- The Canadian Greenback caught a slight bid on Tuesday, easing again into latest highs.

- Regardless of near-term positive aspects, the Loonie stays steeply off its perch in opposition to the US Greenback.

- Canadian GDP progress figures due later this week, to be overshadowed by US inflation knowledge.

The Canadian Greenback (CAD) caught a slight bid on Tuesday, gaining some floor in opposition to the softening US Greenback (USD) heading right into a quiet midweek. Questions in regards to the Federal Reserve’s (Fed) independence are using on the excessive aspect as President Donald Trump makes an attempt to oust extra Fed Board of Governors members in his quest for arbitrarily decrease rates of interest.

Canadian financial knowledge stays restricted this week. Canadian Gross Home Product (GDP) progress figures are due on Friday, however will likely be overshadowed by the newest US Private Consumption Expenditures Worth Index (PCE) inflation knowledge.

Each day digest market movers: all quiet on the Northern entrance

- The Canadian Greenback discovered some headroom in opposition to the US Greenback.

- Amid a quiet backdrop of skinny financial knowledge, US President Donald Trump’s makes an attempt to “fireplace” Fed Board member Dr. Lisa Cook dinner will likely be heading for a authorized conflict.

- The US President making an attempt to immediately undermine the Fed’s political independence could have markets on edge, and watching intently.

- US Sturdy Items Orders fell lower than anticipated in July.

- Canadian GDP progress is anticipated to contract on an annualized foundation throughout Q2.

