By James Van Straten (All occasions ET except indicated in any other case)

As August attracts towards an in depth, bitcoin bulls might welcome the tip of a modest pullback, with the biggest cryptocurrency down round 4% for the month and 12% off its all-time excessive of $124,500.

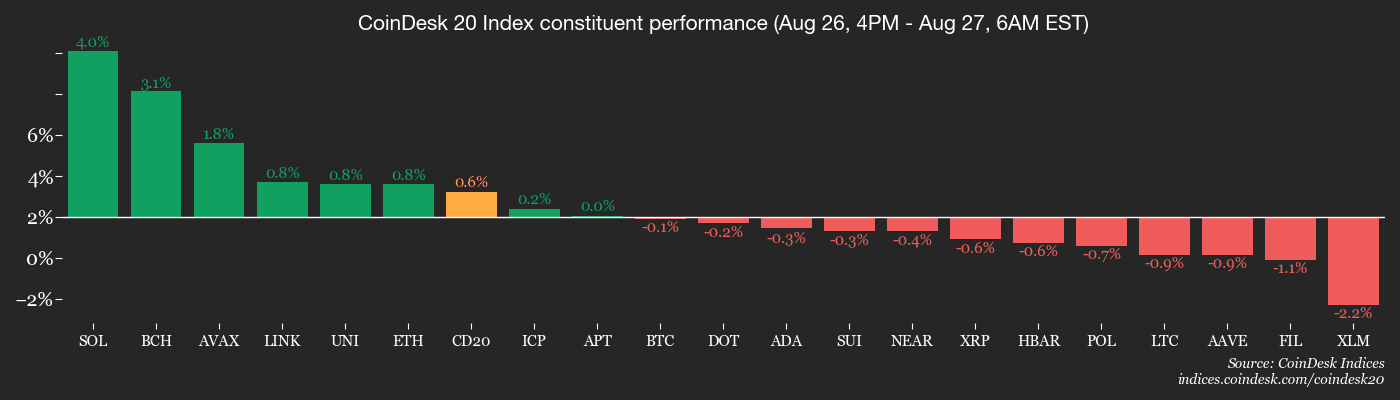

For now, it is little modified round $110,580, up lower than 0.5% over 24 hours whereas ether (ETH) has added 3.4%. The CoinDesk 20 index, a measure of the broader market, rose 2.7% in the identical interval.

A unfavorable finish to August would halt a streak of 4 consecutive inexperienced months, the longest run since March final yr. Encouragingly, August has held up higher than previously three years, and September ought to deliver a pickup in buying and selling exercise as the vacation season winds down.

