Key takeaways:

-

Dogecoin whales offload massive volumes of DOGE, signaling threat aversion.

-

Declining open curiosity and each day energetic addresses sign much less demand for DOGE.

-

DOGE’s rising wedge sample indicators a bearish reversal with a forty five% value drop potential.

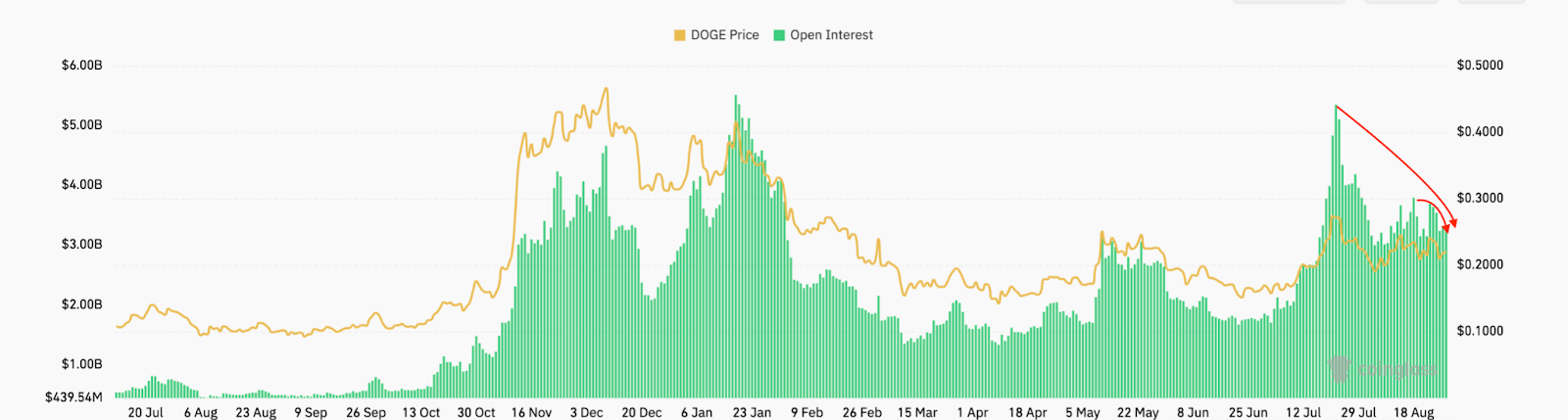

Dogecoin (DOGE) value has dropped by over 24% after hitting a multimonth excessive of $0.28 on July 21. Because of this, the memecoin’s largest holders have been offloading DOGE throughout latest value declines, indicating their insecurity in a possible rebound within the coming weeks.

Dogecoin onchain metrics trace at additional losses

Investor curiosity in DOGE stays subdued primarily based on derivatives knowledge. Dogecoin’s futures open curiosity (OI) is all the way down to $3.24 billion after peaking at $5.35 billion on July 22. An 8% decline since Sunday implies diminished speculative positioning and fewer merchants betting on short-term value will increase.

Wallets holding $10-$100 million DOGE have decreased by 6% since late July, Santiment knowledge exhibits.

This displays an earlier transaction flagged by Whale Alert that 900 million DOGE, price over $200 million, was transferred to Binance by an unknown whale, elevating issues about short-term promote stress.

Sometimes, when massive holders distribute an asset whereas costs drop, it indicators that they see dangers of additional declines.

Associated: Ether breaks out in opposition to BTC, however new highs rely upon $4.7K turning into help

