Google Cloud is transferring ahead with plans to launch its personal layer-1 (L1) blockchain, positioning the community as impartial infrastructure for world finance at a time when fintech opponents are growing out their very own distributed ledgers.

In a LinkedIn put up printed Tuesday, Wealthy Widmann, Google’s head of Web3 technique, supplied recent particulars on the undertaking, often called the Google Cloud Common Ledger (GCUL). He described the platform as a credibly impartial, high-performance blockchain designed for establishments, supporting Python-based sensible contracts to make it extra accessible to builders and monetary engineers.

“Any monetary establishment can construct with GCUL,” Widmann stated, arguing that whereas firms like Tether could also be unlikely to undertake Circle’s blockchain and fee companies like Adyen could hesitate to make use of Stripe’s, Google’s impartial infrastructure removes these limitations.

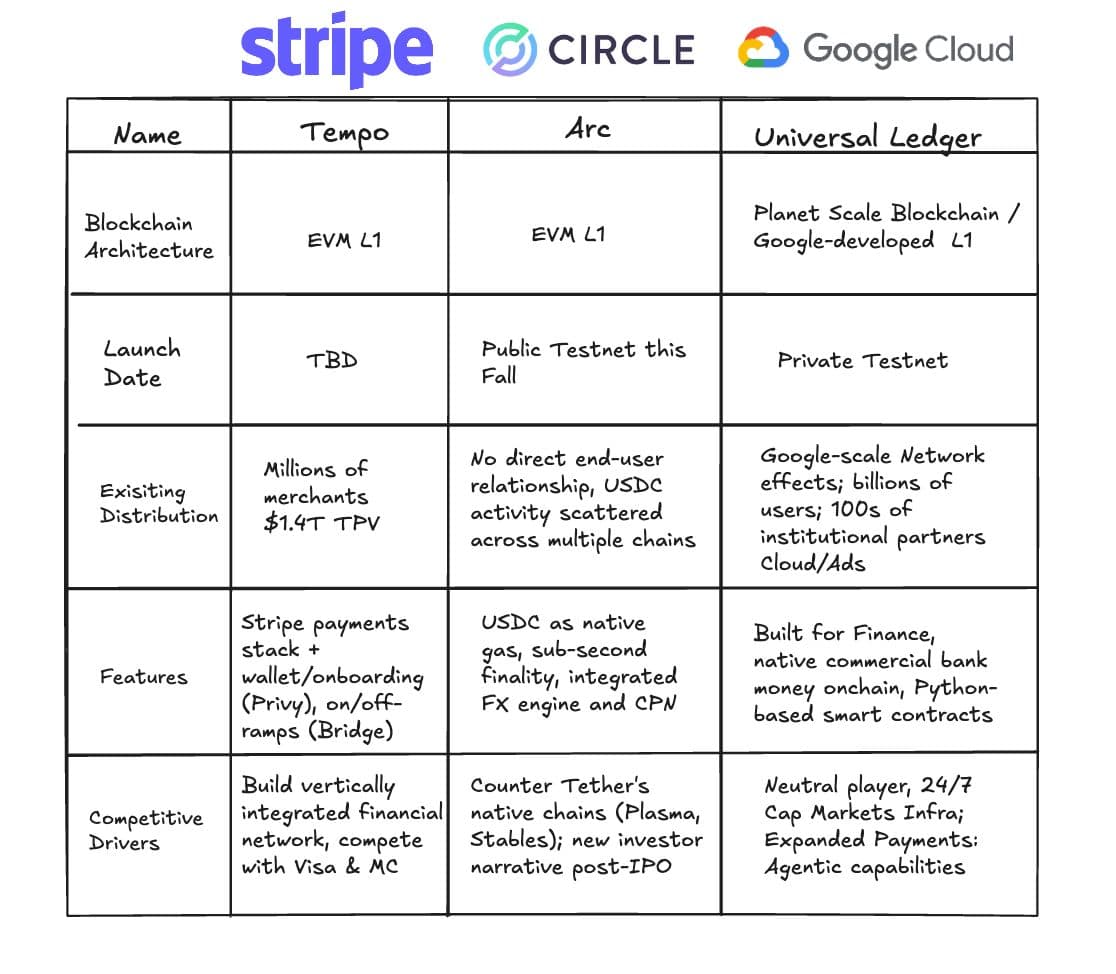

He additionally expanded on a comparative chart by fintech strategist Chuk Okpalugo, highlighting how GCUL differs from Stripe’s Tempo and Circle’s Arc, two different high-profile L1 efforts.

In setting out Google’s case for the Common Ledger, Widmann drew contrasts with different high-profile entrants.

Stripe’s undertaking, Tempo, is rooted in its funds empire, successfully extending the corporate’s current service provider rails right into a vertically coffntrolled chain. Circle’s Arc, in contrast, locations its stablecoin on the heart of the system, treating USDC because the protocol’s native gasoline and promising lightning-fast settlement with built-in forex trade.

Google’s method is totally different nonetheless: the Common Ledger is designed as a shared infrastructure layer, meant to be credibly impartial and accessible to any establishment relatively than certain to a single funds ecosystem.

Timelines additionally set the initiatives aside. Circle has already begun piloting Arc, whereas Stripe is concentrating on a launch subsequent yr. Google and CME, in the meantime, have accomplished an preliminary integration of GCUL, with broader testing to comply with later this yr and full providers anticipated in 2026.

The distribution story reinforces these distinctions. Stripe can lean on greater than a trillion {dollars} in annual service provider fee flows. Circle can depend on USDC’s world footprint and liquidity integrations. Google brings the attain of its cloud platform, together with the promise of scaling a ledger that may help billions of customers and lots of of establishments.