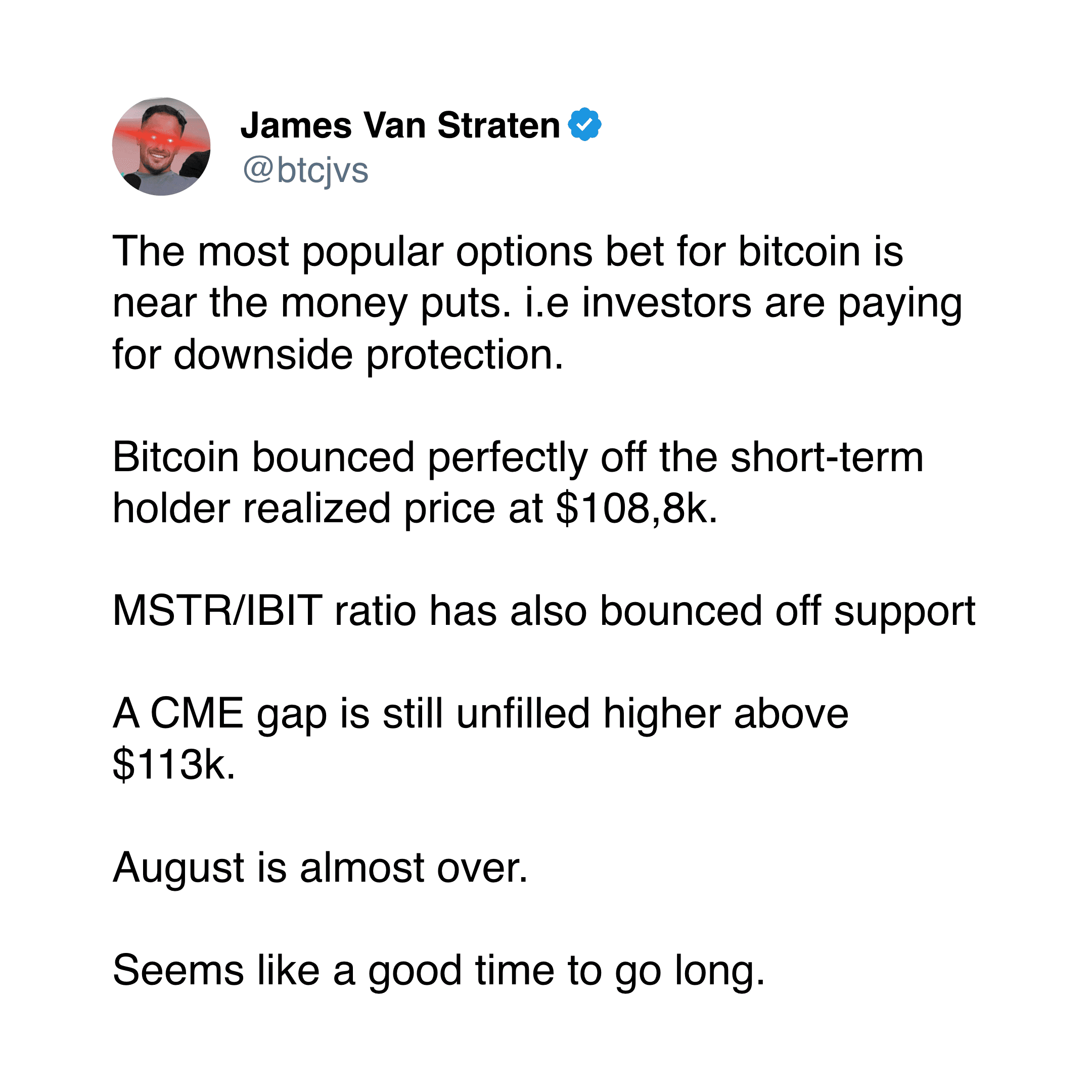

On-chain information reveals bitcoin merchants used the Quick-Time period Holder Realized Worth (STH-RP), at the moment $108,800, as assist. This metric tracks the common acquisition worth of cash moved on-chain previously 155 days and excludes alternate reserves. In bull markets, the STH RP usually acts as a key assist stage.

The Quick-Time period Holder Spent Output Revenue Ratio (STH-SOPR), which measures earnings or losses on cash youthful than 155 days, signifies that short-term traders are at the moment promoting at a loss. Traditionally, this habits tends to seem close to native market bottoms. However capitulation has but to be seen.

In the meantime, the choices market factors to a “max ache” stage at $116,000. Max ache is the strike worth at which the biggest variety of choices expire nugatory, typically inflicting the best monetary ache to choice holders and best profit to choices sellers. With this stage above the spot worth, it suggests upside aid might be on the horizon.

Past crypto, U.S. commerce tensions escalated once more as Washington imposed 50% tariffs on India, doubling earlier duties after talks broke down. The transfer, geared toward curbing India’s purchases of Russian oil, highlights strained ties between President Donald Trump and Indian Prime Minister Narendra Modi. Analysts warn of falling exports, job losses and a possible 1% drag on GDP progress.

For bitcoin merchants, the important thing vary to look at is $113,500 to $117,200, the place the CME futures hole stays open. Traditionally, such gaps are usually crammed, making this zone one to watch intently. Keep alert.

