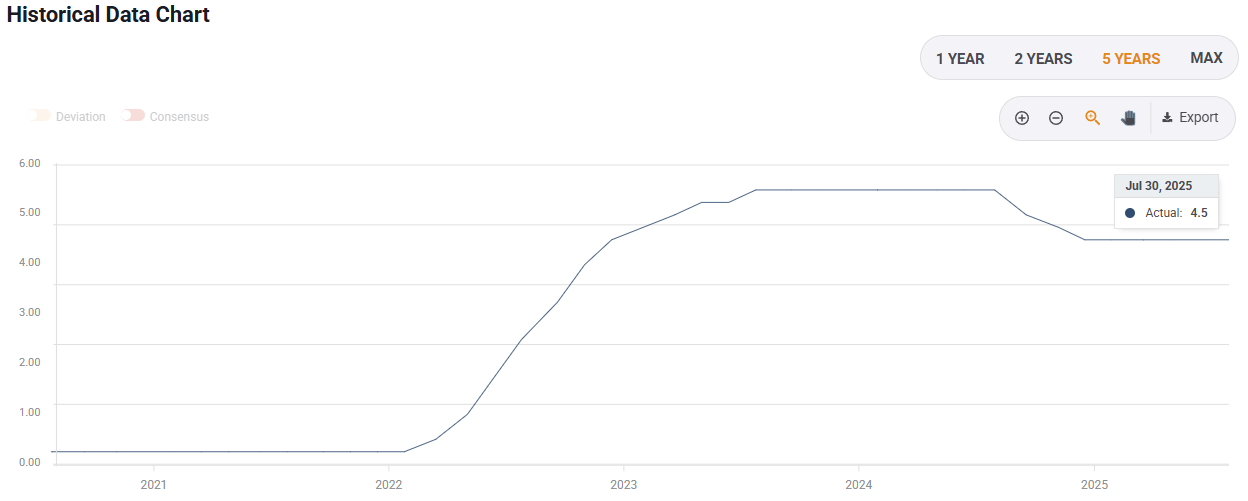

Within the case of the USA, the Fed’s charge hikes in 2022 and 2023 propelled the Buck, with the US Greenback Index (DXY) even reaching a twenty-year excessive.

However immediately, the cycle is reversing: inflation is falling, development is exhibiting indicators of fatigue, and employment, the mainstay of the US financial system, is weakening.

United States Fed rate of interest. Supply: FXStreet

Powell prepares markets for financial easing

In his Jackson Gap speech, Jerome Powell acknowledged that US financial coverage remained “restrictive” and that the steadiness of dangers was now shifting in the direction of the labor market.

He talked about the potential for an adjustment as early because the September 17 assembly, confirming the expectations of many merchants.

Markets have been fast to react. Bond yields fell, and the US Greenback retreated in opposition to the Euro (EUR) and Japanese Yen (JPY).

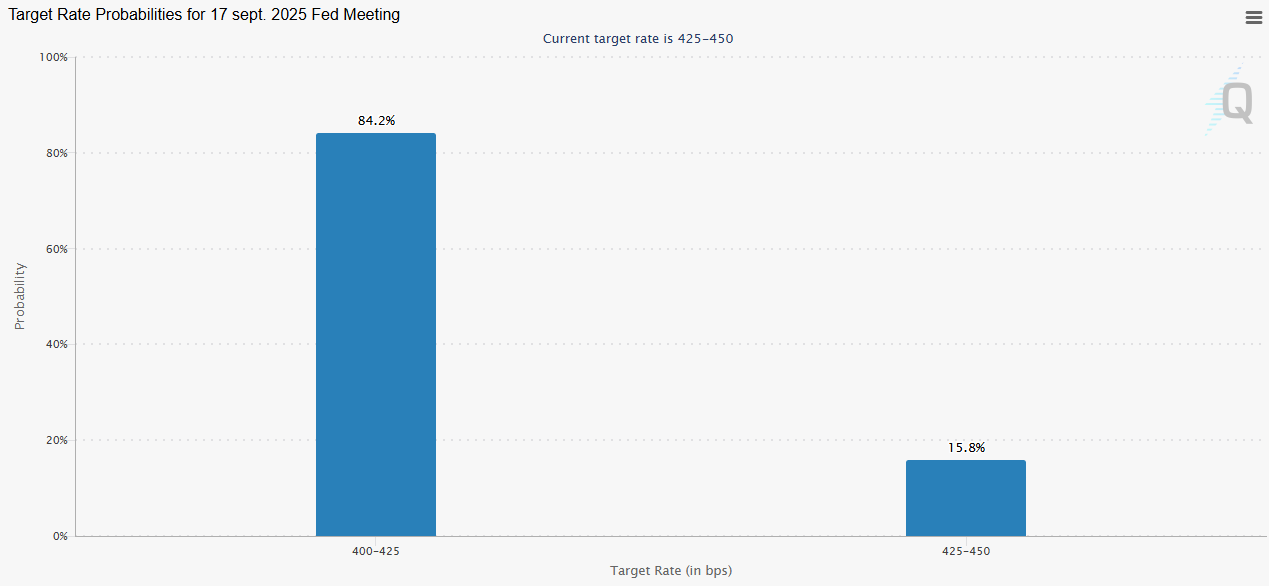

In keeping with the CME FedWatch Instrument, the likelihood of a 25 foundation level minimize in September now exceeds 84%. Buyers are even anticipating two additional rate of interest cuts between now and the tip of the 12 months.

CME FedWatch Instrument. Supply: CME Group

A direct affect on the US Greenback and Foreign exchange

In sensible phrases, a fall in US rates of interest reduces the yield differential with different currencies. If the Fed eases its coverage sooner than the European Central Financial institution (ECB) or the Financial institution of England (BoE), the Buck will lose its attraction and will weaken in opposition to the Euro or the British Pound (GBP). That is what we’ve got seen in latest weeks, with the EUR/USD again above 1.15.

EUR/USD value day by day chart. Supply: FXStreet.

However the future stays unsure. If inflation have been to rise once more, notably on account of the US President Donald Trump administration’s tariffs, the Fed might decelerate its cuts, thereby supporting the US Greenback.

Conversely, a marked weakening within the labor market would immediate Jerome Powell to speed up easing, to the detriment of the Buck.

The position of expectations

It is necessary to do not forget that in Foreign exchange, it isn’t simply the choices themselves that depend, however above all, expectations.

Foreign exchange merchants regulate their positions even earlier than the Fed declares a transfer. Thus, a speech by Powell that’s deemed “dovish” (accommodating) might instantly weaken the US Greenback, even when rates of interest stay unchanged in the interim.

Conversely, a hawkish tone might strengthen the Buck, regardless of a established order choice.

A strategic turning level for merchants

For market operators, this autumn might mark a turning level. The prospect of Federal Reserve charge cuts is reshuffling the deck, creating new alternatives for main pairs.

If the US Greenback weakens, rising currencies and people of higher-rate nations, such because the Canadian Greenback (CAD) and Australian Greenback (AUD), may gain advantage.

Past the speedy information, this sequence reminds us of a basic fact: rates of interest, by dictating international capital flows, are Foreign exchange’s number-one barometer.

For any investor, following Jerome Powell’s and the Federal Reserve’s bulletins is just not an possibility, however a necessity.