Options additional differentiate the chains. Arc’s focus is pace and seamless international trade, Tempo’s is service provider integration, and GCUL’s is programmability by way of Python-based sensible contracts and institutional-grade tokenization.

The consequence, Widmann argued, is divergent positioning. Stripe’s and Circle’s ledgers could serve their very own ecosystems nicely however threat deterring opponents, whereas Google is pitching GCUL as impartial floor — a ledger that anybody, from exchanges to fee suppliers, can use with out concern of strengthening a rival.

The institutional-first positioning shouldn’t be new.

In March, Google Cloud and CME Group collectively introduced GCUL, unveiling it as a programmable distributed ledger tailor-made for wholesale funds and asset tokenization.

CME Group stated it had already accomplished the primary section of integration and testing, describing the know-how as a possible breakthrough for collateral, settlement, and charge funds in markets which might be more and more transferring towards 24/7 buying and selling.

“Because the President and new Administration have inspired Congress to create landmark laws for commonsense market construction, we’re happy to associate with Google Cloud to allow progressive options for low-cost, digital switch of worth,” CME Chairman and CEO Terry Duffy stated on the time. He instructed GCUL might ship significant efficiencies throughout core market features, together with margin and collateral administration.

In response to the March announcement, CME and Google plan to start direct testing with market contributors later this yr, with a watch to launching providers in 2026. Widmann’s Aug. 26 remarks add new element to that roadmap, reinforcing GCUL’s function as infrastructure designed to be broadly adopted throughout the monetary sector relatively than managed by a single funds firm.

By positioning GCUL towards Stripe’s Tempo and Circle’s Arc, Google is signaling that competitors amongst main know-how companies to outline the subsequent technology of monetary settlement rails is accelerating.

Technical particulars on GCUL’s structure stay restricted, although Widmann stated extra can be launched within the coming months. For now, Google is presenting the Common Ledger as a basis for global-scale funds, institutional tokenization and around-the-clock capital markets infrastructure.

Learn Extra: Why Circle and Stripe (And Many Others) Are Launching Their Personal Blockchains