What to Watch

- Crypto

- Aug. 27, 3 a.m.: Mantle Community (MNT), an Ethereum layer-2 blockchain, will roll out its mainnet improve to model 1.3.1, enabling assist for Ethereum’s Prague replace and introducing new options for platform customers and builders.

- Macro

- Aug. 28, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases July unemployment charge information.

- Unemployment Fee Est. 2.9% vs. Prev. 2.7%

- Aug. 28, 8:30 a.m.: The U.S. Bureau of Financial Evaluation (BEA) releases (2nd Estimate) Q2 GDP information.

- Core PCE Costs QoQ st. 2.6% vs. Prev. 3.5%

- GDP Development Fee QoQ Est. 3.1% vs. Prev. -0.5%

- GDP Worth Index QoQ Est. 2% vs. Prev. 3.8%

- GDP Gross sales QoQEst. 6.3% vs. Prev. -3.1%

- PCE Costs QoQ Est. 2.1% vs. Prev. 3.7%

- Actual Shopper Spending QoQ Est. 1.4% vs. Prev. 0.5%

- Aug. 28, 1:30 p.m.: Uruguay’s Nationwide Statistics Institute releases July unemployment charge information.

- Unemployment Fee Prev. 7.3%

- Aug. 28, 6:00 p.m.: Fed Governor Christopher J. Waller will communicate on “Funds” on the Financial Membership of Miami Dinner, Miami, Fla. Watch reside.

- Aug. 29, 8:30 a.m.: Statistics Canada releases Q2 GDP information.

- GDP Development Fee Annualized Est. -0.6% vs. Prev. 2.2%

- GDP Development Fee QoQ Prev. 0.5%

- Aug. 29, 8:30 a.m.: The U.S. Bureau of Financial Evaluation (BEA) releases July shopper earnings and expenditure information.

- Core PCE Worth Index MoM Est. 0.3% vs. Prev. 0.3%

- Core PCE Worth Index YoY Est. 2.9% vs. Prev. 2.8%

- PCE Worth Index MoM Est. 0.2% vs. Prev. 0.3%

- PCE Worth Index YoY Est. 2.6% vs. Prev. 2.6%

- Private Revenue MoM Est. 0.4% vs. Prev. 0.3%

- Private Spending MoM Est. 0.5% vs. Prev. 0.3%

- Aug. 29, 11 a.m.: Colombia’s Nationwide Administrative Division of Statistics (DANE) releases July unemployment charge information.

- Unemployment Fee Est. 8.9% vs. Prev. 8.6%

- Aug. 28, 8 a.m.: Mexico’s Nationwide Institute of Statistics and Geography releases July unemployment charge information.

- Earnings (Estimates based mostly on FactSet information)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Occasions

- Governance votes & calls

- Unlocks

- Aug. 28: Jupiter to unlock 1.78% of its circulating provide price $26.36 million.

- Sep. 1: Sui to launch 1.25% of its circulating provide price $153.1 million.

- Sep. 2: Ethena to launch 0.64% of its circulating provide price $25.64 million.

- Sep. 5: Immutable (IMX) to unlock 1.27% of its circulating provide price $13.26 million.

- Token Launches

- Aug. 27: Bitlayer (BTR) to listing on Kraken, KuCoin and LBank

- Aug. 27: sBTC (SBTC) to listing on Moso.

Conferences

The CoinDesk Coverage & Regulation convention (previously referred to as State of Crypto) is a one-day boutique occasion held in Washington on Sept. 10 that permits basic counsels, compliance officers and regulatory executives to fulfill with public officers answerable for crypto laws and regulatory oversight. Area is restricted. Use code CDB15 for 15% off your registration via Sept. 1.