Canadian Greenback worth forecast

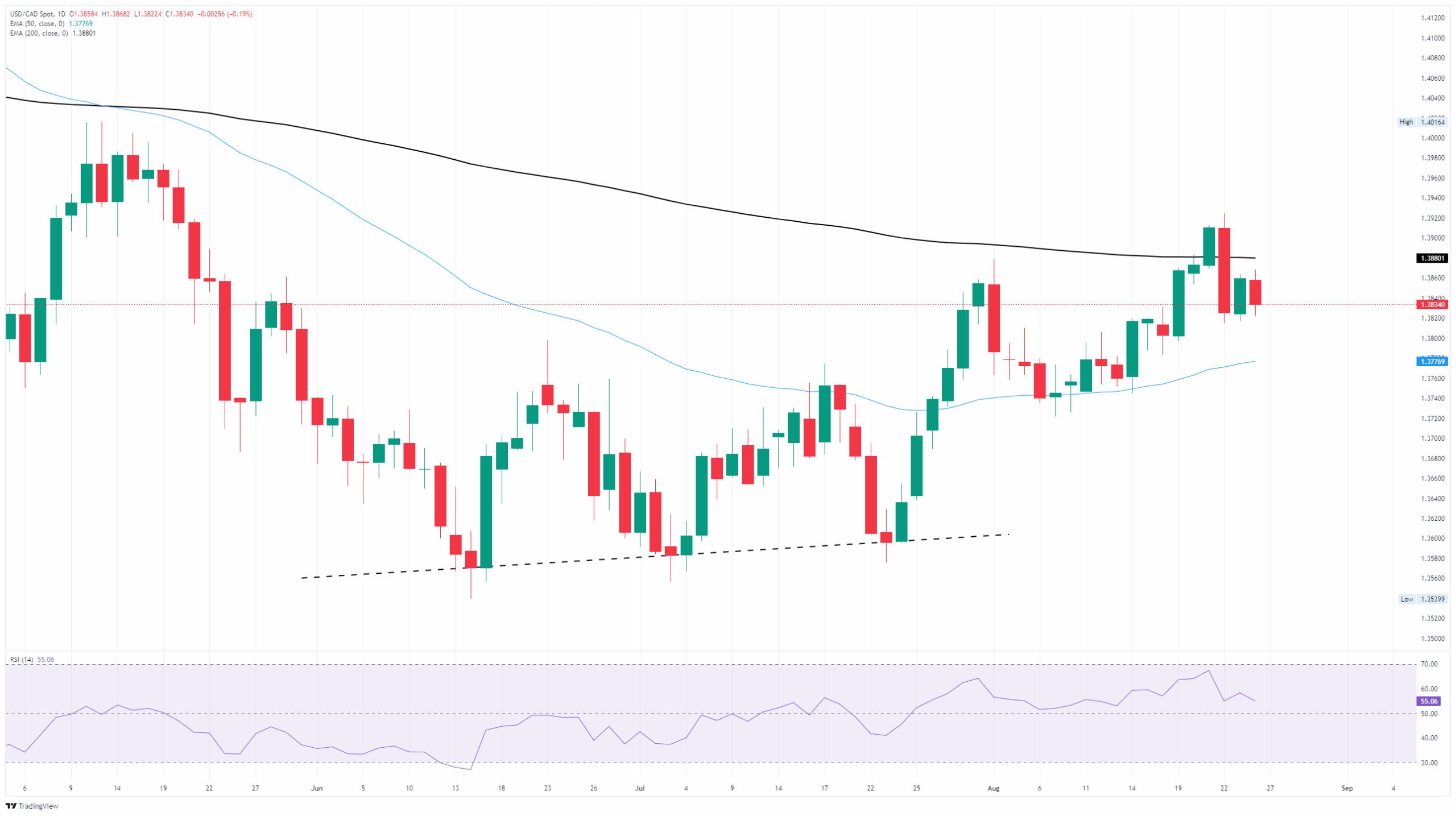

A normal lack of momentum is plaguing the USD/CAD pair. The CAD’s restricted positive aspects on Tuesday have pushed the pair again under the 1.3850 degree, with a stiff technical ceiling priced in on the 200-day Exponential Transferring Common (EMA) close to 1.3880.

Regardless of a near-term resurgence in CAD power (or Buck weak spot), the USD/CAD continues to be sharply up from July’s lows close to 1.3600. The Loonie’s notably lack of latest power has given the Buck a much-needed leg up, and the pair is battling into a brand new higher-lows sample on the each day candlesticks.

USD/CAD each day chart

Canadian Greenback FAQs

The important thing elements driving the Canadian Greenback (CAD) are the extent of rates of interest set by the Financial institution of Canada (BoC), the worth of Oil, Canada’s largest export, the well being of its financial system, inflation and the Commerce Stability, which is the distinction between the worth of Canada’s exports versus its imports. Different elements embrace market sentiment – whether or not traders are taking over extra dangerous belongings (risk-on) or looking for safe-havens (risk-off) – with risk-on being CAD-positive. As its largest buying and selling accomplice, the well being of the US financial system can be a key issue influencing the Canadian Greenback.

The Financial institution of Canada (BoC) has a big affect on the Canadian Greenback by setting the extent of rates of interest that banks can lend to at least one one other. This influences the extent of rates of interest for everybody. The principle purpose of the BoC is to take care of inflation at 1-3% by adjusting rates of interest up or down. Comparatively larger rates of interest are usually constructive for the CAD. The Financial institution of Canada may use quantitative easing and tightening to affect credit score situations, with the previous CAD-negative and the latter CAD-positive.

The worth of Oil is a key issue impacting the worth of the Canadian Greenback. Petroleum is Canada’s largest export, so Oil worth tends to have a direct impression on the CAD worth. Typically, if Oil worth rises CAD additionally goes up, as mixture demand for the foreign money will increase. The alternative is the case if the worth of Oil falls. Greater Oil costs additionally are likely to lead to a larger chance of a constructive Commerce Stability, which can be supportive of the CAD.

Whereas inflation had all the time historically been considered a damaging issue for a foreign money because it lowers the worth of cash, the alternative has really been the case in trendy instances with the comfort of cross-border capital controls. Greater inflation tends to steer central banks to place up rates of interest which attracts extra capital inflows from world traders looking for a profitable place to maintain their cash. This will increase demand for the native foreign money, which in Canada’s case is the Canadian Greenback.

Macroeconomic knowledge releases gauge the well being of the financial system and might have an effect on the Canadian Greenback. Indicators akin to GDP, Manufacturing and Providers PMIs, employment, and client sentiment surveys can all affect the path of the CAD. A robust financial system is nice for the Canadian Greenback. Not solely does it appeal to extra overseas funding however it could encourage the Financial institution of Canada to place up rates of interest, resulting in a stronger foreign money. If financial knowledge is weak, nevertheless, the CAD is prone to fall.