Key factors:

-

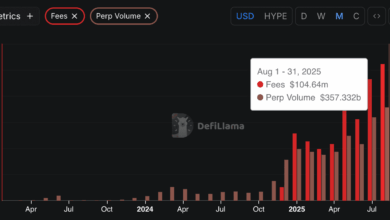

Bitcoin can reverse its newest hunch to hit new all-time highs within the subsequent 4 months, primarily based on historic efficiency.

-

Analysis says that the outlook for Bitcoin between now and Christmas is “constructive but much less risky.”

-

The present dip could also be “frontrunning” conventional September BTC value draw back.

Bitcoin (BTC) faces common positive factors of 44% by Christmas as analysts play down the influence of a deeper BTC value correction.

Analysis from community economist Timothy Peterson, launched on X this week, predicts “constructive” efficiency for BTC/USD in This autumn.

Bitcoin evaluation performs with $160,000 goal

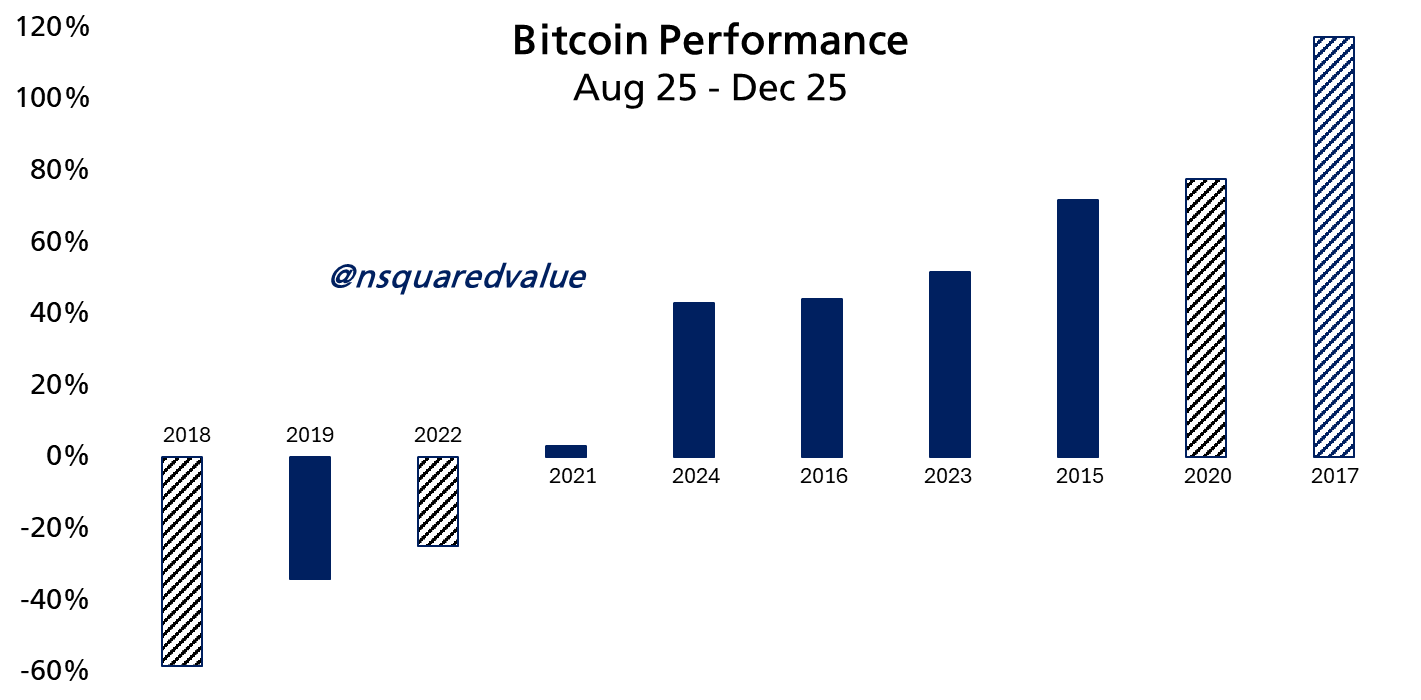

Bitcoin historically sees its weakest positive factors in September, a month that BTC/USD has by no means completed greater than 8% larger.

Regardless of that, Peterson, who usually compares efficiency over a number of bull markets, stays optimistic.

“Precisely 4 Months Till Christmas. How does Bitcoin fare throughout this time? Up 70% of the time. Common achieve +44%,” he summarized.

That common upside would put Bitcoin at $160,000 by the final week of 2025, knowledge from Cointelegraph Markets Professional and TradingView confirms.

Peterson acknowledges that such expectations are extra a suggestion than a rule, with numerous nonconformant years over Bitcoin’s lifetime.

“Nevertheless, I believe some years do not need market/financial situations akin to 2025. I might exclude 2018, 2022, 2020, and 2017 as uncharacteristic years,” he concluded.

“This skews the end result to favoring constructive but much less risky efficiency.”

Bitcoin “frontrunning” normal September blues

Elsewhere, others are unfazed by the present BTC value weak spot, which has seen the bottom ranges since early July return this week.

Associated: Bitcoin Q2 dip similarities ‘uncanny’ as Coinbase Premium flips inexperienced

Widespread dealer Donny instructed X followers that BTC/USD is “frontrunning” conventional September draw back.

“The dimensions is completely different — however the end result is similar. A lot larger,” he forecast whereas evaluating value motion to the 2017 bull market.

Donny added that he noticed BTC/USD copying gold after a interval of lag — a basic relationship that has continued to play out in recent times.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.