Token Speak

By Oliver Knight

- Cronos defied Tuesday’s bearish crypto sentiment, rallying greater than 56% after Crypto.com and Trump Media (DJT) stated they deliberate to create a $6.4 billion CRO treasury firm.

- Crypto treasury bulletins have occurred virtually day by day over the previous month as firms start to undertake and adapt the strategy pioneered by Michael Saylor’s Technique (MSTR).

- Nonetheless, the value motion usually fails to match what may be perceived as a bullish occasion. When Verb Know-how Co. (VERB) introduced a $558 million non-public placement to determine a toncoin treasury, TON virtually instantly fell by round 10%.

- This CRO deal is completely different. Firstly it’s tied to Trump Media, an organization linked to President Donald Trump, however secondly — and arguably extra importantly — it offers a use case to the cronos token that was beforehand used predominately as an alternate token for Crypto.com.

- The deal consists of the creation of a brand new rewards system on Fact Social that can permit customers to transform the platform’s “gems” into CRO tokens, with additional plans to allow subscription funds and discounted companies utilizing CRO.

- Bloomberg famous that Crypto.com CEO Kris Marszalek donated $1 million to Trump’s inaugural committee and likewise visited Trump’s Mar-a-Lago residence after the election victory.

- CRO at the moment trades at $0.225 regardless of being down at $0.141 final week, the information lifted 24 hour buying and selling quantity up by 1,300% to greater than $1 billion because it turned a market outlier whereas bitcoin and ether languished close to vital ranges of assist.

Derivatives Positioning

- Bitcoin open curiosity (OI) throughout prime derivatives venues has began to slide, which is consistent with the downward worth motion over the previous few days, implying merchants are actively exiting their leveraged positions.

- BTC OI now stands at $30.3 billion, simply shy of the all time excessive at $32.6 billion, Velo information reveals. Three-month annualized foundation remains to be rising, and is at the moment 8%- 9% throughout all exchanges, implying that the premise commerce remains to be worthwhile.

- In choices, bitcoin’s upward-sloping implied volatility curve suggests the market expects long-term volatility to be greater than short-term, whereas different metrics level to a extra speedy bearish outlook.

- Particularly, the current transfer of the 25 delta skew into unfavorable territory for near-term maturities signifies a transparent shift in market sentiment, with merchants paying a premium for places over calls to achieve draw back safety.

- The bearish sentiment is confirmed by the 24-hour put/name quantity, which reveals a big skew in direction of places, one other signal merchants are actively hedging in opposition to or speculating on a worth decline.

- Funding charge APRs throughout main perpetual swap venues are beginning to bounce again at round 8%-10% annualized, based on Velo information.

- BTC annualized funding on Binance turned unfavorable (-0.39%) for a brief interval at this time earlier than bouncing again to round 10%. This means that whereas there might have been pockets of bearish sentiment, the general market development is beginning to be extra supportive by merchants keen to pay a premium to wager on a worth enhance.

- Coinglass information reveals $266 million in 24 hour liquidations, skewed 58% in direction of shorts. ETH ($99 million), BTC ($47 million) and SOL ($20 million) have been the leaders by way of notional liquidations. The Binance liquidation heatmap signifies $111,593 as a core liquidation stage to watch in case of a worth rise.

Market Actions

- BTC is down 0.34% from 4 p.m. ET Tuesday at $110,981.61 (24hrs: +0.72%)

- ETH is up 0.41% at $4,605.94 (24hrs: +3.56%)

- CoinDesk 20 is up 0.11% at 4,130.44 (24hrs: +3.15%)

