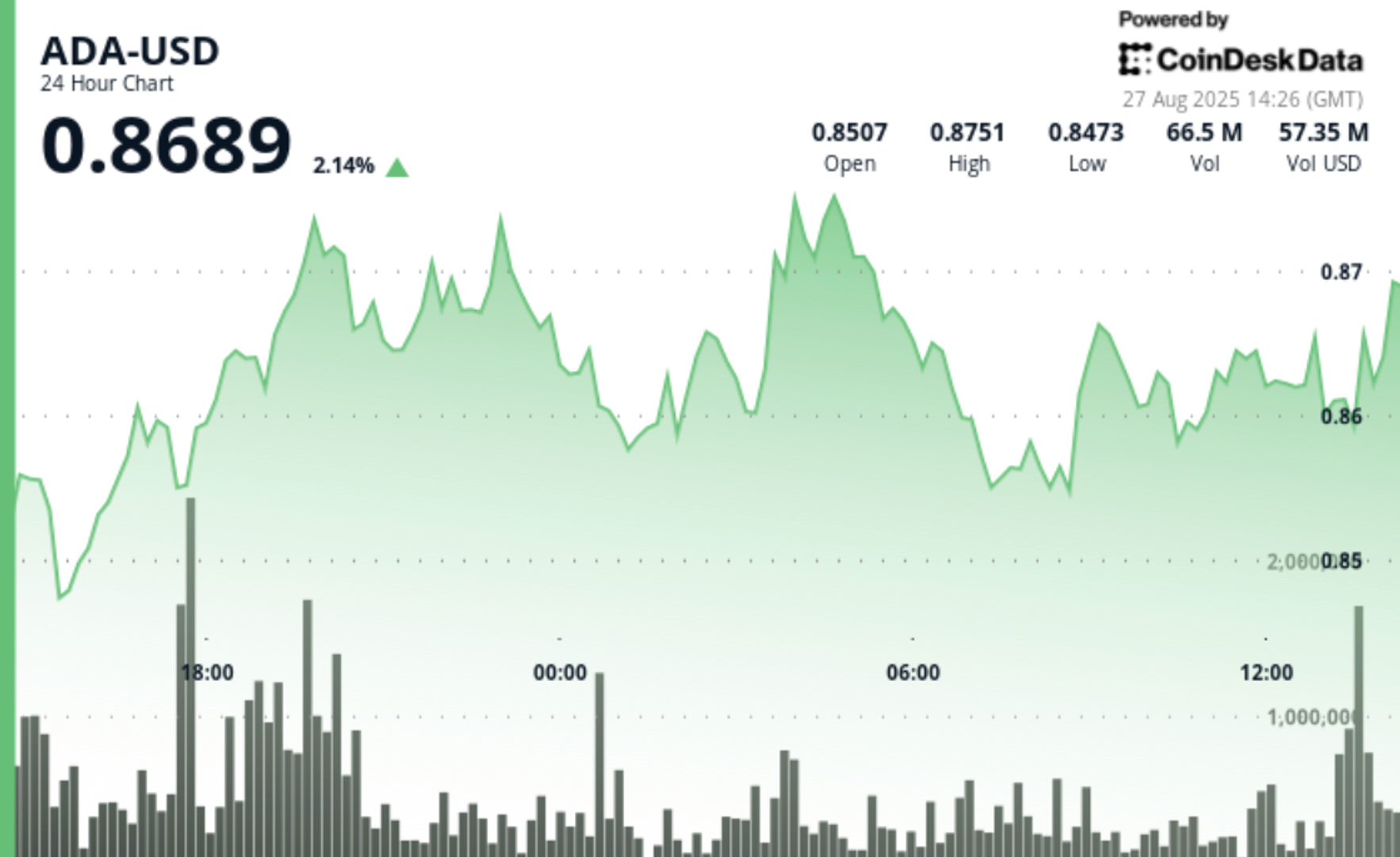

Cardano’s ADA token climbed 2% to $0.87 up to now 24 hours, echoing a broader restoration throughout crypto markets. The CoinDesk 20 Index (CD20), which tracks the biggest digital property, gained 2.8% over the identical interval.

The transfer got here as merchants weighed two main developments: rising confidence in a September rate of interest reduce by the Federal Reserve and the U.S. Securities and Change Fee’s (SEC) resolution to increase its evaluate of Grayscale’s proposed spot Cardano exchange-traded fund (ETF) till late October 2025.

ADA traded in a decent however unstable $0.04 band, swinging between a low of $0.83 and a excessive of $0.88, in line with knowledge from CoinDesk Analytics. That unfold of roughly 5% mirrored heightened exercise. At one level, the token broke sharply greater, surging from $0.84 to $0.88 on buying and selling volumes that greater than doubled the 24-hour common of 39.3 million.

After the breakout, ADA settled into consolidation. Merchants pegged resistance at $0.88, with new help forming round $0.85. Late-session motion noticed the worth stabilize at $0.86, a degree analysts say might level to institutional accumulation forward of one other potential rally.

The broader market backdrop has been uneven. Crypto property fell sharply Monday as merchants locked in earnings from a weekend surge sparked by Fed Chair Jerome Powell’s dovish remarks in Jackson Gap. These feedback fueled expectations of charge cuts, which usually help threat property like cryptocurrencies by making conventional yields much less engaging. By Tuesday, buyers appeared to deal with the pullback as a shopping for alternative, serving to altcoins rebound.

Decrease rates of interest typically act as a tailwind for the crypto sector, the place buyers hunt for greater returns in contrast with authorities debt. Traditionally, such circumstances have set the stage for “altcoin season,” durations the place smaller tokens outperform bitcoin throughout consolidation phases.

In the meantime, the SEC’s delay of Grayscale’s Cardano ETF was broadly anticipated, because the regulator has slowed practically all spot crypto ETF choices. Whereas the information briefly injected uncertainty, ADA’s resilience recommended merchants have been extra centered on broader market momentum and capital rotation from bitcoin into altcoins.