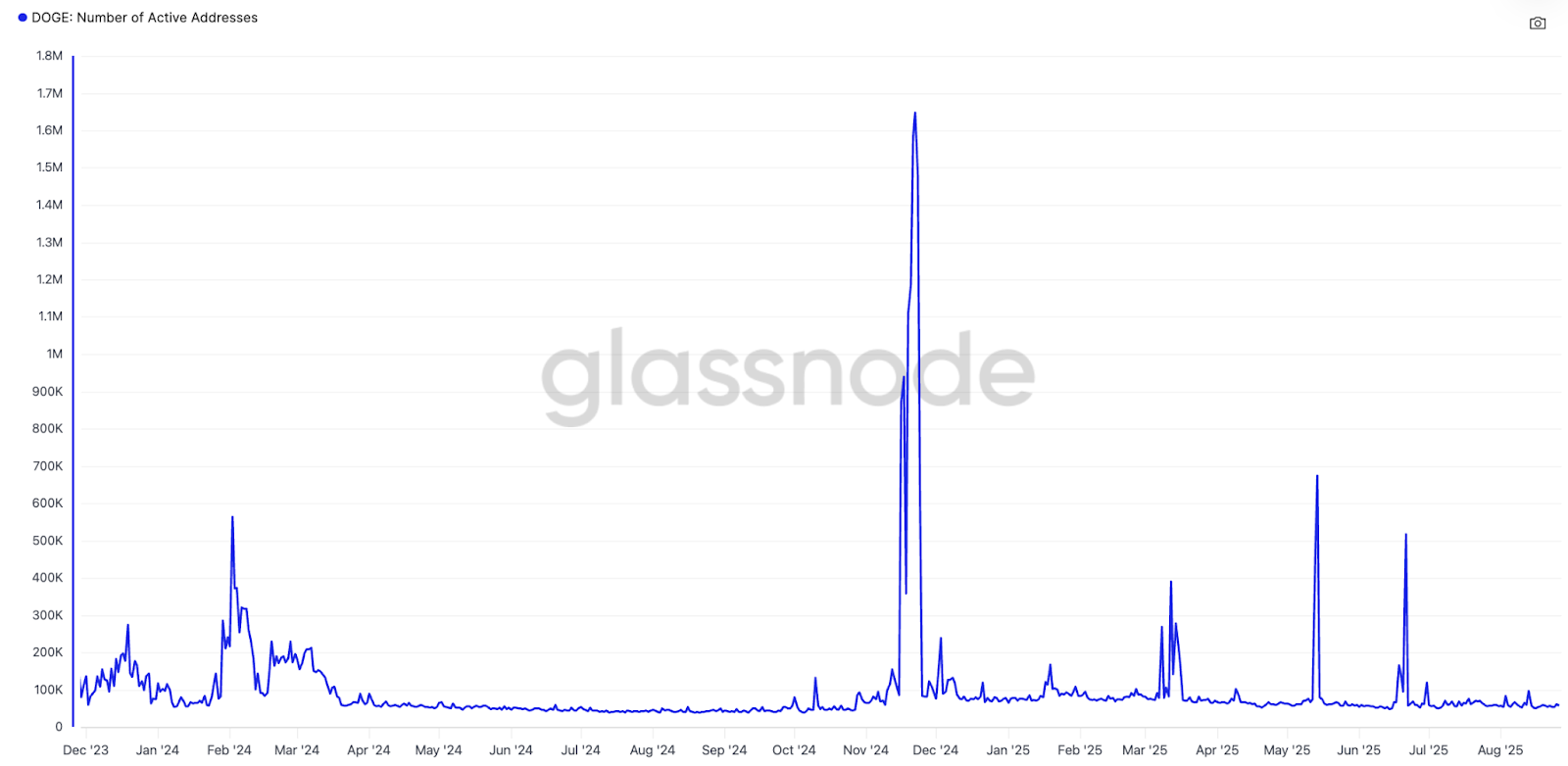

In the meantime, the variety of each day energetic addresses on the Dogecoin community has dropped considerably to 58,000 in comparison with a peak of 1.65 million in This fall/2024 and 674,500 in July, suggesting weak community exercise.

A lower in energetic addresses signifies decrease consumer engagement on the community, presumably reflecting waning retail curiosity.

DOGE rising wedge sample targets $0.12

From a technical perspective, promote stress on DOGE may acquire vital downward momentum if it breaks beneath a rising wedge sample.

In technical evaluation, a rising wedge is a bearish reversal chart sample that includes two converging pattern traces that join increased highs and better lows. This convergence signifies that the bulls are shedding momentum.

DOGE value is presently retesting the help supplied by the decrease trendline of the wedge at $0.218.

A break beneath this degree will probably set off a deeper drop in value, with a technical goal of the wedge at $0.12, a forty five% lower from present costs.

The relative power index (RSI) additionally exhibits weak spot, falling to 49 from overbought circumstances at 85 on July 20, indicating that bearish momentum has been steadily increase.

As Cointelegraph reported, DOGE value should maintain above the $0.19-$0.20 zone, or the 100-day and 200-day shifting averages, to keep away from additional losses towards $0.16.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.