- Ether CESR Composite Staking Fee is down 2 bps at 2.93%

- BTC funding charge is at 0.0076% (8.3297% annualized) on Binance

- DXY is up 0.37% at 98.59

- Gold futures are unchanged at $3,431.20

- Silver futures are down 0.65% at $38.35

- Nikkei 225 closed up 0.3% at 42,520.27

- Hold Seng closed down 1.27% at 25,201.76

- FTSE is unchanged at 9,273.12

- Euro Stoxx 50 is up 0.16% at 5,392.10

- DJIA closed on Tuesday up 0.3% at 45,418.07

- S&P 500 closed up 0.41% at 6,465.94

- Nasdaq Composite closed up 0.44% at 21,544.27

- S&P/TSX Composite closed up 0.6% at 28,339.88

- S&P 40 Latin America closed down 0.43% at 2,715.37

- U.S. 10-Yr Treasury charge is up 1.5 bps at 4.271%

- E-mini S&P 500 futures are unchanged at 6,485.25

- E-mini Nasdaq-100 futures are unchanged at 23,596.00

- E-mini Dow Jones Industrial Common Index are unchanged at 45,516.00

Bitcoin Stats

- BTC Dominance: 58.03% (-0.29%)

- Ether-bitcoin ratio: 0.04129 (0.32%)

- Hashrate (seven-day shifting common): 960 EH/s

- Hashprice (spot): $54.07

- Whole charges: 3.19 BTC / $351,661

- CME Futures Open Curiosity: 137,600 BTC

- BTC priced in gold: 32.8 oz.

