- The Dow Jones caught near the center on Tuesday, holding above 45,000.

- US Sturdy Items Orders hit markets with out a lot as a splash.

- The most recent spherical of key US inflation information looms massive later this week.

The Dow Jones Industrial Common (DJIA) spun a decent circle on Tuesday, holding regular close to acquainted ranges as buyers await significant information or information headlines to get the machine chugging once more. World markets are bracing for the newest spherical of US Private Consumption Expenditures Worth Index (PCE) inflation due later this week. Federal Reserve (Fed) rate of interest reduce expectations will hinge on whether or not the Fed will proceed to focus extra on slumping jobs information.

Trump makes an attempt to fireplace Fed officers

US President Donald Trump tried to declare Fed Board of Governors member Dr. Lisa Prepare dinner “fired” on Monday night, and buyers are watching from the sidelines to see how issues progress. Donald Trump’s declare of with the ability to hearth Fed members for trigger beneath a century-old modification, and whether or not that trigger applies to defective tax filings, are sure to face a steep authorized battle shifting ahead.

Satan’s within the particulars

US Sturdy Items Orders declined in July, printing at -2.8%, however the determine nonetheless represents a bigger rebound from the earlier month’s -9.4% than analysts anticipated. The US Census Bureau famous that, excluding transportation, new orders truly rose by 1.1%. Nevertheless, excluding protection spending, new orders nonetheless decreased by 2.5%. The important thing missed datapoint in Tuesday’s Sturdy Items Orders information was funding in transportation gear, which declined 9.7%, extending into a 3rd month-to-month decline over a four-month interval.

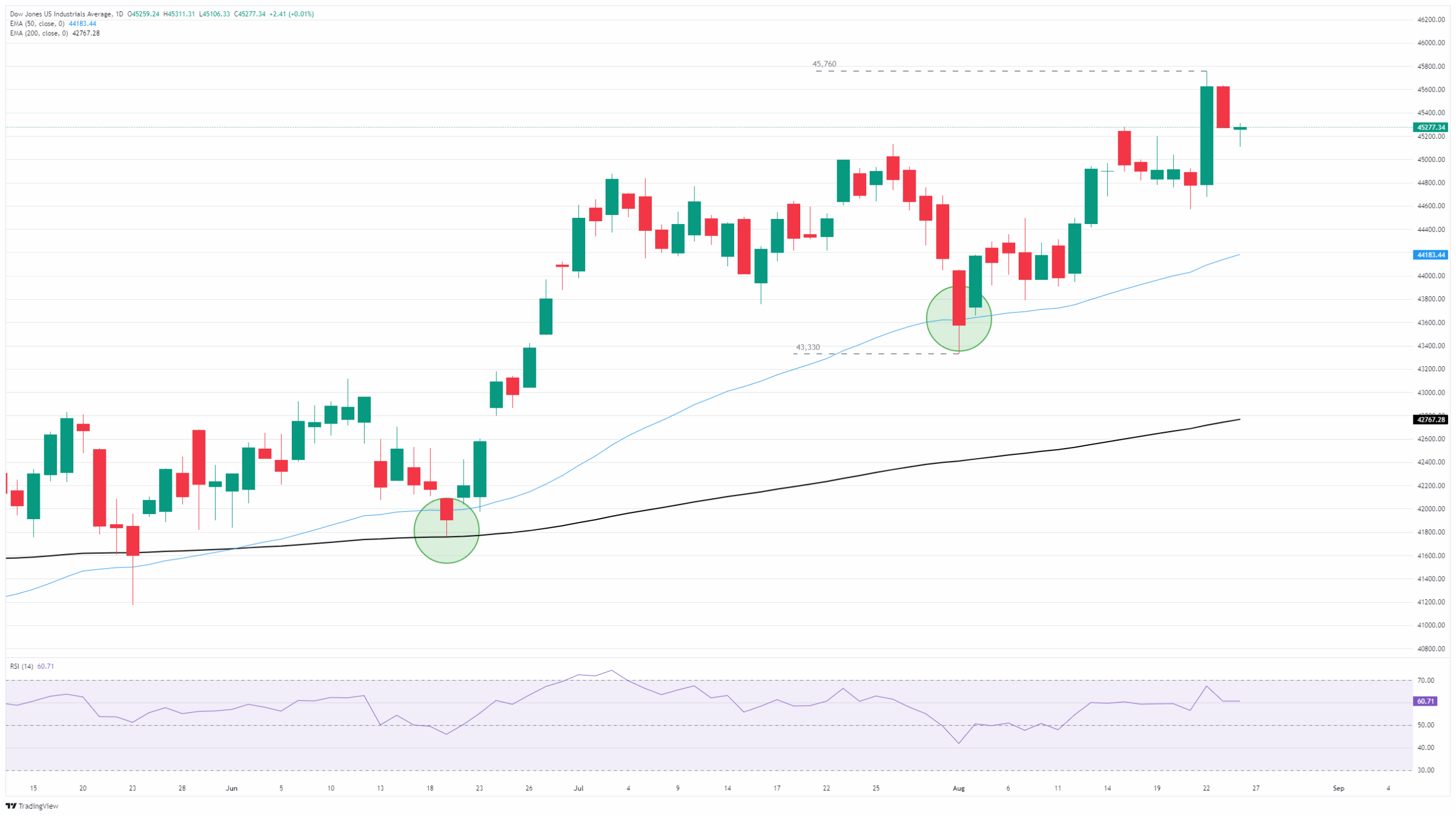

Dow Jones every day chart

Dow Jones FAQs

The Dow Jones Industrial Common, one of many oldest inventory market indices on the earth, is compiled of the 30 most traded shares within the US. The index is price-weighted moderately than weighted by capitalization. It’s calculated by summing the costs of the constituent shares and dividing them by an element, at present 0.152. The index was based by Charles Dow, who additionally based the Wall Road Journal. In later years it has been criticized for not being broadly consultant sufficient as a result of it solely tracks 30 conglomerates, not like broader indices such because the S&P 500.

Many alternative elements drive the Dow Jones Industrial Common (DJIA). The combination efficiency of the element corporations revealed in quarterly firm earnings experiences is the principle one. US and international macroeconomic information additionally contributes because it impacts on investor sentiment. The extent of rates of interest, set by the Federal Reserve (Fed), additionally influences the DJIA because it impacts the price of credit score, on which many firms are closely reliant. Due to this fact, inflation is usually a main driver in addition to different metrics which influence the Fed choices.

Dow Idea is a technique for figuring out the first pattern of the inventory market developed by Charles Dow. A key step is to match the course of the Dow Jones Industrial Common (DJIA) and the Dow Jones Transportation Common (DJTA) and solely observe traits the place each are shifting in the identical course. Quantity is a confirmatory standards. The idea makes use of components of peak and trough evaluation. Dow’s principle posits three pattern phases: accumulation, when good cash begins shopping for or promoting; public participation, when the broader public joins in; and distribution, when the good cash exits.

There are a variety of the way to commerce the DJIA. One is to make use of ETFs which permit buyers to commerce the DJIA as a single safety, moderately than having to purchase shares in all 30 constituent corporations. A number one instance is the SPDR Dow Jones Industrial Common ETF (DIA). DJIA futures contracts allow merchants to take a position on the longer term worth of the index and Choices present the fitting, however not the duty, to purchase or promote the index at a predetermined worth sooner or later. Mutual funds allow buyers to purchase a share of a diversified portfolio of DJIA shares thus offering publicity to the general index.