Japanese funding firm Metaplanet authorised a plan to boost 180.3 billion yen ($1.2 billion) via an abroad share issuance, with virtually $835 million put aside for Bitcoin purchases.

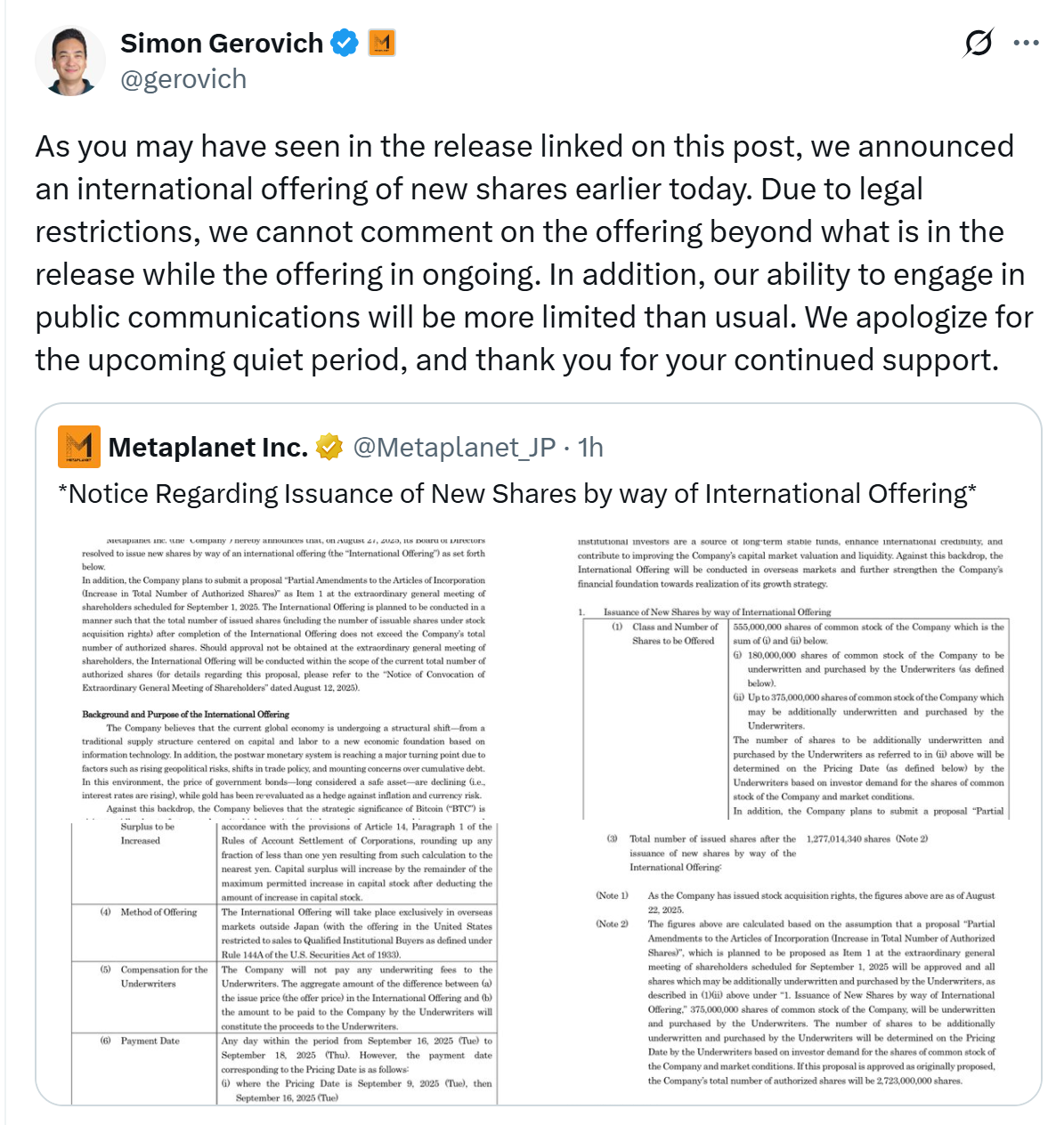

In response to a Wednesday submitting, the corporate plans to concern as much as 555 million new shares, which may improve its complete excellent inventory from 722 million to about 1.27 billion shares. The problem value shall be decided Sept. 9/11, with funds scheduled to settle shortly after.

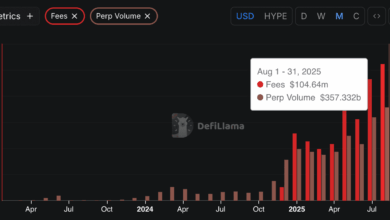

Metaplanet mentioned the majority of the funds will go towards buying further Bitcoin (BTC), including to its current treasury reserves of 18,991 BTC (valued at round $2.1 billion). The corporate mentioned the technique is designed to guard in opposition to Japan’s weak yen, mitigate inflation dangers and improve company worth.

An additional $440 million shall be directed into the agency’s “Bitcoin Earnings Enterprise,” which generates income by promoting lined name choices on its BTC holdings. The corporate mentioned this system is already producing revenue and shall be expanded with the brand new funds.

Associated: Metaplanet, Smarter Net add virtually $100M in Bitcoin to treasuries

A part of long-term BTC technique

The transfer is the most recent step in Metaplanet’s aggressive Bitcoin-focused technique, which incorporates the “21 Million Plan” introduced in April and the “555 Million Plan” revealed in June. The corporate has set a goal of holding greater than 210,000 BTC by 2027, representing over 1% of Bitcoin’s complete provide.

The providing shall be performed via abroad placements to institutional buyers. The submitting mentioned that the issuance was not registered below the US Securities Act of 1933, and won’t be publicly provided in the USA.

“We introduced a global providing of recent shares earlier right this moment,” Metaplanet CEO Simon Gerovich wrote on X. “On account of authorized restrictions, we can not touch upon the providing past what’s within the launch whereas the providing in ongoing,” he added.

Associated: Metaplanet plans to boost further $3.7B to purchase Bitcoin

Metaplanet joins FTSE Japan

Metaplanet has been upgraded from a small-cap to a mid-cap inventory in FTSE Russell’s September 2025 Semi-Annual Assessment, incomes inclusion within the FTSE Japan Index. The transfer follows the corporate’s sturdy Q2 efficiency.

In consequence, Metaplanet will even be routinely added to the FTSE All-World Index, which options the biggest publicly traded firms by market capitalization throughout completely different areas. This can place it alongside main world gamers.

Journal: Bitcoin’s long-term safety finances downside: Impending disaster or FUD?