- BTC vs gold market cap: 9.28%

Technical Evaluation

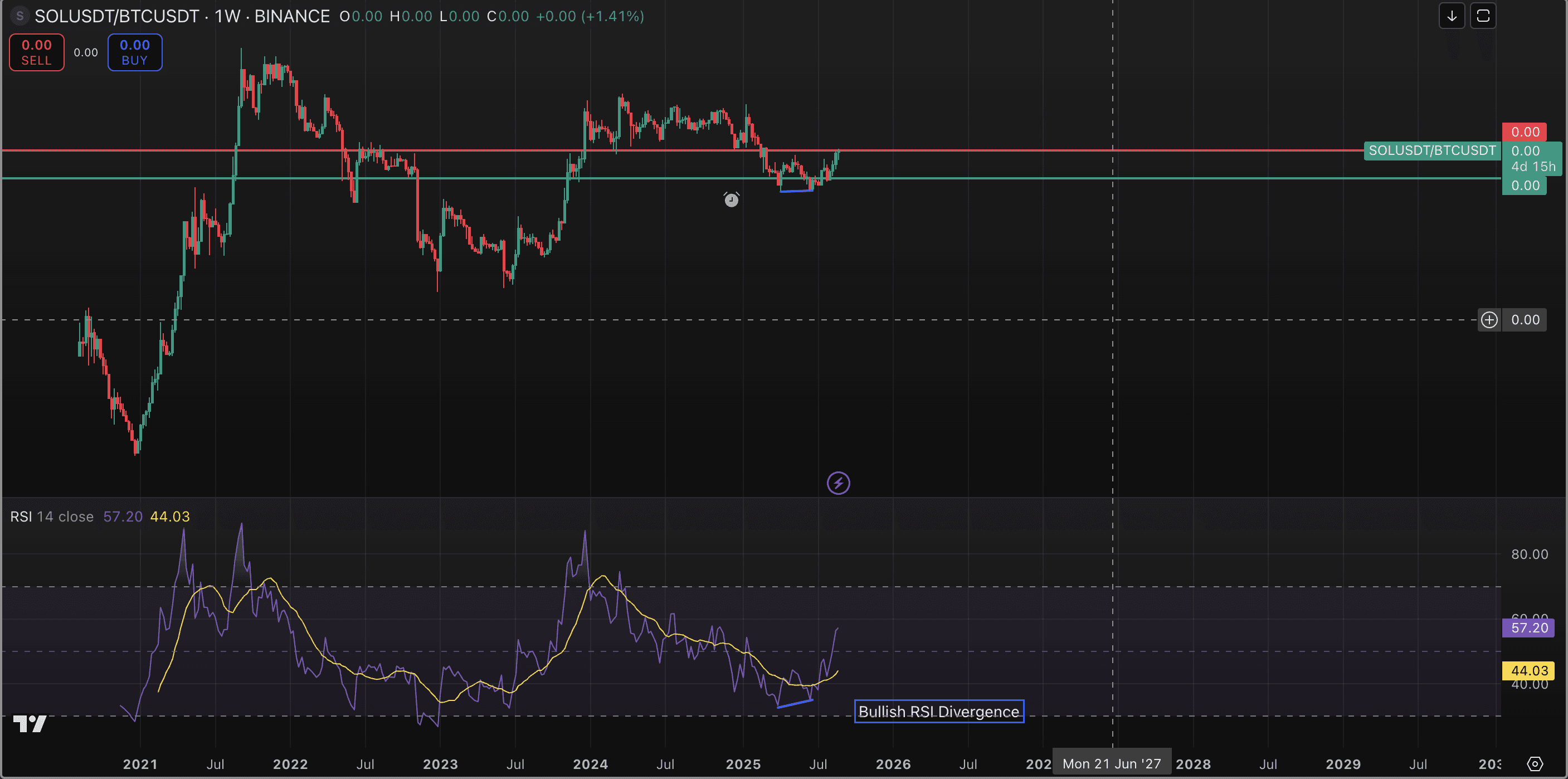

- The SOL-BTC weekly chart is approaching a key resistance stage that, for the time being, is trying more likely to be damaged.

- This SOL energy is extra of a results of a bullish RSI divergence that appears to be already in play, as confirmed by the magnitude of the transfer.

- The ratio acts as proxy for the energy of altcoins basically, and a confirmed break within the pair would sign continued energy in choose altcoins relative to BTC.

Crypto Equities

- Technique (MSTR): closed on Tuesday at $351.36 (+2.38%), -0.6% at $349.26 in pre-market

- Coinbase International (COIN): closed at $308.48 (+0.81%), -0.28% at $307.62

- Circle (CRCL): closed at $129.05 (+3.04%), -0.46% at $128.45

- Galaxy Digital (GLXY): closed at $24.72 (+0.69%), +0.36% at $24.81

- Bullish (BLSH): closed at $66.08 (+1.38%), -0.42% at $65.80

- MARA Holdings (MARA): closed at $15.84 (+2.86%), -0.63% at $15.74

- Riot Platforms (RIOT): closed at $13.69 (+3.09%), -0.88% at $13.57

- Core Scientific (CORZ): closed at $14.04 (+2.63%), +0.36% at $14.09

- CleanSpark (CLSK): closed at $9.68 (+2.43%), -0.41% at $9.64

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.39 (+2.73%)

- Semler Scientific (SMLR): closed at $30.79 (+2.56%)

- Exodus Motion (EXOD): closed at $26.98 (+2.74%)

