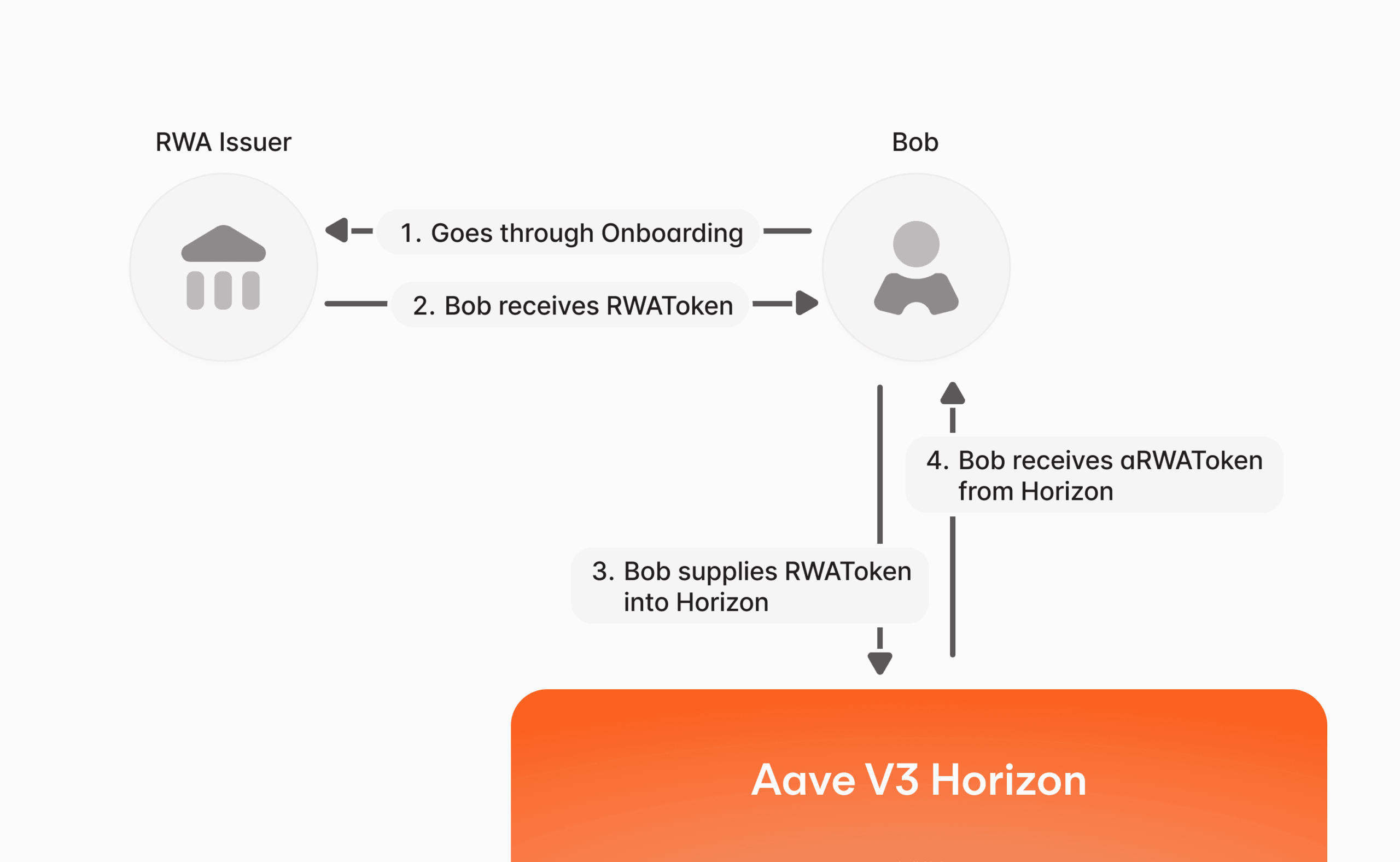

Aave Labs has launched Horizon, its new platform devoted to institutional debtors to entry stablecoins utilizing tokenized variations of real-world belongings (RWAs) like U.S. Treasuries as collateral.

At launch, establishments will be capable to borrow Circle’s USDC, Ripple’s RLUSD and Aave’s GHO in opposition to a set of tokenized belongings, together with Superstate’s short-duration U.S. Treasury and crypto carry funds, Circle’s yield fund, and Centrifuge’s tokenized Janus Henderson merchandise.

The platform goals to supply certified buyers with short-term financing on their RWA holdings and permit them to deploy yield methods.

With Horizon, first introduced in March, Aave goals to faucet into the quickly rising, $26 billion tokenized asset market and turning these belongings into usable capital for establishments. Tokenized belongings are projected to balloon right into a a number of trillion-dollar market over the following few years as main banks and asset managers more and more place conventional devices like bonds, equities, actual property on blockchain rails as a token for operational effectivity.

Nonetheless, efforts to make RWA tokens helpful within the decentralized finance (DeFi) lending markets are within the early innings, limiting their sensible use.

“Horizon delivers the infrastructure and deep stablecoin liquidity that establishments require to function on-chain, unlocking 24/7 entry, transparency and extra environment friendly markets,” Aave Labs founder Stain Kulechov stated in a press release.

The protocol runs on Aave V3, which is the most important decentralized lending protocol with greater than $66 billion in belongings on the platform, in accordance with DefiLlama information.

The platform’s setup blends permissioned and permissionless options: collateral tokens embed issuer-level compliance checks, whereas the lending swimming pools stay open and composable.

Chainlink’s oracle providers provide real-time pricing information, beginning with NAVLink, delivering web asset values of tokenized funds immediately on-chain to make sure the loans are appropriately collateralized.

Launch companions embrace a variety of asset issuers together with Ethena, OpenEden, Securitize, VanEck, Hamilton Lane and WisdomTree, with plans to broaden collateral choice to extra tokenized belongings.

Learn extra: Tokenization of Actual-World Belongings is Gaining Momentum, Says Financial institution of America