- SharpLink Gaming (SBET): closed at $19.92 (+3.91%), -1.2% at $19.68

ETF Flows

Spot BTC ETFs

- Each day web flows: $88.1 million

- Cumulative web flows: $54.08 billion

- Whole BTC holdings ~1.29 million

Spot ETH ETFs

- Each day web flows: $455 million

- Cumulative web flows: $13.34 billion

- Whole ETH holdings ~6.43 million

Supply: Farside Buyers

Chart of the Day

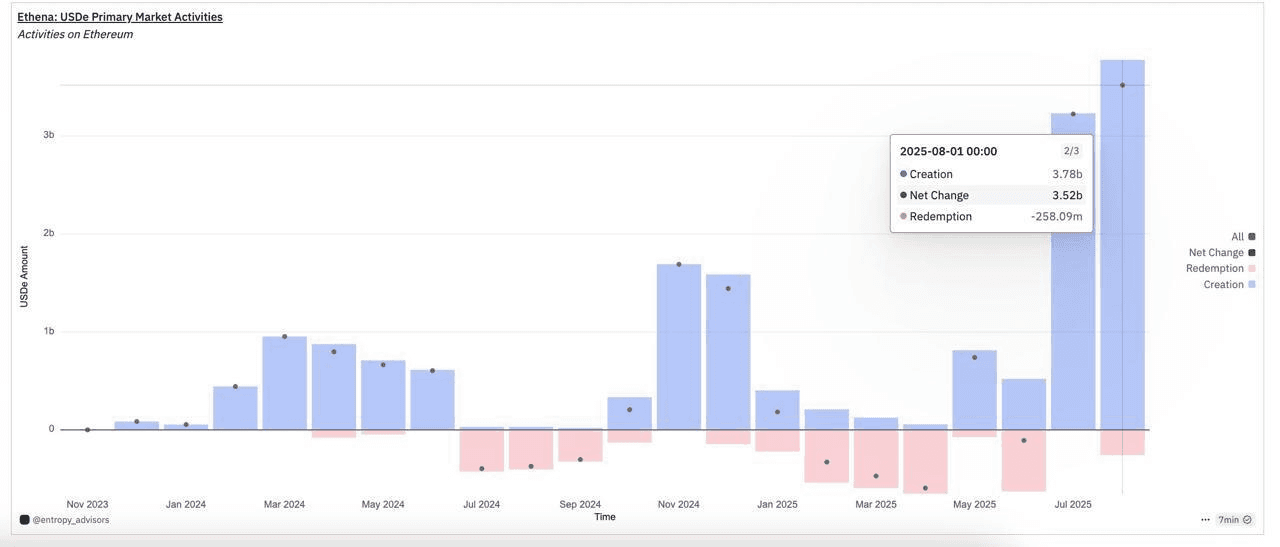

- In August, creation of Ethena’s USDe stablecoin reached a document excessive, with over $3.78 billion in new provide.

- USDe’s whole circulating provide has now climbed previous $12 billion, solidifying its place because the third-largest stablecoin by market capitalization.

- The month-to-month progress notably outpaced the $3.4 billion issuance of Tether’s market-leading USDT for a similar interval.

Whereas You Have been Sleeping

- Unified Crypto Lobbyists: Shield Software program Builders, Senate, or We’re Out (CoinDesk): Over 110 organizations, builders and traders advised U.S. senators they’ll’t assist the Readability Act except software program builders and non-custodial service suppliers are shielded from legal responsibility when unhealthy actors misuse their know-how.

- Well being-Care Agency KindlyMD Plans $5B Fairness Elevate for Bitcoin Treasury (CoinDesk): Shares of the corporate, which not too long ago merged with bitcoin treasury agency Nakamoto, slid 12% Tuesday after unveiling plans to lift as much as $5 billion via an at-the-money fairness sale.

- Metaplanet Shares Leap 6% on Worldwide Inventory Sale, Financing Strikes (CoinDesk): The Japanese agency will search 130.3 billion yen ($880 million) from a global share sale, primarily for bitcoin purchases, whereas suspending warrant workouts and redeeming bonds early to bolster its steadiness sheet.

- Markets Want Guidelines — Crypto Is No Completely different (Monetary Occasions): Scott Duke Kominers, a professor at Harvard Enterprise Faculty, says crypto markets want guidelines to make sure predictability, property rights, transparency and honest competitors, arguing that with out them innovation falters and hypothesis dominates.

- Putin Acts Like He Doesn’t Care About Peace. Russia’s Economic system May Depend upon It (CNBC): Army spending has propped up Russia’s financial system, however falling oil revenues, a swelling deficit and renewed inflation dangers are fueling analyst warnings of stagnation and even recession.

- Trump Needs European Troops in Ukraine. Europe’s Voters Aren’t Satisfied. (The Wall Avenue Journal): Public opposition displays a want to keep away from repeating previous navy failures, fears of nationwide armies getting overstretched and anxieties about being drawn right into a struggle with Russia.

Within the Ether